The DOGE Effect: Weakening The Agency That Protects Banks From Consumer Exploitation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The DOGE Effect: How Meme Coins Could Weaken Consumer Financial Protection

The meteoric rise of Dogecoin, a cryptocurrency born as a joke, has unexpectedly shone a spotlight on a crucial issue: the potential weakening of agencies tasked with protecting consumers from financial exploitation. While seemingly unrelated, the volatility and speculative nature of meme coins like DOGE highlight vulnerabilities in regulatory frameworks and raise serious questions about the future of consumer financial protection. This "DOGE Effect," as we'll call it, isn't about Dogecoin itself, but rather the broader implications of unregulated digital assets on established regulatory bodies.

The Crucial Role of Consumer Financial Protection Agencies

Agencies like the Consumer Financial Protection Bureau (CFPB) in the US play a vital role in shielding consumers from predatory lending practices, unfair fees, and deceptive marketing tactics employed by banks and financial institutions. These agencies are responsible for:

- Enforcing consumer protection laws: They investigate complaints, impose fines, and take legal action against companies violating consumer rights.

- Educating consumers: They provide resources and information to help consumers understand their rights and avoid financial scams.

- Supervising financial institutions: They monitor the activities of banks and other financial firms to ensure compliance with regulations.

How the DOGE Effect Undermines Consumer Protection

The rapid rise and fall of meme coins like Dogecoin illustrate the unpredictable nature of the cryptocurrency market. This volatility diverts resources and attention from traditional regulatory efforts. Consider these points:

- Resource Diversion: The CFPB and similar agencies are facing increased workloads dealing with emerging crypto-related consumer complaints and investigations. This diversion of resources can weaken their capacity to effectively address traditional financial exploitation cases.

- Regulatory Gaps: The current regulatory framework often struggles to keep pace with the rapid innovation in the digital asset space. This lag creates loopholes that predatory actors can exploit, leaving consumers vulnerable.

- Public Perception: The excitement surrounding meme coins can overshadow the importance of traditional financial literacy and consumer protection, leading to a decline in public awareness and engagement.

- Market Manipulation: The susceptibility of meme coins to manipulation and pump-and-dump schemes demonstrates a vulnerability within the financial system that can impact consumer confidence and trust in regulated markets.

The Need for a Holistic Approach

The DOGE Effect underscores the urgent need for a more holistic and adaptable approach to consumer financial protection. This requires:

- Increased Regulatory Scrutiny: Strengthening regulations around digital assets and clarifying the responsibilities of agencies regarding crypto-related consumer protection is paramount.

- Enhanced Technological Capabilities: Agencies need to invest in technological infrastructure and expertise to effectively monitor and regulate the evolving digital landscape.

- Improved Consumer Education: Targeted educational campaigns are needed to help consumers navigate the risks associated with cryptocurrencies and make informed financial decisions.

- International Collaboration: Given the global nature of cryptocurrencies, international cooperation is crucial in combating fraud and protecting consumers across borders.

Conclusion: Protecting Consumers in the Age of Crypto

The seemingly frivolous world of meme coins has inadvertently revealed a critical weakness in the consumer protection infrastructure. The DOGE Effect is a wake-up call, demanding a more robust and forward-thinking approach to safeguarding consumers from financial exploitation in the ever-evolving digital economy. Failure to adapt could lead to a significant erosion of consumer trust and an increase in financial harm. The future of consumer financial protection hinges on the ability of regulatory bodies to adapt to these new challenges effectively.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The DOGE Effect: Weakening The Agency That Protects Banks From Consumer Exploitation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Outpost Pengorbanan Prajurit Di Afghanistan Sebuah Sinopsis

Apr 12, 2025

The Outpost Pengorbanan Prajurit Di Afghanistan Sebuah Sinopsis

Apr 12, 2025 -

Big Ten Transfer Portal Shakeup 7 Footer Chooses Michigan

Apr 12, 2025

Big Ten Transfer Portal Shakeup 7 Footer Chooses Michigan

Apr 12, 2025 -

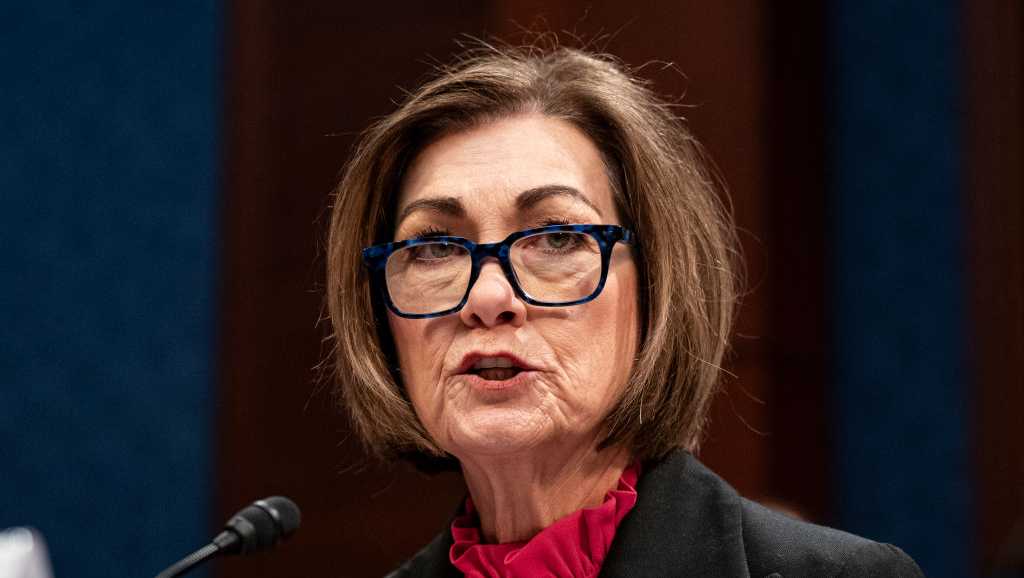

Difficult Decision Iowa Governor Forgoes Third Term Bid

Apr 12, 2025

Difficult Decision Iowa Governor Forgoes Third Term Bid

Apr 12, 2025 -

Jaiswal Receives Blunt Message From Former Pakistan Cricketer Prithvi Shaw Involved

Apr 12, 2025

Jaiswal Receives Blunt Message From Former Pakistan Cricketer Prithvi Shaw Involved

Apr 12, 2025 -

Follow The Masters Leaderboard Predicting The Cut Line At Augusta

Apr 12, 2025

Follow The Masters Leaderboard Predicting The Cut Line At Augusta

Apr 12, 2025