The Evolving Crypto Landscape And Its Antiquated Tax Regulations.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Evolving Crypto Landscape and its Antiquated Tax Regulations: A Perfect Storm Brewing?

The cryptocurrency market is a dynamic, ever-shifting landscape. From the meteoric rise of Bitcoin to the explosion of NFTs and DeFi, the pace of innovation is breathtaking. Yet, this rapid evolution clashes dramatically with the often antiquated and ill-suited tax regulations designed for a pre-digital age. This mismatch creates a perfect storm of confusion, uncertainty, and potential legal pitfalls for both individual investors and businesses involved in the crypto space.

The Complexity of Crypto Taxation:

The core issue lies in the inherent complexity of cryptocurrencies. Unlike traditional assets, cryptocurrencies operate on decentralized, blockchain-based systems, making tracking transactions and determining fair market value a significant challenge for tax authorities worldwide. Many jurisdictions struggle to classify cryptocurrencies – are they commodities, securities, currencies, or something entirely new? This lack of clear classification directly impacts how they are taxed.

Outdated Regulations Fail to Keep Pace:

Most existing tax laws were formulated long before the existence of Bitcoin, let alone the myriad of altcoins, stablecoins, and decentralized finance (DeFi) protocols that now exist. These regulations were built for traditional financial instruments and simply aren't equipped to handle the speed, anonymity, and global nature of cryptocurrency transactions. This leads to several key problems:

- Difficulty in Determining Taxable Events: Every transaction, including staking, lending, airdrops, and DeFi interactions, potentially triggers a taxable event. Determining the precise value at the time of each event, especially for volatile cryptocurrencies, is incredibly difficult.

- Lack of Clear Reporting Requirements: Many tax authorities lack the infrastructure and expertise to effectively process crypto-related tax returns. The reporting requirements themselves are often unclear, leading to inconsistencies and potential errors.

- International Tax Complications: The borderless nature of cryptocurrencies creates significant challenges for international tax compliance. Determining which jurisdiction has the right to tax a particular transaction can be a complex and contentious issue.

The Consequences of Regulatory Lag:

The consequences of this regulatory lag are significant. Investors face the risk of hefty penalties for unintentional non-compliance. Businesses operating in the crypto space struggle with compliance costs and face uncertainty about future regulations. This regulatory uncertainty can stifle innovation and hinder the growth of the crypto industry as a whole.

The Path Forward: Towards Modernized Crypto Tax Frameworks:

Addressing this issue requires a multi-faceted approach. Governments need to:

- Develop Clear and Comprehensive Guidelines: This includes establishing clear definitions of cryptocurrencies, specifying taxable events, and implementing robust reporting mechanisms.

- Invest in Technology and Training: Tax authorities need to invest in the necessary technology and train their staff to effectively handle crypto-related tax data.

- Foster International Cooperation: International collaboration is crucial to establish consistent and fair tax rules for cross-border crypto transactions.

- Consider Tax Incentives for Crypto Innovation: Strategic tax incentives could encourage responsible development and adoption of crypto technologies.

Conclusion:

The cryptocurrency revolution is here to stay. However, its continued growth and adoption hinge on creating a regulatory framework that is both effective and adaptable. Outdated tax regulations are a major hurdle. By proactively addressing these challenges, governments can help unlock the full potential of this transformative technology while ensuring fair and transparent taxation. The future of crypto depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Evolving Crypto Landscape And Its Antiquated Tax Regulations.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Apples App Store Power Wanes A Look At Shifting Control

May 03, 2025

Apples App Store Power Wanes A Look At Shifting Control

May 03, 2025 -

Password Manager Showdown Googles Dominance Among Tech Radar Pro Readers

May 03, 2025

Password Manager Showdown Googles Dominance Among Tech Radar Pro Readers

May 03, 2025 -

Indispensable Or Not Pritam Singh Weighs In On Dpm Gans Punggol Move Ahead Of Ge 2025

May 03, 2025

Indispensable Or Not Pritam Singh Weighs In On Dpm Gans Punggol Move Ahead Of Ge 2025

May 03, 2025 -

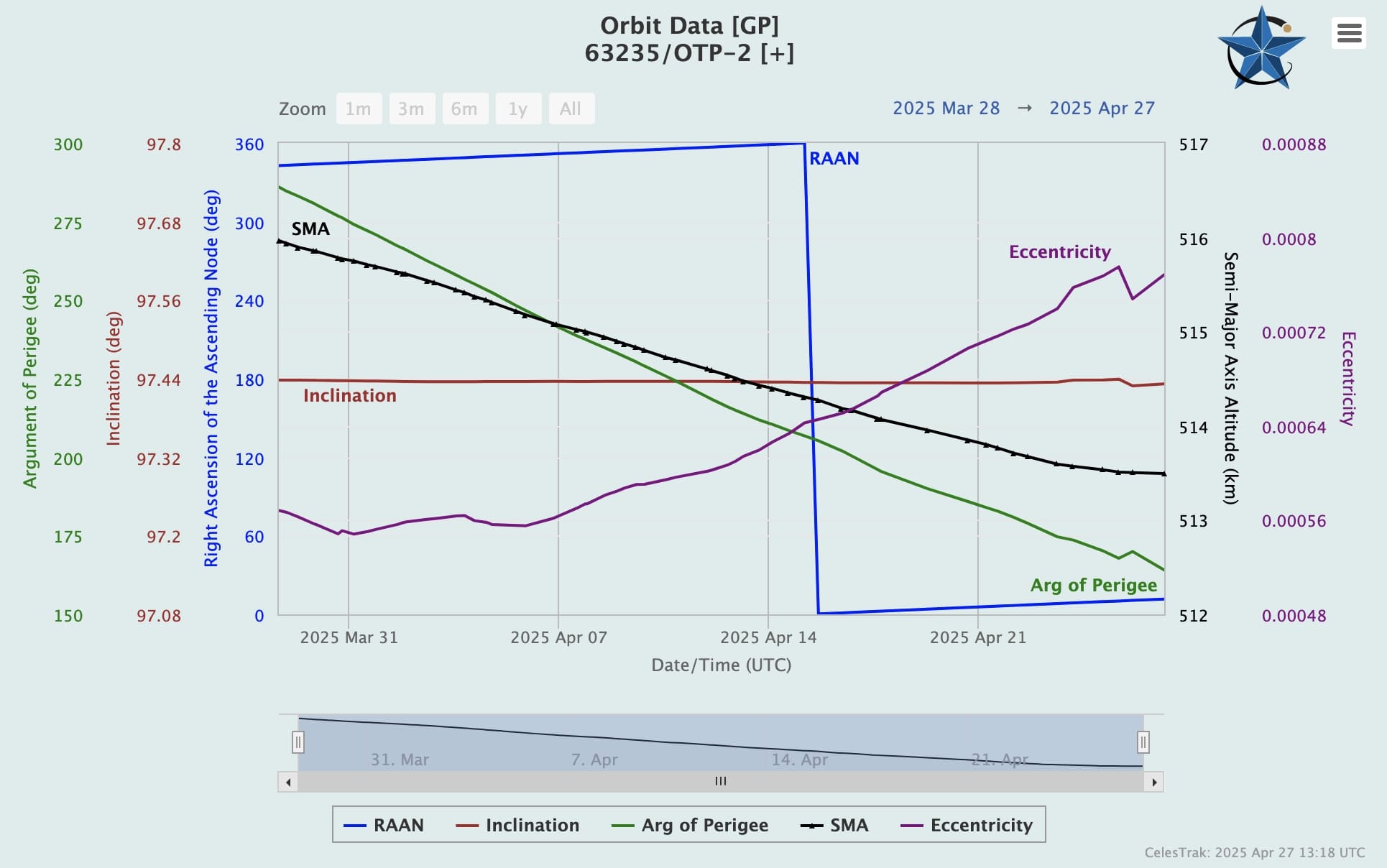

Propellantless Propulsion Advance Otp 2 Satellite Shows Reduced Orbital Decay

May 03, 2025

Propellantless Propulsion Advance Otp 2 Satellite Shows Reduced Orbital Decay

May 03, 2025 -

Neh And Nea Facing Elimination In Trumps 2026 Budget Plan

May 03, 2025

Neh And Nea Facing Elimination In Trumps 2026 Budget Plan

May 03, 2025

Latest Posts

-

From Overconfidence To Knockout Munguias Strategy Against Surace

May 04, 2025

From Overconfidence To Knockout Munguias Strategy Against Surace

May 04, 2025 -

One Win Away Harleys Performance Crucial For Dallas Stars West Semifinal Advance

May 04, 2025

One Win Away Harleys Performance Crucial For Dallas Stars West Semifinal Advance

May 04, 2025 -

Stablecoin Future Uncertain Impact Of The Us Genius Act Analyzed

May 04, 2025

Stablecoin Future Uncertain Impact Of The Us Genius Act Analyzed

May 04, 2025 -

Ufc Iowa In Depth Analysis And Prediction For Rodriguez Vs Robertson

May 04, 2025

Ufc Iowa In Depth Analysis And Prediction For Rodriguez Vs Robertson

May 04, 2025 -

Exclusive How Firmino Mendy And Mahrez Conquered The Asian Champions League

May 04, 2025

Exclusive How Firmino Mendy And Mahrez Conquered The Asian Champions League

May 04, 2025