The Evolving Crypto Landscape Demands Updated Tax Laws.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Evolving Crypto Landscape Demands Updated Tax Laws

The meteoric rise of cryptocurrency has left tax laws scrambling to keep up. What was once a niche digital asset is now a global phenomenon, influencing markets, driving innovation, and creating a complex tax landscape that desperately needs an overhaul. Governments worldwide are grappling with how to effectively tax crypto transactions, a challenge exacerbated by the technology's decentralized nature and rapid evolution. This article explores the urgent need for updated tax laws to reflect the reality of the modern crypto market.

The Current Regulatory Maze: A Patchwork of Approaches

Currently, cryptocurrency taxation varies wildly across jurisdictions. Some countries treat crypto as property, subject to capital gains tax upon sale. Others classify it as a currency, leading to different tax implications for transactions. This inconsistency creates confusion for both taxpayers and businesses operating in the crypto space. The lack of clear, standardized regulations leads to:

- Increased Compliance Costs: Businesses face significant costs in navigating conflicting rules and ensuring compliance across multiple jurisdictions.

- Uncertainty for Investors: The uncertainty surrounding crypto taxation discourages investment and hinders the growth of legitimate crypto businesses.

- Opportunities for Tax Evasion: The lack of clarity presents opportunities for tax evasion, undermining the fairness and integrity of tax systems.

The Need for Clarity and Consistency:

The complexity of decentralized finance (DeFi) and non-fungible tokens (NFTs) further complicates the issue. These innovative applications of blockchain technology introduce new tax challenges that existing frameworks struggle to address. For example, how should the staking rewards from DeFi protocols be taxed? How are NFTs valued for tax purposes, especially given their fluctuating market values?

Experts argue that a clear, consistent, and internationally harmonized approach to crypto taxation is vital. This includes:

- Defining Crypto Assets: Establishing clear definitions for various crypto assets (e.g., Bitcoin, Ethereum, stablecoins, NFTs) and their tax treatment.

- Streamlining Reporting Requirements: Implementing user-friendly reporting systems that simplify the process of declaring crypto transactions.

- Addressing DeFi and NFT Taxation: Developing specific tax guidelines for DeFi and NFT transactions, addressing issues like staking rewards, NFT sales, and decentralized autonomous organization (DAO) participation.

- International Collaboration: Promoting international cooperation to establish consistent global standards for crypto taxation.

Looking Ahead: The Future of Crypto Tax Laws

The future of crypto taxation will likely involve a combination of legislative action and technological solutions. Governments are increasingly investing in blockchain analytics and AI-powered tax compliance tools to improve the monitoring and enforcement of crypto tax laws. However, the rapid pace of innovation in the crypto space demands ongoing dialogue between policymakers, industry experts, and taxpayers to ensure that tax laws remain relevant and effective. Failure to adapt will not only stifle innovation but also create significant challenges for fair and equitable taxation. The evolving crypto landscape necessitates a proactive and adaptable approach to taxation, one that fosters growth while maintaining fiscal integrity. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Evolving Crypto Landscape Demands Updated Tax Laws.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Star Wars Canon Under Scrutiny Andor Season 2s Bold Choices

May 09, 2025

Star Wars Canon Under Scrutiny Andor Season 2s Bold Choices

May 09, 2025 -

Nintendo Switch 2 Retailer Pre Order Updates And Restock Information

May 09, 2025

Nintendo Switch 2 Retailer Pre Order Updates And Restock Information

May 09, 2025 -

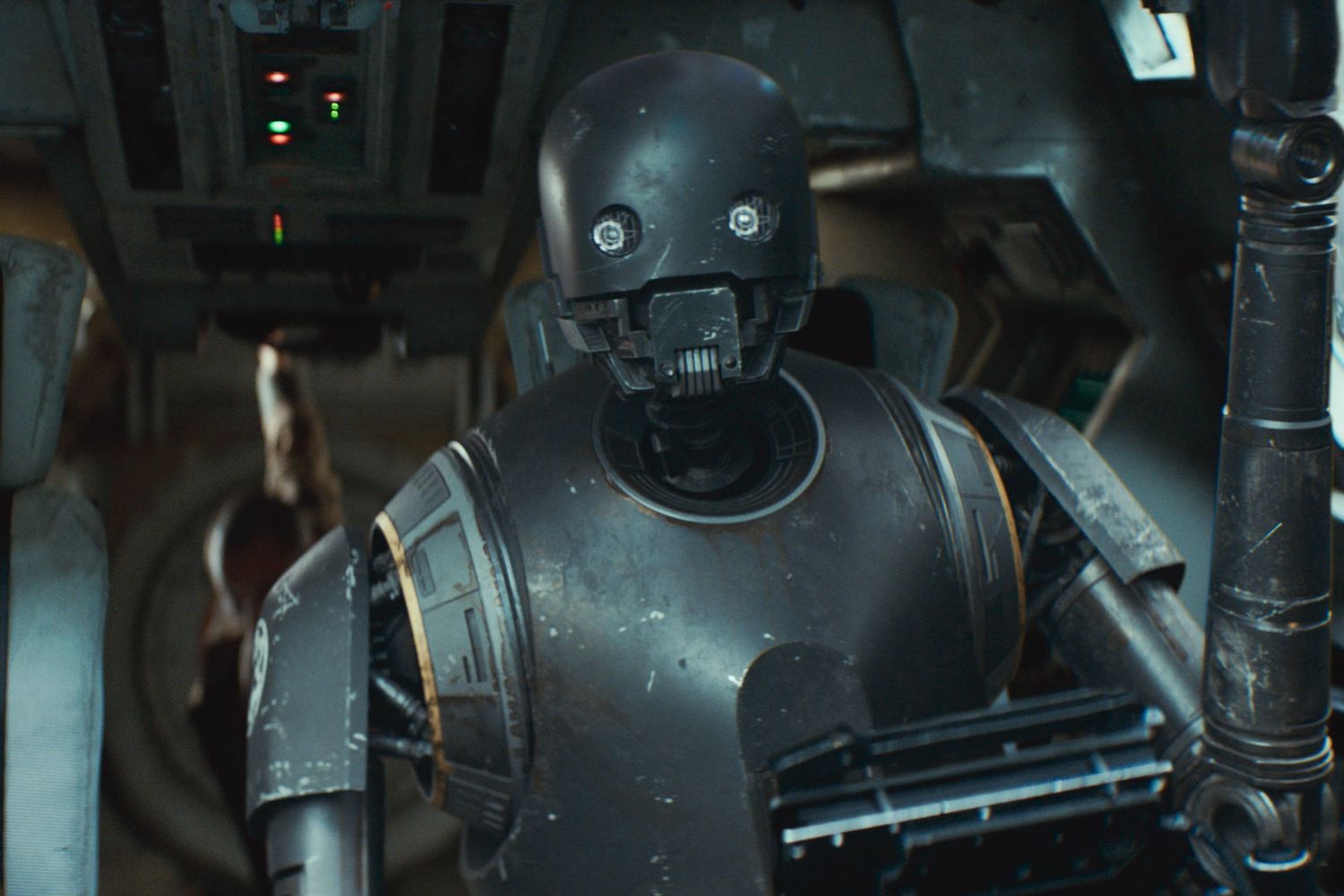

Andors Deleted Scenes The Untold K 2 So Horror

May 09, 2025

Andors Deleted Scenes The Untold K 2 So Horror

May 09, 2025 -

Jimmy Butlers Candid Admission To Warriors Coach Game 1 Mic D Up Moment

May 09, 2025

Jimmy Butlers Candid Admission To Warriors Coach Game 1 Mic D Up Moment

May 09, 2025 -

Score The Lowest Price Best Air Pods Deals And Sales This May 2025

May 09, 2025

Score The Lowest Price Best Air Pods Deals And Sales This May 2025

May 09, 2025