The Growing Pains Of Crypto: Navigating Outdated Tax Regulations.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Growing Pains of Crypto: Navigating Outdated Tax Regulations

The meteoric rise of cryptocurrency has left global tax systems scrambling to keep up. While crypto offers exciting opportunities for investment and financial innovation, its rapid evolution has exposed significant gaps in outdated tax regulations, creating confusion and headaches for both individual investors and businesses. This leaves many grappling with complex tax implications, often leading to unintentional non-compliance and potentially hefty penalties.

The Problem: A Regulatory Wild West

Many countries are still struggling to define cryptocurrency for tax purposes. Is it a currency? A commodity? An asset? The lack of clear legal definitions creates a regulatory grey area, making it difficult to determine the appropriate tax treatment for various crypto transactions. This ambiguity is further complicated by the decentralized nature of cryptocurrencies, making it challenging for tax authorities to track and monitor transactions effectively.

Outdated Laws Struggle to Keep Pace with Innovation

Existing tax laws were designed for traditional financial instruments and fail to account for the unique characteristics of cryptocurrencies. For instance, regulations often don't adequately address:

- Tax Implications of Staking and Lending: Earning passive income through staking or lending cryptocurrencies presents a complex tax challenge. The tax treatment varies widely across jurisdictions, and the lack of clear guidance often leads to miscalculations.

- Reporting Requirements for Decentralized Exchanges (DEXs): Unlike centralized exchanges, DEXs operate without intermediaries, making it difficult for tax authorities to track transactions and enforce reporting requirements. This opacity increases the risk of tax evasion and makes compliance significantly harder for users.

- Taxation of Airdrops and Forking Events: Receiving free cryptocurrency through airdrops or participating in forking events introduces another layer of complexity. The tax implications of these events are often unclear, requiring careful consideration and potentially professional tax advice.

- Cross-Border Transactions: The global nature of cryptocurrency transactions creates jurisdictional challenges. Determining which country's tax laws apply to specific transactions can be extremely difficult, particularly for individuals holding and trading crypto across multiple borders.

Navigating the Challenges: Practical Steps for Crypto Investors

Despite the complexities, there are steps individual investors can take to navigate the current regulatory landscape:

- Maintain Detailed Records: Meticulously track all cryptocurrency transactions, including the date, amount, and relevant parties involved. This meticulous record-keeping is crucial for accurate tax reporting.

- Seek Professional Tax Advice: Consult with a qualified tax advisor specializing in cryptocurrency taxation. They can provide guidance tailored to your specific situation and help you understand the complexities of crypto tax laws in your jurisdiction.

- Stay Updated on Regulatory Changes: Cryptocurrency regulations are constantly evolving. Stay informed about updates and changes in your jurisdiction to ensure you remain compliant.

- Utilize Crypto Tax Software: Several software platforms are designed to simplify the process of calculating and reporting cryptocurrency taxes. These tools can automate aspects of tax preparation and reduce the risk of errors.

The Future of Crypto Taxation

As cryptocurrency adoption continues to grow, we can expect to see more comprehensive and specific regulations emerge globally. International collaboration and harmonization of tax policies are crucial to creating a more predictable and transparent regulatory environment for the cryptocurrency industry. Until then, careful planning, diligent record-keeping, and professional guidance are vital for navigating the challenging landscape of cryptocurrency taxation. Failure to do so could result in significant financial penalties and legal repercussions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Growing Pains Of Crypto: Navigating Outdated Tax Regulations.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ge 2025 Heated Exchange Tambyah Counters Ong Ye Kungs Critique Of Sdp

May 01, 2025

Ge 2025 Heated Exchange Tambyah Counters Ong Ye Kungs Critique Of Sdp

May 01, 2025 -

Power Restored In Spain And Portugal Following Major Outage

May 01, 2025

Power Restored In Spain And Portugal Following Major Outage

May 01, 2025 -

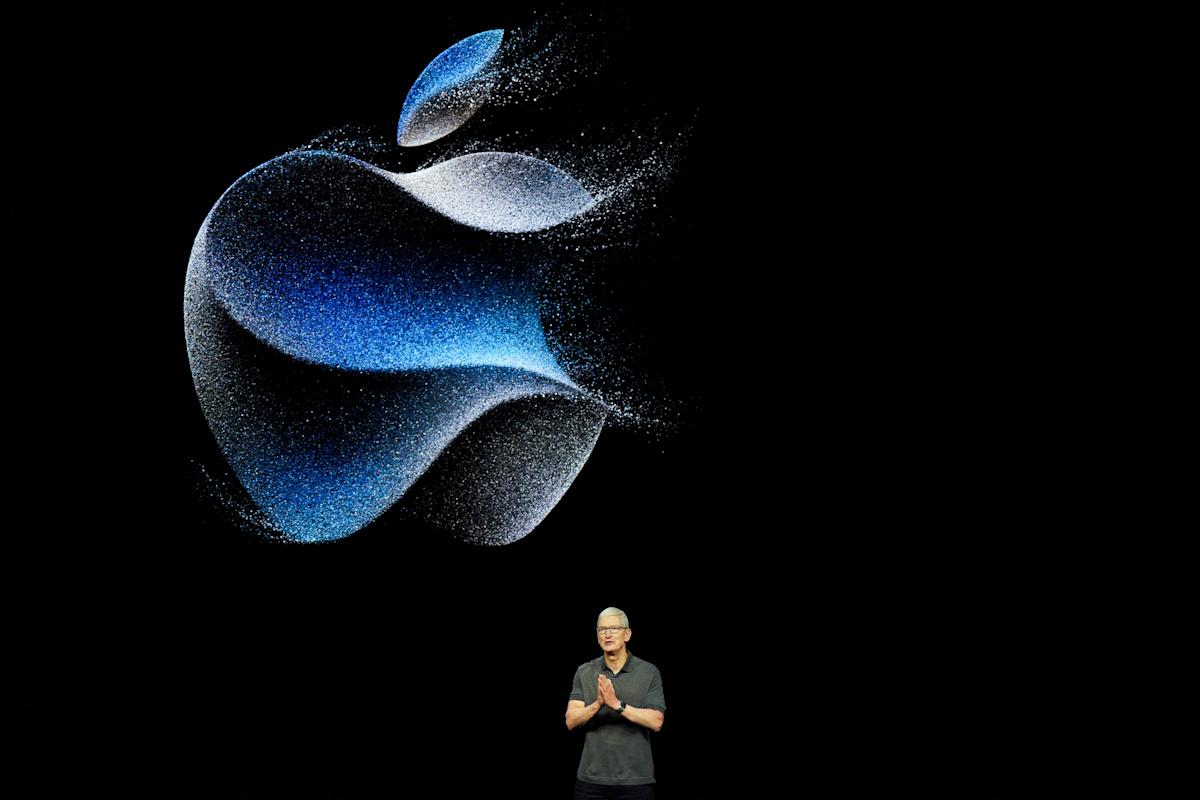

Apple Q2 2024 Earnings I Phone Sales Power Record Results

May 01, 2025

Apple Q2 2024 Earnings I Phone Sales Power Record Results

May 01, 2025 -

Power Outage Forces Fearnley Out Of Madrid Open Tennis Competition

May 01, 2025

Power Outage Forces Fearnley Out Of Madrid Open Tennis Competition

May 01, 2025 -

The Growing Threat Of Space Junk Starlink And The Future Of Orbit

May 01, 2025

The Growing Threat Of Space Junk Starlink And The Future Of Orbit

May 01, 2025