The Growing Pains Of Crypto: Tax Code Needs A 21st-Century Overhaul.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Growing Pains of Crypto: Tax Code Needs a 21st-Century Overhaul

The meteoric rise of cryptocurrency has brought with it a whirlwind of innovation, investment opportunities, and…tax headaches. Existing tax codes, designed for a pre-digital age, are struggling to keep pace with the complexities of Bitcoin, Ethereum, and the thousands of other digital assets flooding the market. This mismatch is creating significant challenges for both taxpayers and tax authorities, highlighting the urgent need for a 21st-century overhaul of tax laws concerning cryptocurrency.

The Current Landscape: A Patchwork of Confusion

Currently, the taxation of cryptocurrency varies significantly across jurisdictions. Many countries treat crypto transactions as property, meaning capital gains taxes apply on any profits realized from buying and selling. However, the intricacies of decentralized finance (DeFi), staking, airdrops, and NFTs introduce layers of complexity that traditional tax codes simply weren't designed to handle.

-

Capital Gains Tax Challenges: Determining the cost basis of cryptocurrency can be a nightmare, especially for those who have engaged in frequent trading or received crypto as payment for goods or services. Tracking numerous transactions across multiple platforms and wallets requires meticulous record-keeping, something many individual investors struggle with.

-

DeFi's Tax Implications: The decentralized nature of DeFi platforms makes tracking transactions incredibly difficult. Yield farming, lending, and borrowing all generate taxable events, yet the lack of clear regulatory guidelines leaves many taxpayers unsure of their obligations.

-

NFTs and the Murky Waters of Digital Assets: Non-Fungible Tokens (NFTs) present another unique challenge. Are they collectibles? Are they investments? The classification of NFTs for tax purposes remains ambiguous, causing confusion and potential for misreporting.

-

International Tax Complications: The borderless nature of cryptocurrency presents significant challenges for international tax authorities. Tracking cross-border transactions and ensuring accurate tax collection becomes exponentially more difficult with the decentralized and pseudonymous nature of many crypto transactions.

The Need for Modernization: A Call for Clearer Regulations

The current tax landscape for cryptocurrency is a minefield of uncertainty, potentially leading to:

-

Increased Tax Avoidance: The complexity of the current system encourages some individuals to underreport their crypto income, hindering government revenue collection.

-

Increased Compliance Costs: Taxpayers spend significant time and resources trying to navigate the unclear regulations, adding to the overall burden on individuals and businesses.

-

Stifled Innovation: The uncertainty around crypto taxation can discourage investment and innovation in the cryptocurrency space.

Towards a Solution: Recommendations for Reform

To address these issues, a comprehensive overhaul of tax laws is necessary. This should include:

-

Clearer Definitions and Guidelines: Tax authorities need to provide clear definitions and guidelines on how different crypto activities are taxed, including DeFi, NFTs, and staking.

-

Simplified Reporting Mechanisms: Developing user-friendly reporting mechanisms and software will streamline the process for taxpayers, reducing the administrative burden.

-

International Cooperation: Global collaboration is crucial to establish consistent tax standards for cryptocurrency across jurisdictions, preventing tax evasion and arbitrage.

-

Targeted Education and Awareness Campaigns: Educating taxpayers about their crypto tax obligations is vital to ensuring compliance.

The future of finance is inextricably linked with the future of cryptocurrency. To foster innovation and ensure fair taxation, a modernized and comprehensive approach to crypto taxation is no longer optional—it’s essential. Failing to act decisively risks leaving behind a system ill-equipped to handle the transformative power of digital assets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Growing Pains Of Crypto: Tax Code Needs A 21st-Century Overhaul.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Evander Kanes Impact Stauffers Assessment Of A Key Acquisition

May 09, 2025

Evander Kanes Impact Stauffers Assessment Of A Key Acquisition

May 09, 2025 -

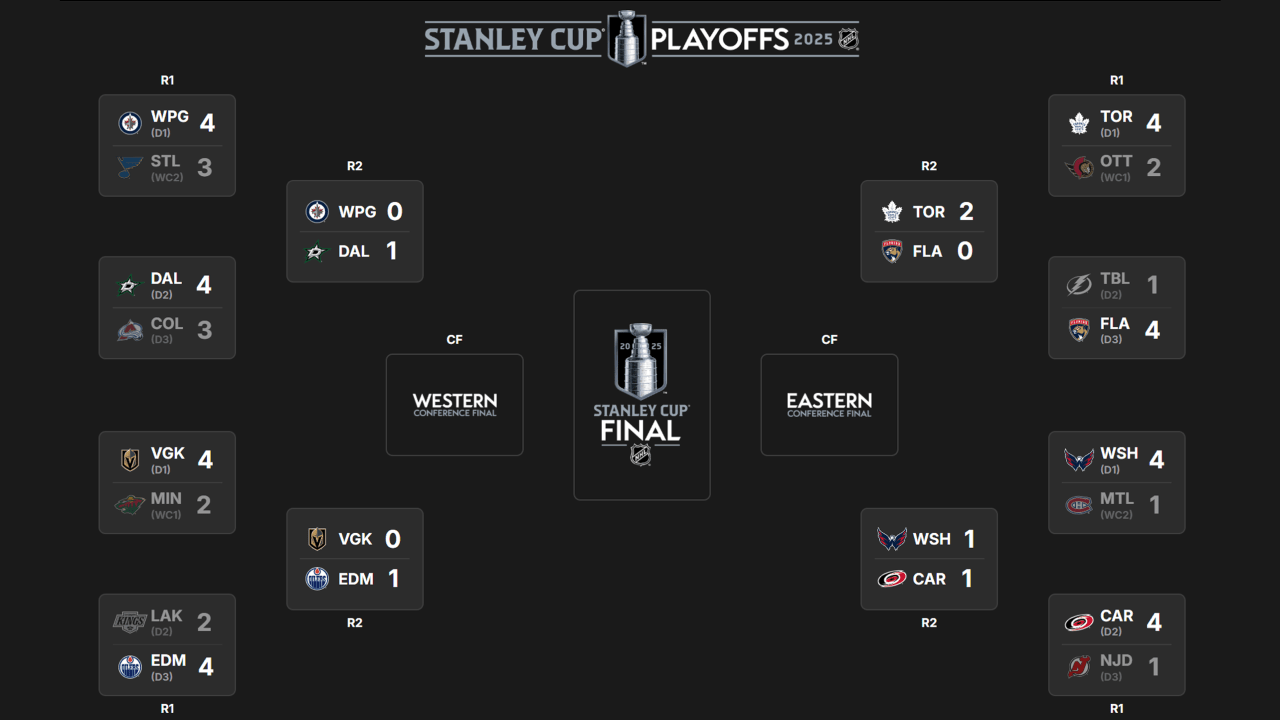

Nhl 2025 Stanley Cup Playoffs Complete Round 2 Schedule

May 09, 2025

Nhl 2025 Stanley Cup Playoffs Complete Round 2 Schedule

May 09, 2025 -

Glyn Davis Stepping Down End Of An Era For Australias Top Bureaucrat

May 09, 2025

Glyn Davis Stepping Down End Of An Era For Australias Top Bureaucrat

May 09, 2025 -

Rising Oil Prices Renewed Hope In Us China Trade Deal

May 09, 2025

Rising Oil Prices Renewed Hope In Us China Trade Deal

May 09, 2025 -

Suitcase Containing Body Found In Haryana Investigation Launched

May 09, 2025

Suitcase Containing Body Found In Haryana Investigation Launched

May 09, 2025