The Growing Pains Of Crypto: Tax Code Needs An Update

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Growing Pains of Crypto: Tax Code Needs a Desperate Update

The meteoric rise of cryptocurrency has brought with it a whirlwind of opportunities, but also a significant headache for both taxpayers and tax authorities: outdated tax codes struggling to keep pace with this rapidly evolving digital landscape. From Bitcoin to Dogecoin, the complexities of crypto taxation are leaving many investors confused and potentially vulnerable to penalties. The current system is simply not equipped to handle the unique nuances of digital assets, highlighting the urgent need for a comprehensive overhaul of tax laws.

The Current State of Crypto Taxation: A Patchwork of Confusion

Currently, cryptocurrency is treated by many tax authorities as property, meaning gains and losses are subject to capital gains taxes. However, the application of this principle is far from straightforward. The lack of clear guidelines leads to significant challenges, including:

- Determining the cost basis: Tracking the acquisition cost of cryptocurrency across numerous exchanges and wallets can be incredibly difficult, leading to inaccurate tax reporting.

- Handling staking and mining rewards: The taxation of staking rewards and mining income remains a grey area, further compounding the difficulties for taxpayers.

- International implications: The decentralized nature of cryptocurrency presents complex jurisdictional issues, making international tax compliance a significant hurdle.

- Reporting requirements: The complexity of reporting cryptocurrency transactions on tax returns is often overwhelming for individuals and businesses alike.

These ambiguities create a breeding ground for errors and potential legal repercussions. The penalties for misreporting cryptocurrency transactions can be substantial, adding to the already considerable stress of navigating this complex tax landscape.

Why an Update is Crucial: Protecting Investors and Fostering Innovation

The current system not only disadvantages individual investors but also stifles innovation within the cryptocurrency industry. Uncertainty regarding tax regulations discourages investment and hinders the growth of legitimate businesses operating within the crypto space. A clear and consistent regulatory framework is essential to:

- Promote investor confidence: Clear guidelines will encourage greater participation in the market, fostering economic growth.

- Reduce tax evasion: A well-defined tax code will make it easier to detect and prevent tax evasion, ensuring fair tax collection.

- Support legitimate businesses: A clear regulatory environment will provide stability and encourage investment in legitimate cryptocurrency businesses.

- Improve tax compliance: Simpler reporting requirements will make it easier for taxpayers to comply with tax laws, reducing the burden on both individuals and the IRS.

What Needs to Change: Recommendations for Reform

Several crucial changes are needed to modernize cryptocurrency taxation:

- Simplified reporting mechanisms: The development of user-friendly reporting tools and integration with existing tax software would streamline the reporting process.

- Clearer definitions and guidelines: Specific guidance on the taxation of staking, mining, and other crypto activities is crucial.

- International cooperation: Collaboration between tax authorities globally is essential to address the jurisdictional challenges presented by cryptocurrency.

- Education and outreach: Increased public awareness and education initiatives can help taxpayers understand their obligations and avoid costly mistakes.

The future of cryptocurrency is inextricably linked to the evolution of tax policy. Ignoring the need for comprehensive reform will only exacerbate the existing challenges and stifle the potential of this transformative technology. A proactive approach, focused on clarity, simplicity, and international cooperation, is essential to unlock the full potential of cryptocurrency while ensuring fair and efficient tax collection. The time for action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Growing Pains Of Crypto: Tax Code Needs An Update. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Political Commentary In Andor The Significance Of The Genocide Term

May 08, 2025

Political Commentary In Andor The Significance Of The Genocide Term

May 08, 2025 -

Pakistan Minister Tarars No Terror Camps Claim Debunked Live On Air

May 08, 2025

Pakistan Minister Tarars No Terror Camps Claim Debunked Live On Air

May 08, 2025 -

Currys Hamstring Confirmed Out Of Game 1 For The Warriors

May 08, 2025

Currys Hamstring Confirmed Out Of Game 1 For The Warriors

May 08, 2025 -

Albanese Meets King Charles Live Updates And Labors Ministry Shake Up

May 08, 2025

Albanese Meets King Charles Live Updates And Labors Ministry Shake Up

May 08, 2025 -

Andors Canon Breaking Moment Deconstructing Mon Mothmas Senate Address

May 08, 2025

Andors Canon Breaking Moment Deconstructing Mon Mothmas Senate Address

May 08, 2025

Latest Posts

-

From Subtle Symptom To Devastating Diagnosis Living With A Rare Tumor

May 09, 2025

From Subtle Symptom To Devastating Diagnosis Living With A Rare Tumor

May 09, 2025 -

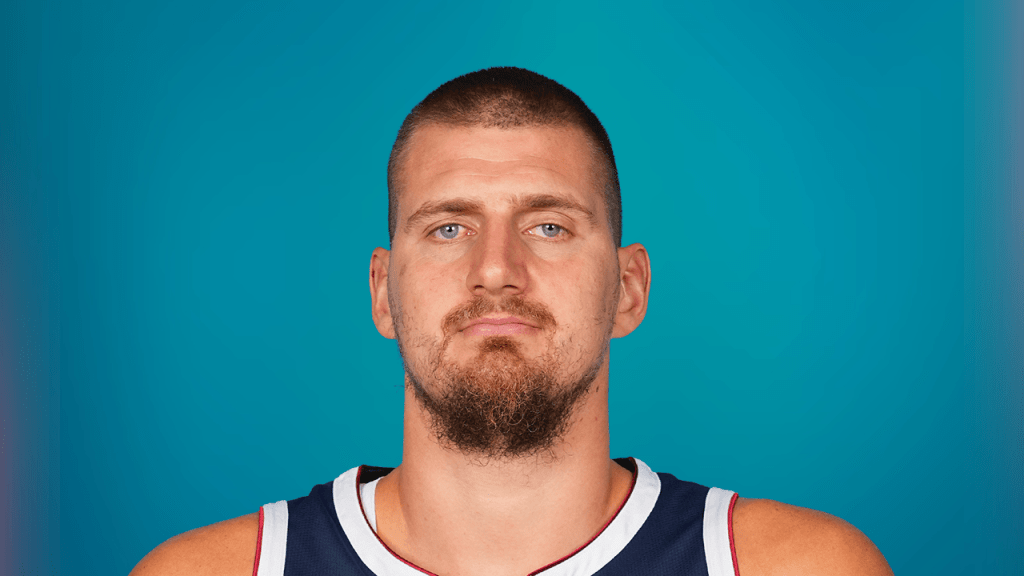

Nikola Jokics Amusing Reaction To Fan Chants About His Free Throws

May 09, 2025

Nikola Jokics Amusing Reaction To Fan Chants About His Free Throws

May 09, 2025 -

New Travel Restrictions Uk Foreign Office Issues Warning For Popular Holiday Area

May 09, 2025

New Travel Restrictions Uk Foreign Office Issues Warning For Popular Holiday Area

May 09, 2025 -

Hyunseong Kim On His Post Game Celebration With Shohei Ohtani

May 09, 2025

Hyunseong Kim On His Post Game Celebration With Shohei Ohtani

May 09, 2025 -

Final Destination Bloodlines The Goriest Horror Sequel Ever

May 09, 2025

Final Destination Bloodlines The Goriest Horror Sequel Ever

May 09, 2025