The Impact Of CBDCs On Consumer Buying Power

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of CBDCs on Consumer Buying Power: A New Era of Digital Finance?

Central Bank Digital Currencies (CBDCs) are rapidly emerging as a potential game-changer in the global financial landscape. While offering exciting possibilities for increased efficiency and financial inclusion, their impact on consumer buying power remains a complex and hotly debated topic. This article delves into the potential benefits and drawbacks of CBDCs, exploring how they might reshape the way we spend, save, and invest.

What are CBDCs and Why are They Important?

CBDCs are digital versions of a country's fiat currency, issued and regulated by the central bank. Unlike cryptocurrencies, they are not decentralized and are directly linked to the national currency. Their rise is driven by several factors, including:

- Increased efficiency: CBDCs offer the potential for faster and cheaper transactions, eliminating the need for intermediaries like banks.

- Financial inclusion: They can provide access to financial services for the unbanked and underbanked populations globally.

- Enhanced security: CBDCs can potentially offer greater security against fraud and counterfeiting.

- Monetary policy effectiveness: Central banks could potentially use CBDCs to implement monetary policy more effectively.

How Could CBDCs Affect Consumer Buying Power?

The impact of CBDCs on consumer buying power is multifaceted and depends on several factors, including the specific design of the CBDC and the existing financial infrastructure of a country.

Potential Benefits:

- Reduced transaction costs: Lower transaction fees could translate into more disposable income for consumers.

- Increased access to credit: CBDCs could facilitate the development of innovative lending products and services, potentially making credit more accessible.

- Improved financial literacy: The digital nature of CBDCs could promote greater financial literacy among consumers.

- Enhanced price transparency: Real-time transaction data could improve price transparency and potentially reduce inflation.

Potential Drawbacks:

- Privacy concerns: The potential for government surveillance through CBDC transactions raises significant privacy concerns. Maintaining anonymity while ensuring security is a critical design challenge.

- Technological risks: Cybersecurity threats and potential system failures could disrupt transactions and negatively impact consumer confidence.

- Monetary policy risks: Improper management of a CBDC could lead to unintended consequences for inflation and economic stability.

- Exclusion risks: The digital divide could exclude certain segments of the population from accessing and using CBDCs, exacerbating existing inequalities.

The Future of Consumer Buying Power in a CBDC World

The long-term impact of CBDCs on consumer buying power remains uncertain. Successful implementation hinges on addressing the critical challenges related to privacy, security, and inclusivity. Careful design and robust regulation are crucial to ensure that CBDCs benefit consumers and contribute to a more efficient and equitable financial system. Ongoing research and public discourse are essential to navigate this complex landscape and harness the potential of CBDCs while mitigating potential risks. The future of finance is rapidly evolving, and CBDCs are at the forefront of this transformation. The effects on individual buying power will depend greatly on how these innovative systems are designed and implemented. Careful consideration of the potential benefits and drawbacks is crucial as we move forward.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of CBDCs On Consumer Buying Power. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Doctor Whos Bbc Return Confirmed But With A Significant Condition

Sep 20, 2025

Doctor Whos Bbc Return Confirmed But With A Significant Condition

Sep 20, 2025 -

Top Restaurant Deals For National Cheeseburger Day 2025

Sep 20, 2025

Top Restaurant Deals For National Cheeseburger Day 2025

Sep 20, 2025 -

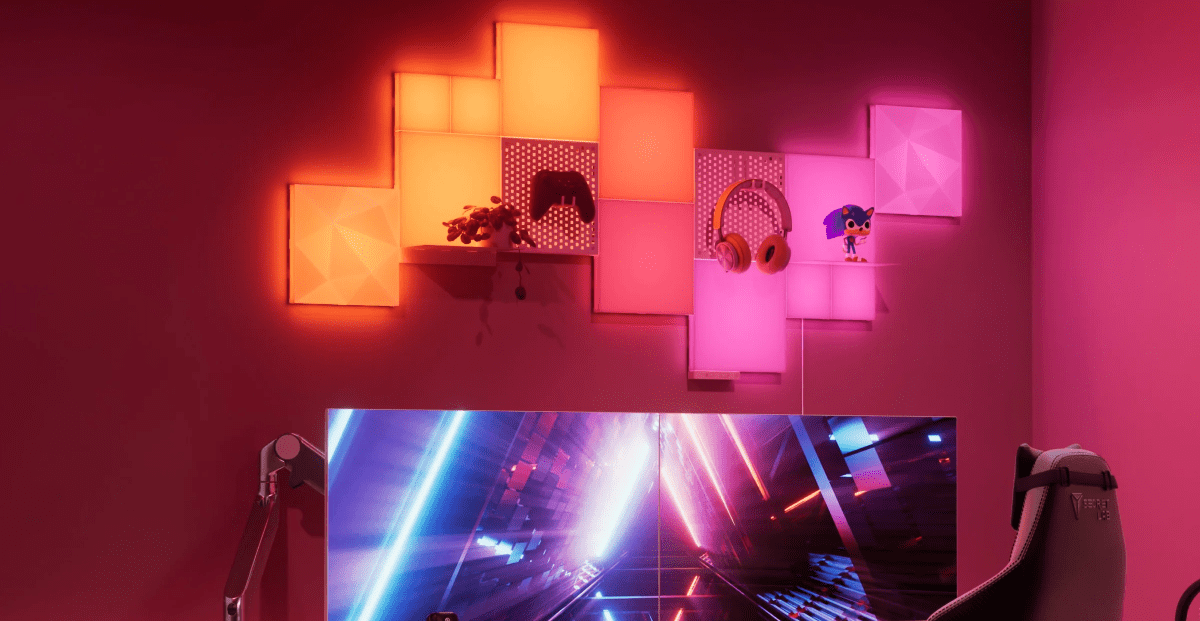

Exclusive Deal 20 Off Nanoleaf For Verge Readers

Sep 20, 2025

Exclusive Deal 20 Off Nanoleaf For Verge Readers

Sep 20, 2025 -

From Partial Views To Complete Maps How Mapping Changed Our Understanding Of Mars

Sep 20, 2025

From Partial Views To Complete Maps How Mapping Changed Our Understanding Of Mars

Sep 20, 2025 -

Fonsecas Astounding Tournament Experience Its Crazy

Sep 20, 2025

Fonsecas Astounding Tournament Experience Its Crazy

Sep 20, 2025