The Impact Of Donald Trump's Crypto Relationships On US Stablecoin Bills And Securities Law

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Crypto Connections: Shaking Up US Stablecoin Bills and Securities Law

Donald Trump's foray into the cryptocurrency world, albeit indirect, is sending ripples through the already turbulent waters of US stablecoin regulation and securities law. His endorsements, associations, and the sheer weight of his influence are impacting the legislative landscape and creating uncertainty for investors and businesses alike. This article delves into the complex interplay between Trump's crypto relationships and the evolving regulatory framework.

The Unclear Landscape of Stablecoin Regulation:

The US Congress is currently grappling with the challenge of regulating stablecoins – digital currencies pegged to the value of a fiat currency like the US dollar. These cryptocurrencies aim for price stability, unlike volatile assets like Bitcoin. However, their regulatory status remains unclear, with proposals ranging from comprehensive oversight to a more laissez-faire approach. Trump's involvement, or rather, the perception of his involvement, complicates matters significantly.

Any endorsement – explicit or implicit – from a figure as influential as Trump can sway public opinion and potentially impact the trajectory of legislative efforts. This makes predicting the future of stablecoin regulation even more difficult, especially with the already significant partisan divides on Capitol Hill. Lawmakers are struggling to balance innovation with consumer protection, and Trump's presence in the crypto sphere adds another layer of complexity.

Securities Law Implications:

Beyond stablecoins, Trump's connections to the crypto industry also raise questions under US securities law. The Howey Test, the cornerstone of US securities law, is used to determine whether an investment contract qualifies as a security. Several cryptocurrencies and related projects have been deemed securities by the Securities and Exchange Commission (SEC), leading to regulatory scrutiny and enforcement actions.

Trump's involvement, through endorsements or investments (whether direct or indirect through associates), could potentially influence the SEC's approach to regulating crypto assets. This uncertainty creates a chilling effect on innovation and investment within the crypto sector. Companies are left navigating a regulatory landscape clouded by the potential impact of Trump’s influence, hindering their ability to plan for long-term growth and expansion.

The Role of Trump's Advisors and Associates:

The influence isn't solely emanating from Trump himself. His advisors and associates, many with ties to the crypto industry, also play a significant role. Their actions and public statements contribute to the overall narrative surrounding Trump and cryptocurrency, furthering the ambiguity surrounding regulations. This network of influence adds another dimension to the regulatory challenge, making it more challenging to predict future regulatory outcomes.

Looking Ahead: Uncertainty and the Need for Clarity:

The impact of Donald Trump's crypto relationships on US stablecoin bills and securities law is undeniable. The current uncertainty necessitates a clear and comprehensive regulatory framework that addresses the complexities of the crypto market while fostering innovation. The SEC and Congress must work together to create rules that are both effective and transparent, minimizing the influence of extraneous factors like political endorsements and focusing instead on the underlying risks and opportunities presented by this rapidly evolving technology. Failure to do so could stifle innovation and potentially harm investors. The future of US crypto regulation hinges on clear, decisive action, irrespective of any external pressures.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of Donald Trump's Crypto Relationships On US Stablecoin Bills And Securities Law. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fussball Bundesliga Wittmann Mit Angriffsplan Im Spitzenspiel Gegen Dresden

Apr 10, 2025

Fussball Bundesliga Wittmann Mit Angriffsplan Im Spitzenspiel Gegen Dresden

Apr 10, 2025 -

Ipl 2024 Mukesh Kumar Achieves Rare Feat Following In Jofra Archers Footsteps

Apr 10, 2025

Ipl 2024 Mukesh Kumar Achieves Rare Feat Following In Jofra Archers Footsteps

Apr 10, 2025 -

Follow Gt Vs Rr Live Score Rajasthan Royals Field First Against Gujarat Titans Ipl 2025

Apr 10, 2025

Follow Gt Vs Rr Live Score Rajasthan Royals Field First Against Gujarat Titans Ipl 2025

Apr 10, 2025 -

April 8 2025 Your Daily Nyt Connections Hints And Solution

Apr 10, 2025

April 8 2025 Your Daily Nyt Connections Hints And Solution

Apr 10, 2025 -

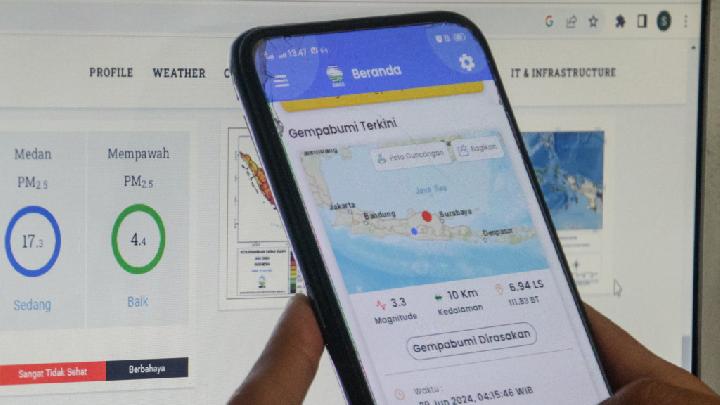

Strong Indian Ocean Earthquake M5 9 Bmkg Assessment And Tsunami Update

Apr 10, 2025

Strong Indian Ocean Earthquake M5 9 Bmkg Assessment And Tsunami Update

Apr 10, 2025