The Impact Of US Stablecoin Regulation On The Future Of CBDCs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of US Stablecoin Regulation on the Future of CBDCs

The looming shadow of US stablecoin regulation is dramatically reshaping the landscape of digital finance, with significant implications for the future of Central Bank Digital Currencies (CBDCs). The debate isn't just about stablecoins themselves; it's about the broader implications for financial innovation, consumer protection, and the very role of central banks in the digital age. Will tighter regulations stifle innovation, or pave the way for a more robust and secure CBDC ecosystem?

The Current Regulatory Landscape: A Tightening Grip

The US is grappling with how to regulate stablecoins, digital assets pegged to a reserve asset like the US dollar. Proposals range from treating them as securities, requiring hefty reserve requirements and stringent audits, to a more tailored approach focusing on risk management and consumer protection. The ambiguity surrounding this regulatory framework creates uncertainty for issuers and investors alike. This uncertainty, however, is not simply a matter of bureaucratic hurdles; it's fundamentally affecting the trajectory of CBDC development.

Stablecoins: A Stepping Stone to CBDCs?

Many see stablecoins as a precursor to CBDCs. They offer a taste of the potential benefits of digital currencies – faster transactions, lower costs, and increased accessibility – while operating within a relatively familiar regulatory framework. The success or failure of stablecoin regulation will inevitably influence how policymakers approach the development and implementation of CBDCs. A heavy-handed approach could deter innovation and create a less competitive landscape, making the adoption of a CBDC less appealing.

The Case for a Balanced Approach:

The optimal path forward lies in finding a balance. Regulation is essential to mitigate risks associated with stablecoins, such as bank runs and market manipulation. However, overregulation could stifle the very innovation that makes digital currencies so attractive. A balanced approach would focus on:

- Robust reserve requirements and transparency: Ensuring stablecoins are backed by sufficient assets and that their holdings are publicly auditable.

- Consumer protection measures: Protecting users from fraud and ensuring they understand the risks involved in using stablecoins.

- Interoperability standards: Facilitating seamless transactions between different stablecoins and potentially with a future CBDC.

- A clear regulatory framework: Reducing uncertainty and providing a stable environment for innovation.

CBDC Development: A Race Against Time?

Many countries are already exploring or implementing CBDCs, putting the US potentially behind in the global race for digital currency dominance. The regulatory uncertainty surrounding stablecoins could further delay the development of a US CBDC, giving other nations a significant advantage. This delay could have far-reaching consequences for the US financial system and its global standing.

The Future is Digital: Navigating the Challenges

The future of finance is undeniably digital. The way the US regulates stablecoins will significantly impact the adoption and success of its own CBDC. Striking a balance between robust regulation and fostering innovation will be crucial in ensuring that the US remains a leader in the global digital economy. The coming months and years will be pivotal in shaping this landscape, with the implications reaching far beyond the realm of finance itself. The choices made today will define the future of digital currency for generations to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of US Stablecoin Regulation On The Future Of CBDCs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

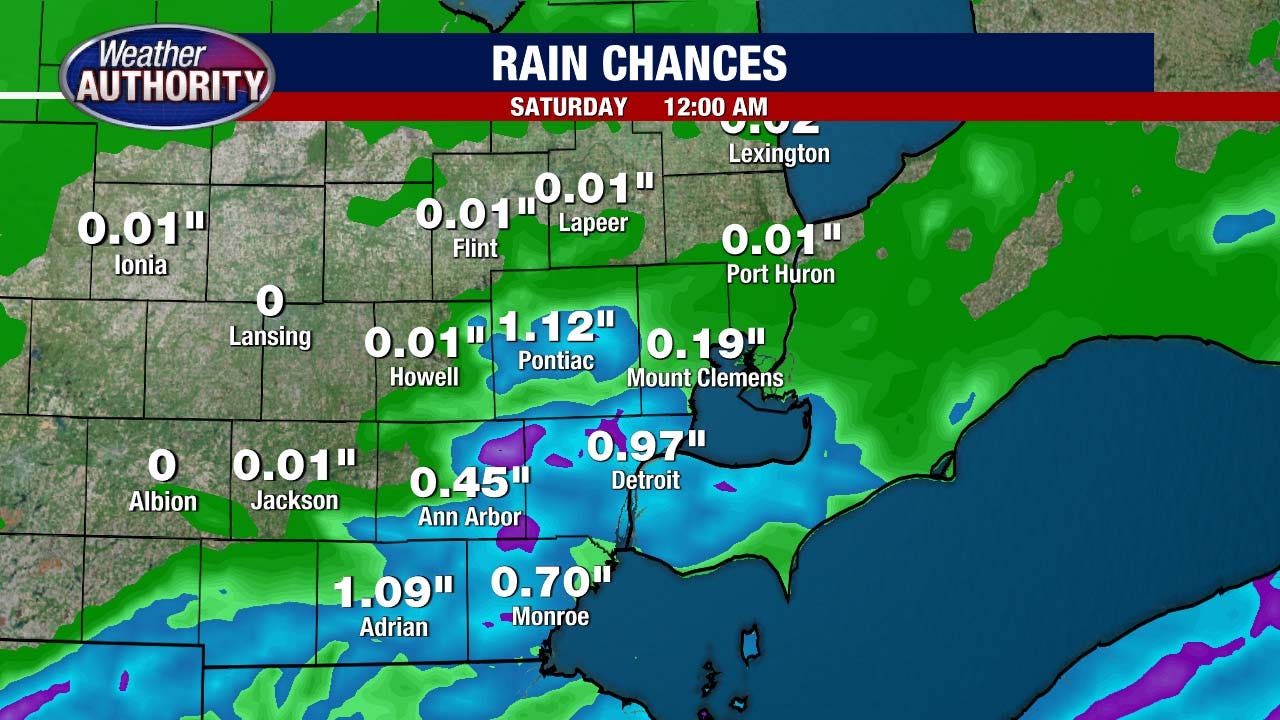

Metro Detroit Weather Forecast Storms Today Crisp And Cooler Weekend Predicted

Apr 26, 2025

Metro Detroit Weather Forecast Storms Today Crisp And Cooler Weekend Predicted

Apr 26, 2025 -

From Frustration To Function A Practical Guide To I Phone Screen Time

Apr 26, 2025

From Frustration To Function A Practical Guide To I Phone Screen Time

Apr 26, 2025 -

Official Pricing Revealed Pop Marts Labubu 3 0 Costs 99 Yuan

Apr 26, 2025

Official Pricing Revealed Pop Marts Labubu 3 0 Costs 99 Yuan

Apr 26, 2025 -

Ubisofts Might And Magic Franchise Enters Web3 With New Trading Card Game

Apr 26, 2025

Ubisofts Might And Magic Franchise Enters Web3 With New Trading Card Game

Apr 26, 2025 -

Everything You Need To Know About Celtic H

Apr 26, 2025

Everything You Need To Know About Celtic H

Apr 26, 2025