The Impact Of US Stablecoin Regulations On The Future Of CBDCs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of US Stablecoin Regulations on the Future of CBDCs

The future of Central Bank Digital Currencies (CBDCs) in the US is inextricably linked to the regulatory landscape surrounding stablecoins. Recent regulatory crackdowns and proposed legislation are shaping not only the trajectory of stablecoins but also influencing the design and adoption of a potential US CBDC. The implications are far-reaching, impacting financial innovation, monetary policy, and the very fabric of the American financial system.

The Regulatory Tightrope: Navigating Stablecoin Risks

The US government is increasingly concerned about the risks associated with stablecoins, particularly those pegged to the US dollar. Concerns include:

- Financial stability: A run on a large stablecoin could trigger a broader financial crisis, impacting traditional banking institutions.

- Money laundering and terrorist financing: The anonymity offered by some stablecoins makes them attractive tools for illicit activities.

- Consumer protection: Lack of robust regulation leaves consumers vulnerable to fraud and scams.

These concerns have fueled proposals for stricter regulation, including the potential classification of stablecoins as securities or bank deposits. The debate centers around finding a balance between fostering innovation and mitigating risks. The proposed legislation, while aiming to protect consumers and maintain financial stability, could inadvertently stifle innovation in the fintech space.

The CBDC Conundrum: Stablecoins as a Stepping Stone or a Competitor?

The regulatory scrutiny of stablecoins directly impacts the potential development of a US CBDC. Some argue that stablecoins, if properly regulated, could serve as a stepping stone towards a CBDC, offering a familiar framework and technological infrastructure. This would allow for a gradual transition, minimizing disruption to the existing financial system.

However, others view stablecoins as potential competitors to a CBDC. If stablecoins gain widespread adoption and are subject to less stringent regulation, they could undermine the potential benefits of a centrally-issued digital currency. This could limit the central bank's ability to implement monetary policy effectively and control inflation.

Navigating the Path Forward: Balancing Innovation and Regulation

The path forward requires a careful balancing act. Overly restrictive regulations could stifle innovation and push stablecoin development overseas, potentially hindering US competitiveness in the global fintech arena. Conversely, a lack of regulation could expose the financial system to significant risks.

A key consideration is the design of a potential US CBDC. Will it be a wholesale CBDC, available only to financial institutions, or a retail CBDC, accessible to the general public? This decision will significantly impact its interaction with stablecoins and the broader financial ecosystem. Moreover, the choice of technology underlying a US CBDC will be crucial in determining its scalability, security, and overall efficiency.

Looking Ahead: The Interplay of Stablecoin Regulation and CBDC Adoption

The future of both stablecoins and CBDCs in the US remains uncertain. The ongoing regulatory debate will significantly influence the development and adoption of both. A clear, well-defined regulatory framework is crucial for fostering innovation while mitigating risks. This framework must strike a balance between protecting consumers and promoting competition, ensuring that the US remains at the forefront of the global digital currency revolution. The interaction between these two digital asset classes will undoubtedly shape the financial landscape for years to come. Further developments in this area will be crucial to watch.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of US Stablecoin Regulations On The Future Of CBDCs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game 2 Showdown Will Jayson Tatum Play Against The Orlando Magic

Apr 25, 2025

Game 2 Showdown Will Jayson Tatum Play Against The Orlando Magic

Apr 25, 2025 -

Record Profits For Revolut Crypto Trading Boom Exceeds 1 Billion

Apr 25, 2025

Record Profits For Revolut Crypto Trading Boom Exceeds 1 Billion

Apr 25, 2025 -

Sundays Premier League Fixtures Liverpools Updated Winning Scenarios

Apr 25, 2025

Sundays Premier League Fixtures Liverpools Updated Winning Scenarios

Apr 25, 2025 -

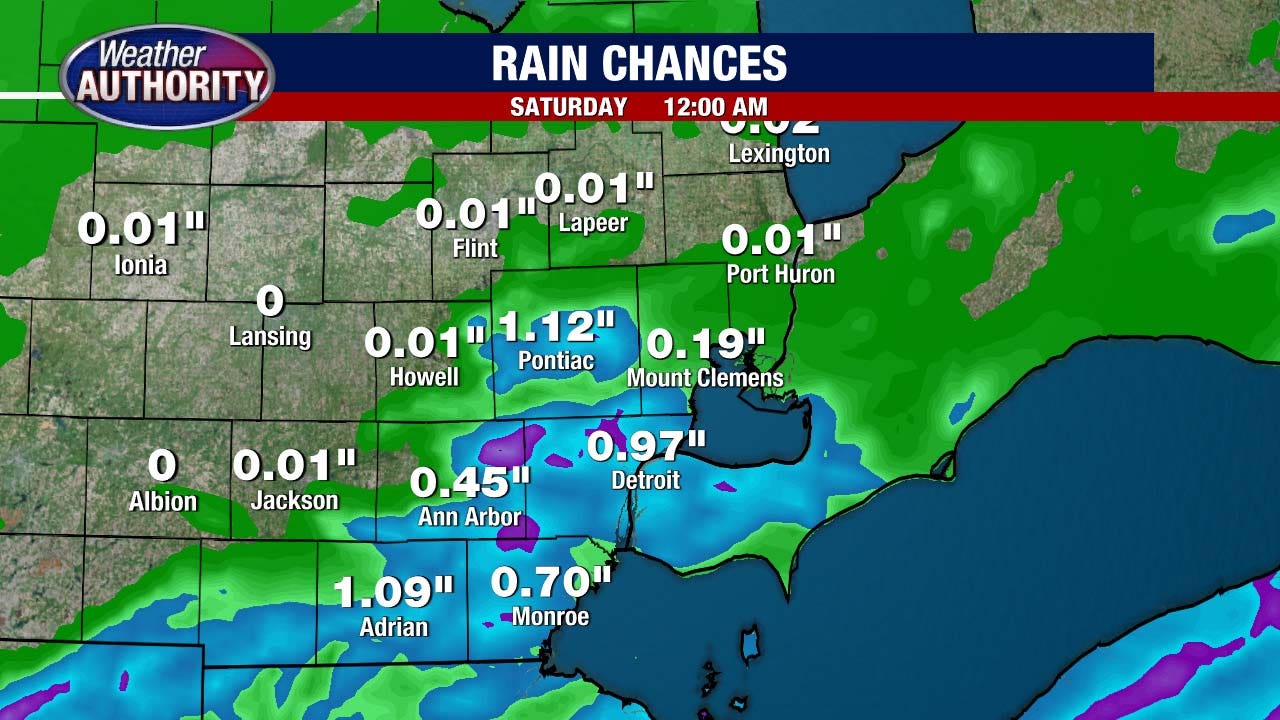

Metro Detroit Faces Afternoon Storms Weekend Brings Cooler Temperatures

Apr 25, 2025

Metro Detroit Faces Afternoon Storms Weekend Brings Cooler Temperatures

Apr 25, 2025 -

Uber Rating System Impacts And Rider Removal Policy

Apr 25, 2025

Uber Rating System Impacts And Rider Removal Policy

Apr 25, 2025

Latest Posts

-

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025

Arsenal Manager Warns Of Psg Danger Ahead Of Crucial Emirates Match

Apr 30, 2025 -

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025

Ligue Des Champions Arsenal Vs Psg Compositions Officielles Avec Doue Et Dembele

Apr 30, 2025 -

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025

Dte Energy Proposes 574 Million Rate Hike For Michigan Customers

Apr 30, 2025 -

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025

Ligue Des Champions Le Psg Et Arsenal S Affrontent A Londres

Apr 30, 2025 -

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025

Data Breach Alert Medical Software Companys Database Compromised Exposing Patient Data

Apr 30, 2025