The $OM Crash: Exploring AI's Potential To Stabilize The Volatile Cryptocurrency Market.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The $OM Crash: Can AI Stabilize the Volatile Crypto Market?

The recent dramatic crash of the OlympusDAO (OHM) stablecoin sent shockwaves through the cryptocurrency market, highlighting the inherent volatility and risks associated with this nascent asset class. While the initial panic subsided, the incident sparked crucial conversations about market stability and the potential role of artificial intelligence (AI) in mitigating future crises. This article delves into the $OM crash, analyzes its causes, and explores how AI could be leveraged to create a more stable and predictable cryptocurrency environment.

Understanding the OlympusDAO (OHM) Crash:

OlympusDAO, a decentralized finance (DeFi) protocol, aimed to create a stablecoin pegged to the US dollar. However, unlike traditional stablecoins backed by reserves, OHM relied on a complex algorithmic mechanism and community governance. The crash, which saw OHM's price plummet significantly, stemmed from a confluence of factors:

- Algorithmic Instability: The complex algorithm underpinning OHM proved susceptible to market manipulation and unforeseen events. Rapid sell-offs triggered a downward spiral, making it difficult for the protocol to maintain its peg.

- Lack of Transparency: Concerns around the protocol's governance and the lack of complete transparency regarding its inner workings contributed to investor anxieties. A lack of clear risk disclosures exacerbated the situation.

- Market Sentiment: Negative news and broader market downturns amplified the sell-off, creating a self-fulfilling prophecy. Fear and uncertainty led to a mass exodus of investors.

AI: A Potential Solution for Crypto Market Volatility?

The $OM crash underscores the need for innovative solutions to stabilize the volatile cryptocurrency market. AI offers several promising avenues:

1. Predictive Analytics: AI algorithms can analyze vast datasets of market data, including price movements, trading volume, social media sentiment, and news articles, to identify potential risks and predict market crashes before they occur. Early warning systems could allow investors and regulators to take preemptive measures.

2. Algorithmic Trading: AI-powered trading bots can execute trades at optimal times, minimizing losses and maximizing profits. These bots can react to market changes far faster than human traders, potentially stabilizing prices during periods of high volatility.

3. Risk Management: AI can assess the risks associated with different cryptocurrencies and DeFi protocols. By analyzing factors such as code security, governance structures, and market capitalization, AI can help investors make informed decisions and avoid high-risk investments.

4. Fraud Detection: AI can play a crucial role in detecting and preventing fraudulent activities, such as pump-and-dump schemes and rug pulls, which can significantly destabilize the market.

Challenges and Considerations:

While AI offers great potential, several challenges must be addressed:

- Data Quality: The accuracy of AI predictions relies heavily on the quality of the data used to train the algorithms. Inaccurate or incomplete data can lead to flawed predictions and potentially exacerbate market instability.

- Regulatory Framework: The lack of a comprehensive regulatory framework for AI in the crypto space presents a significant challenge. Clear guidelines are needed to ensure responsible development and deployment of AI-powered tools.

- Bias and Fairness: AI algorithms can inherit biases from the data they are trained on, potentially leading to unfair or discriminatory outcomes. Addressing these biases is crucial to ensure fairness and transparency.

Conclusion:

The $OM crash serves as a stark reminder of the risks inherent in the cryptocurrency market. While AI is not a silver bullet, its potential to enhance market stability, improve risk management, and prevent fraudulent activities is undeniable. However, the successful integration of AI requires careful consideration of the challenges and the development of robust regulatory frameworks. The future of a stable and resilient cryptocurrency market may well depend on the effective harnessing of AI's power.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The $OM Crash: Exploring AI's Potential To Stabilize The Volatile Cryptocurrency Market.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

De Ridder Vs Whittaker July Fight Card Adds Explosive Middleweight Bout

May 12, 2025

De Ridder Vs Whittaker July Fight Card Adds Explosive Middleweight Bout

May 12, 2025 -

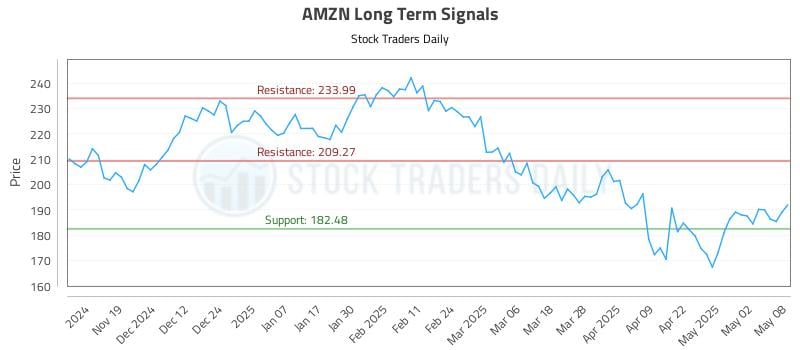

Should You Invest In Amazon Stock For The Long Term

May 12, 2025

Should You Invest In Amazon Stock For The Long Term

May 12, 2025 -

Jasmine Rice Heartbreak Hours Before Britains Got Talent Audition

May 12, 2025

Jasmine Rice Heartbreak Hours Before Britains Got Talent Audition

May 12, 2025 -

Jayson Tatum Silences Critics Celtics Secure Victory In New York

May 12, 2025

Jayson Tatum Silences Critics Celtics Secure Victory In New York

May 12, 2025 -

Agora Cobertura Completa Da Reuniao Anual Da Berkshire Hathaway 2024 Ao Vivo Pelo Info Money

May 12, 2025

Agora Cobertura Completa Da Reuniao Anual Da Berkshire Hathaway 2024 Ao Vivo Pelo Info Money

May 12, 2025

Latest Posts

-

Is Amzn A Buy In Depth Investment Report And Stock Analysis

May 13, 2025

Is Amzn A Buy In Depth Investment Report And Stock Analysis

May 13, 2025 -

Raptors Lottery Odds Can Lewenbergs Hope For A Higher Ceiling Become Reality

May 13, 2025

Raptors Lottery Odds Can Lewenbergs Hope For A Higher Ceiling Become Reality

May 13, 2025 -

Nyt Connections Game 700 May 11 Full Hints And Answers

May 13, 2025

Nyt Connections Game 700 May 11 Full Hints And Answers

May 13, 2025 -

Napolis Draw Opens Door For Inter Serie A Championship Battle Intensifies

May 13, 2025

Napolis Draw Opens Door For Inter Serie A Championship Battle Intensifies

May 13, 2025 -

Cricket Legend Virat Kohli Calls Time On Test Career The 269 Announcement

May 13, 2025

Cricket Legend Virat Kohli Calls Time On Test Career The 269 Announcement

May 13, 2025