The Quiet Revolution: Oil And Gas Giants' Strategic Shift Towards Bitcoin Mining

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Quiet Revolution: Oil and Gas Giants' Strategic Shift Towards Bitcoin Mining

The energy sector is undergoing a seismic shift, and it's not all about renewables. A quiet revolution is brewing, with major oil and gas companies increasingly turning their attention – and considerable resources – towards Bitcoin mining. This strategic pivot isn't just about diversification; it's about leveraging existing infrastructure and expertise to capitalize on the burgeoning cryptocurrency market and address pressing energy challenges.

This unexpected alliance between traditional energy and the decentralized world of Bitcoin is driven by several key factors. Let's delve into the reasons behind this fascinating development.

H2: Excess Energy and Profit Potential: A Perfect Storm

Oil and gas companies often grapple with the problem of excess energy, particularly in remote locations where transmission infrastructure is limited. Flared gas – a byproduct of oil extraction that is typically burned off – represents a significant waste of resources and a contributor to greenhouse gas emissions. Bitcoin mining, however, is incredibly energy-intensive. This presents a unique opportunity: transforming wasted energy into a profitable venture. By utilizing flared gas or excess electricity from their operations, these companies can significantly reduce environmental impact while generating substantial revenue from Bitcoin mining. This is particularly attractive in regions with low electricity costs, making the operation even more profitable.

H2: Diversification and Future-Proofing Strategies

The volatile nature of the oil and gas market necessitates diversification. Bitcoin mining offers a hedge against price fluctuations in the traditional energy sector. Furthermore, as the global adoption of cryptocurrencies continues to grow, investing in this space allows these giants to position themselves for future growth and secure a stake in a rapidly evolving technological landscape. This proactive strategy allows them to explore new revenue streams and reduce reliance on the traditionally unpredictable energy market.

H3: Technological Expertise and Infrastructure Advantage

Oil and gas companies possess significant expertise in managing complex infrastructure, including power generation and data center operations. This existing infrastructure gives them a considerable advantage over newer entrants in the Bitcoin mining space. They can leverage their established logistical networks and operational efficiency to create highly efficient and cost-effective mining operations. This advantage translates directly into higher profit margins and a competitive edge in the market.

H2: Environmental Concerns and Potential Solutions

While Bitcoin mining is energy-intensive, the utilization of excess or flared gas can significantly reduce the overall environmental impact compared to simply burning it off. This approach allows these companies to address some of the environmental criticisms directed at their traditional operations while simultaneously capitalizing on a new market. However, transparency and responsible sourcing of energy for mining operations remain crucial to mitigating environmental concerns. Companies need to clearly articulate their sustainability initiatives to maintain public trust.

H2: The Future of Energy and Cryptocurrency Convergence

The convergence of the traditional energy sector and the cryptocurrency market marks a significant development with far-reaching implications. This strategic shift isn't just about immediate profits; it signifies a potential paradigm shift in how energy is produced, consumed, and monetized. As Bitcoin mining technology continues to evolve and become more energy-efficient, this partnership is likely to become even more prominent, potentially driving innovation in both sectors. This presents exciting possibilities for future energy solutions and the broader cryptocurrency ecosystem. The quiet revolution is only just beginning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Quiet Revolution: Oil And Gas Giants' Strategic Shift Towards Bitcoin Mining. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ge 2025 Rdus First Rally Focuses On Key Bread And Butter Issues

Apr 28, 2025

Ge 2025 Rdus First Rally Focuses On Key Bread And Butter Issues

Apr 28, 2025 -

Eurovision 2025 Meet The Artists Competing In Liverpool

Apr 28, 2025

Eurovision 2025 Meet The Artists Competing In Liverpool

Apr 28, 2025 -

156 7 Kmph Missile Lsgs Pace Ace Sends Shivers Down Mumbai Indians Spines

Apr 28, 2025

156 7 Kmph Missile Lsgs Pace Ace Sends Shivers Down Mumbai Indians Spines

Apr 28, 2025 -

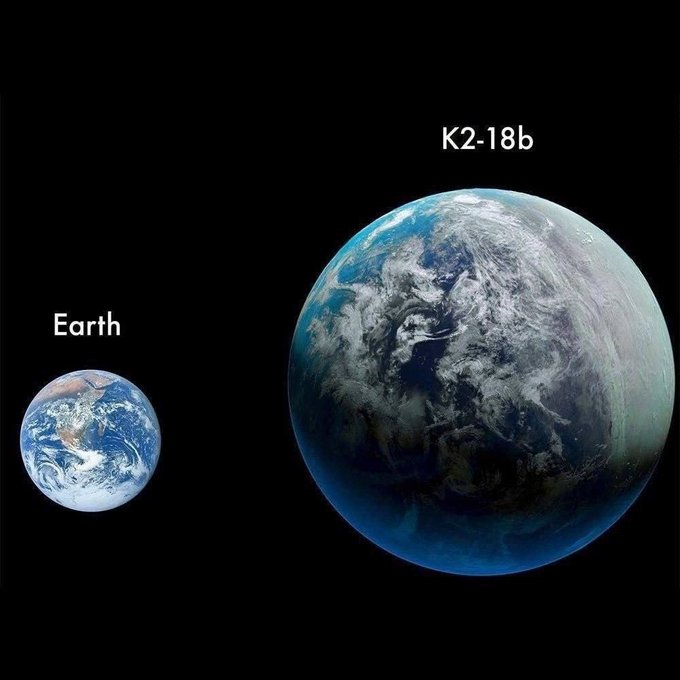

New Research High Probability Of Life On Ocean Exoplanet K2 18b

Apr 28, 2025

New Research High Probability Of Life On Ocean Exoplanet K2 18b

Apr 28, 2025 -

Verified But Vulnerable Exploring The Security Gaps In Web3 Decentralized Applications

Apr 28, 2025

Verified But Vulnerable Exploring The Security Gaps In Web3 Decentralized Applications

Apr 28, 2025

Latest Posts

-

Al Hilals Champions League Semi Final Cancelo Absence Confirmed

Apr 30, 2025

Al Hilals Champions League Semi Final Cancelo Absence Confirmed

Apr 30, 2025 -

In Depth Look Pap Teams Achievements In Punggol Grc

Apr 30, 2025

In Depth Look Pap Teams Achievements In Punggol Grc

Apr 30, 2025 -

Leaked Thunderbolts Post Credits Scene Fuels Premiere Discussion

Apr 30, 2025

Leaked Thunderbolts Post Credits Scene Fuels Premiere Discussion

Apr 30, 2025 -

Hegseth Scraps Pentagons Women Peace And Security Program Over Dei Concerns

Apr 30, 2025

Hegseth Scraps Pentagons Women Peace And Security Program Over Dei Concerns

Apr 30, 2025 -

Faf Du Plessis Match Winning Fifty A New Ipl 2025 Milestone

Apr 30, 2025

Faf Du Plessis Match Winning Fifty A New Ipl 2025 Milestone

Apr 30, 2025