The Regulatory Gap: Why Crypto Needs A Modern Tax Framework

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Regulatory Gap: Why Crypto Needs a Modern Tax Framework

The meteoric rise of cryptocurrency has left global tax authorities scrambling to catch up. The current tax framework, designed for traditional assets, is ill-equipped to handle the complexities and rapid evolution of the digital asset landscape. This regulatory gap presents significant challenges for both taxpayers and governments, highlighting the urgent need for a modern, comprehensive tax framework specifically tailored to cryptocurrencies.

The Current System: A Patchwork of Inconsistencies

Many countries are grappling with how to classify cryptocurrencies for tax purposes. Are they assets, commodities, or currencies? This fundamental ambiguity leads to inconsistencies in tax treatment across jurisdictions. Taxpayers face confusion regarding capital gains taxes, income taxes, and even the application of value-added tax (VAT) or Goods and Services Tax (GST). This uncertainty creates compliance challenges and opens the door to potential tax evasion.

- Capital Gains Tax Confusion: Determining the cost basis of crypto assets, particularly those acquired through staking, mining, or airdrops, is a major hurdle. The lack of clear guidance often leads to miscalculations and potential penalties.

- Income Tax Complications: Using crypto for transactions, payments, or receiving crypto as income raises questions about the tax implications. Is it taxable income, or are there specific rules applying to crypto transactions?

- Cross-border Transactions: The global nature of cryptocurrency creates further complexities. Determining the appropriate tax jurisdiction for cross-border transactions involving crypto remains a significant challenge.

The Need for a Modern Approach

A modern crypto tax framework needs to address these issues head-on. It requires clear and consistent definitions of crypto assets, precise guidance on tax calculation methodologies, and robust reporting mechanisms. Furthermore, international collaboration is crucial to prevent regulatory arbitrage and ensure a level playing field for both taxpayers and businesses.

Key Elements of a Modern Crypto Tax Framework:

- Clear Definitions: Legislatures must define cryptocurrencies and related activities (mining, staking, DeFi participation) with clarity, avoiding ambiguity that creates opportunities for misinterpretations.

- Simplified Tax Calculation: Streamlined tax calculation methods, potentially incorporating blockchain technology itself for automated reporting, would improve compliance and reduce administrative burdens.

- Harmonized International Standards: International cooperation is vital to establish global standards that minimize discrepancies and prevent regulatory arbitrage.

- Education and Awareness: Governments must invest in public education programs to increase taxpayer awareness of crypto tax regulations.

The Consequences of Inaction

Failure to address the regulatory gap poses significant risks. Tax avoidance, hindering the growth of legitimate crypto businesses, and undermining public trust in the crypto market are all potential outcomes. A lack of clarity also discourages institutional investors from entering the space, hindering overall market development.

Looking Ahead: Towards a Future-Proof Framework

The crypto landscape is dynamic. Any effective tax framework must be adaptable and future-proof, capable of responding to emerging technologies and innovations within the digital asset ecosystem. This requires ongoing dialogue between regulators, industry players, and tax professionals to ensure a framework that balances tax efficiency with the need to protect the integrity of the financial system. The future of cryptocurrency relies on a clear, consistent, and adaptable tax framework – a regulatory evolution that is both necessary and long overdue.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Regulatory Gap: Why Crypto Needs A Modern Tax Framework. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

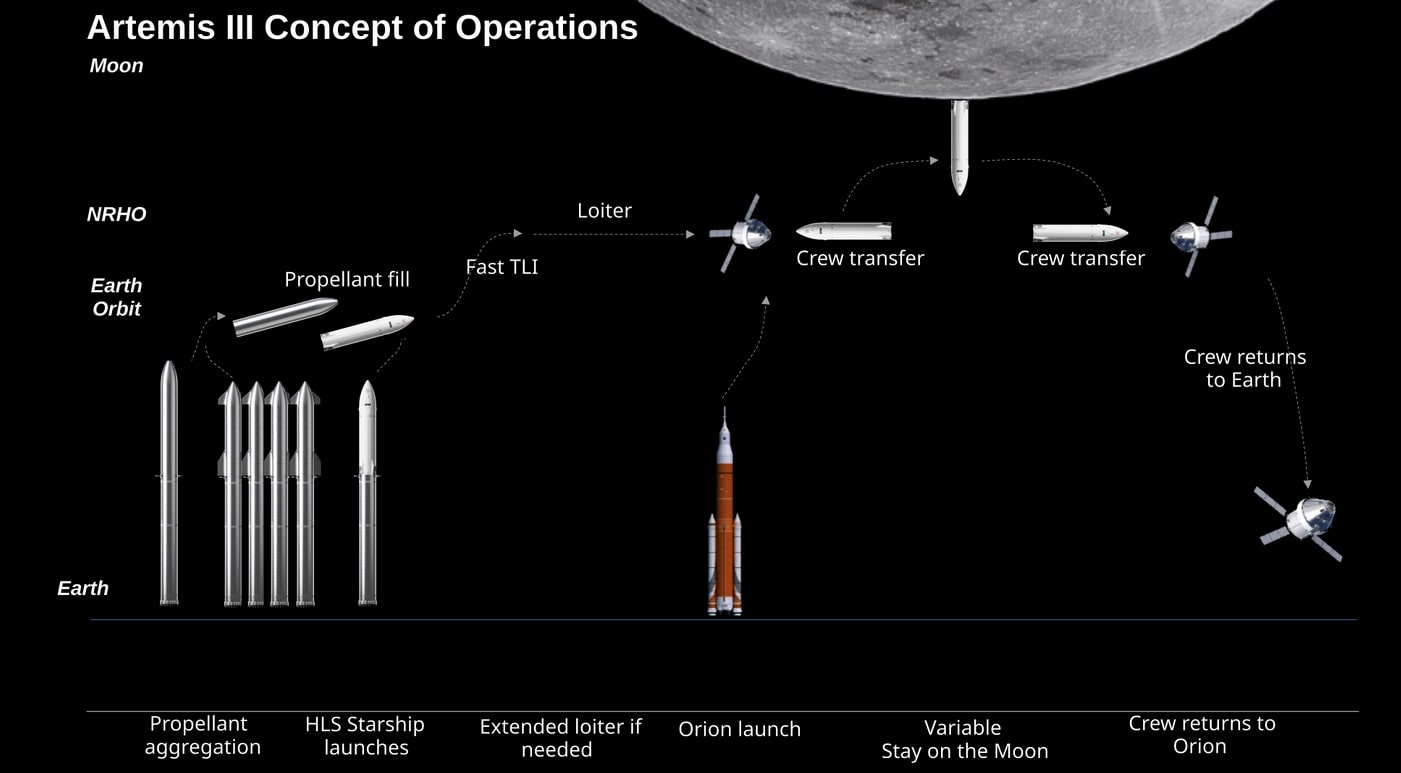

Analysis Space X Starships Anomalous Static Fire Test Results

May 07, 2025

Analysis Space X Starships Anomalous Static Fire Test Results

May 07, 2025 -

Amd Q3 Earnings Strong Performance Despite 1 5 B China Revenue Hit

May 07, 2025

Amd Q3 Earnings Strong Performance Despite 1 5 B China Revenue Hit

May 07, 2025 -

Backlash Against Cnn Interview With Sinaloa Cartel Gangster Draws Criticism

May 07, 2025

Backlash Against Cnn Interview With Sinaloa Cartel Gangster Draws Criticism

May 07, 2025 -

Understanding The Causes Of Budget Overruns Case Study Nasa

May 07, 2025

Understanding The Causes Of Budget Overruns Case Study Nasa

May 07, 2025 -

Following In Giant Footsteps A Sequels Performance Compared

May 07, 2025

Following In Giant Footsteps A Sequels Performance Compared

May 07, 2025

Latest Posts

-

Kashmir Airport Closures India Pakistan Conflict Intensifies

May 08, 2025

Kashmir Airport Closures India Pakistan Conflict Intensifies

May 08, 2025 -

Final Destination Bloodlines A New Level Of Gore

May 08, 2025

Final Destination Bloodlines A New Level Of Gore

May 08, 2025 -

How Us Movie Tariffs Could Reshape The Australian Film Industry

May 08, 2025

How Us Movie Tariffs Could Reshape The Australian Film Industry

May 08, 2025 -

Record Breaking Gore In Final Destination Bloodlines

May 08, 2025

Record Breaking Gore In Final Destination Bloodlines

May 08, 2025 -

Who Is The Mad Scientist Monster On The Masked Singer

May 08, 2025

Who Is The Mad Scientist Monster On The Masked Singer

May 08, 2025