The Significance Of Buffett's Reduced Cash Holdings

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Buffett's Reduced Cash Holdings: A Signal of Bullish Confidence or Cautious Strategy?

Warren Buffett's Berkshire Hathaway recently reported a significant decrease in its cash holdings, sparking considerable debate among investors and financial analysts. This move, after years of accumulating massive cash reserves, signifies a potential shift in the Oracle of Omaha's investment strategy, prompting questions about the future direction of the market and Berkshire's own portfolio. But what does this reduction truly mean? Is it a bullish bet on the economy, a strategic realignment, or something else entirely?

A Dramatic Shift in Berkshire's Approach

For years, Berkshire Hathaway's substantial cash pile was a hallmark of its conservative approach. This massive reserve, often exceeding $100 billion, served as a safety net, allowing Buffett to pounce on attractive investment opportunities during market downturns. However, the recent reduction indicates a change in this long-held strategy. The specific amount of the decrease and the allocation of those funds will be key factors in understanding the implications. Were these funds deployed in existing holdings, or did Berkshire make significant new investments? The answers hold the key to deciphering Buffett's intentions.

Possible Interpretations of the Reduced Cash:

Several interpretations are emerging from this significant shift in Berkshire's cash position:

-

A Bullish Market Outlook: The reduction could be a clear signal that Buffett sees attractive opportunities in the current market environment. This would imply a more optimistic outlook on the economy and future corporate earnings. This interpretation is further supported by the recent increase in share buybacks by Berkshire.

-

Strategic Acquisitions: Buffett has always been a shrewd dealmaker, and the decrease in cash could be linked to significant upcoming acquisitions. While the specifics haven't been disclosed, the possibility of large-scale mergers and acquisitions cannot be ruled out. This strategy would align with Berkshire's historical pattern of acquiring well-established companies with strong fundamentals.

-

Inflationary Pressures: Holding large sums of cash in an inflationary environment can erode its purchasing power. The reduction could be a strategic move to protect against inflation by investing the funds in assets that are expected to appreciate in value.

-

Balancing Risk and Reward: It’s also possible that Buffett is carefully balancing risk and reward. While he may see opportunities, he's likely not betting the entire farm. A partial deployment of cash suggests a cautious optimism, hedging against potential future economic uncertainty.

Analyzing the Long-Term Implications:

The long-term implications of this reduction in cash holdings remain to be seen. However, it undeniably marks a significant shift in Berkshire Hathaway's investment strategy. Further scrutiny of Berkshire's quarterly reports and future investment decisions will be crucial in gaining a more complete understanding of Buffett's rationale. This move is undoubtedly setting the stage for interesting developments in the coming months and years.

Conclusion: More Questions Than Answers

While the reduction in Berkshire Hathaway's cash holdings provides intriguing insights into Buffett's investment strategy, it also raises more questions than answers. The lack of detailed information regarding the allocation of these funds leaves room for speculation. Only time will reveal the true impact and significance of this strategic shift. However, one thing is clear: the market will be closely watching Berkshire Hathaway's future moves for further clues. This story is far from over.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Significance Of Buffett's Reduced Cash Holdings. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fiorentina Holds Milan To 2 2 Draw Key Moments And Player Performances April 5 2025

Apr 07, 2025

Fiorentina Holds Milan To 2 2 Draw Key Moments And Player Performances April 5 2025

Apr 07, 2025 -

Dunia Bisnis Berduka Murdaya Poo Maestro Di Balik Kesuksesan Pondok Indah Mall Telah Tiada

Apr 07, 2025

Dunia Bisnis Berduka Murdaya Poo Maestro Di Balik Kesuksesan Pondok Indah Mall Telah Tiada

Apr 07, 2025 -

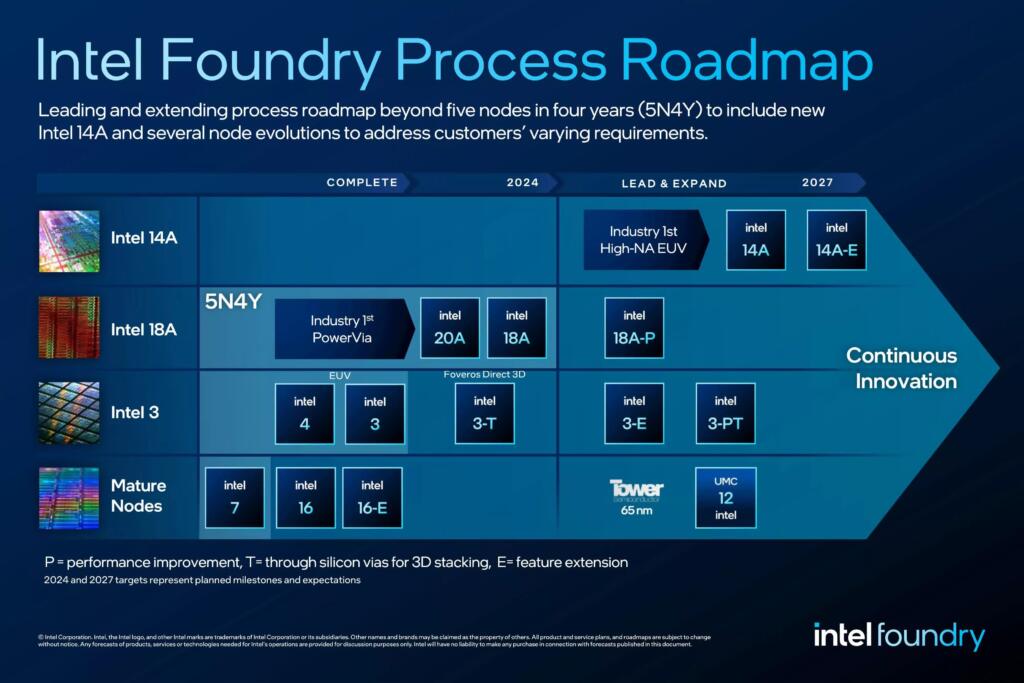

Intels Comeback 18 Angstrom Chips Poised For Mass Production

Apr 07, 2025

Intels Comeback 18 Angstrom Chips Poised For Mass Production

Apr 07, 2025 -

Welsh Rugby Icon Dan Biggar Calls Time On His Career

Apr 07, 2025

Welsh Rugby Icon Dan Biggar Calls Time On His Career

Apr 07, 2025 -

Saturday Night Live Airing April 5th 2025 Host And Musical Guest Details

Apr 07, 2025

Saturday Night Live Airing April 5th 2025 Host And Musical Guest Details

Apr 07, 2025