The State Of The American Economy: A Bleak Picture For Consumers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The State of the American Economy: A Bleak Picture for Consumers

The American economy is sending mixed signals, and for consumers, the outlook is decidedly gloomy. While headline inflation has cooled, underlying economic pressures continue to squeeze household budgets, leaving many Americans feeling financially insecure. This isn't just about rising prices; it's a confluence of factors painting a complex and concerning picture.

Persistent Inflation and its Lingering Impact:

While the annual inflation rate has decreased from its peak, the cost of everyday essentials remains stubbornly high. Grocery prices, rent, and energy costs continue to outpace wage growth for many, leading to a persistent erosion of purchasing power. This means families are having to make difficult choices, sacrificing discretionary spending and struggling to meet basic needs. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, are also contributing to the problem by increasing borrowing costs for everything from mortgages to auto loans.

The Crushing Weight of Debt:

American households are grappling with historically high levels of debt. Student loan repayments are set to resume after a pandemic-era pause, adding further strain to already stretched budgets. Credit card debt is also soaring, driven by inflation and the need to borrow to cover essential expenses. This escalating debt burden limits consumers' ability to spend and invest, further hindering economic growth.

A Weakening Labor Market? The Cracks Appear:

While the unemployment rate remains relatively low, recent job losses in certain sectors, coupled with slowing job growth, are raising concerns. This uncertainty, combined with the threat of further layoffs, is impacting consumer confidence. People are less likely to spend freely when their job security feels precarious.

Consumer Confidence Plummets:

Surveys consistently show a decline in consumer confidence. People are worried about the future, and this anxiety is translating into reduced spending. This decreased consumer spending is a major drag on economic growth, creating a vicious cycle of uncertainty and stagnation.

What Lies Ahead? Navigating the Uncertain Terrain:

The coming months will be crucial in determining the trajectory of the American economy. The Federal Reserve's monetary policy will continue to play a significant role, as will global economic conditions. However, the immediate outlook for consumers remains challenging. Many experts predict a period of continued economic uncertainty, with potential for further economic slowdown.

Strategies for Consumers:

- Budgeting and Financial Planning: Creating a realistic budget and carefully tracking expenses is more critical than ever.

- Debt Management: Developing a strategy to manage and reduce debt is essential. Consider debt consolidation or seeking professional financial advice.

- Emergency Fund: Building an emergency fund can provide a crucial safety net during unexpected financial challenges.

- Seeking Support: Numerous resources are available to help individuals and families facing financial hardship. Don't hesitate to reach out for assistance.

The current state of the American economy presents a significant challenge for consumers. Navigating this difficult period requires careful planning, proactive financial management, and a keen awareness of the economic landscape. The coming months will likely be defined by continued uncertainty, highlighting the need for resilience and responsible financial practices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The State Of The American Economy: A Bleak Picture For Consumers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

El Salvadors Bitcoin Experiment A Legal Tender Case Study And Us Implications

May 16, 2025

El Salvadors Bitcoin Experiment A Legal Tender Case Study And Us Implications

May 16, 2025 -

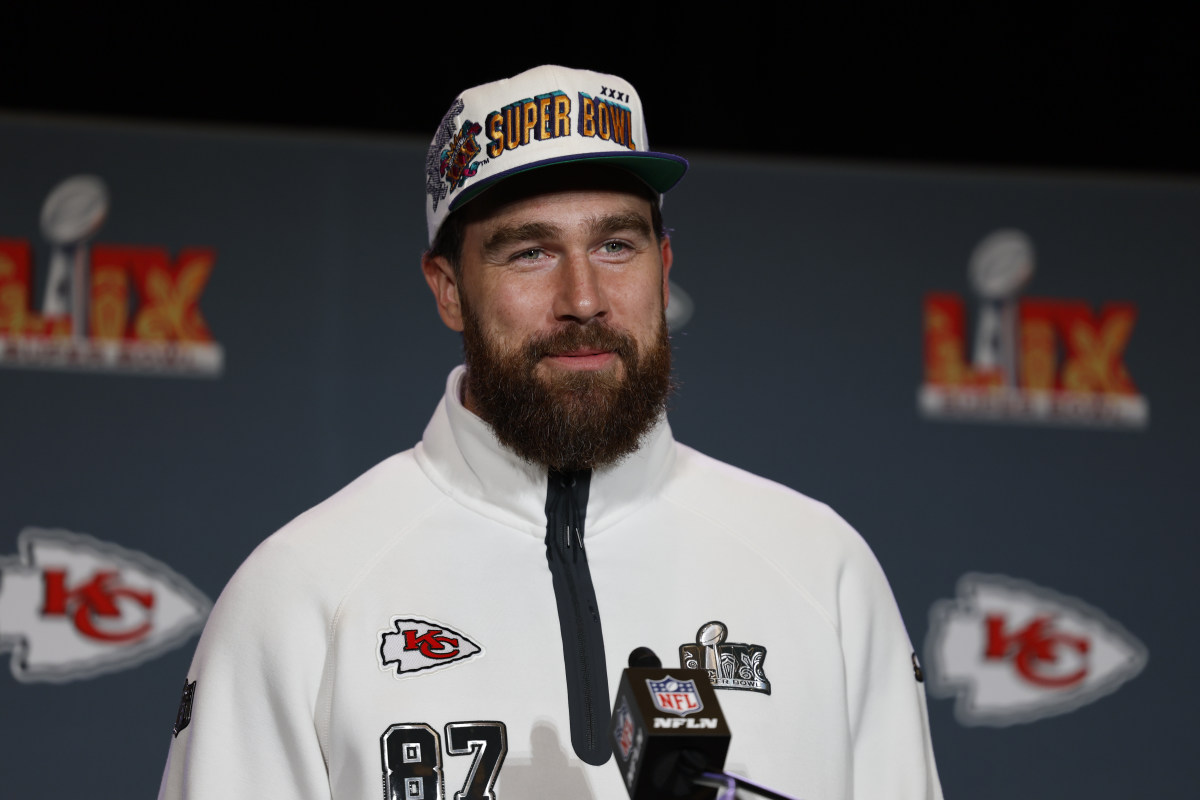

Travis Kelce Reacts To Erin Andrews Latest Career Decision

May 16, 2025

Travis Kelce Reacts To Erin Andrews Latest Career Decision

May 16, 2025 -

Trump Declares Taylor Swift Not Hot Igniting Maga Celebration

May 16, 2025

Trump Declares Taylor Swift Not Hot Igniting Maga Celebration

May 16, 2025 -

Alcaraz Defeats Draper In Hard Fought Italian Open Quarterfinal

May 16, 2025

Alcaraz Defeats Draper In Hard Fought Italian Open Quarterfinal

May 16, 2025 -

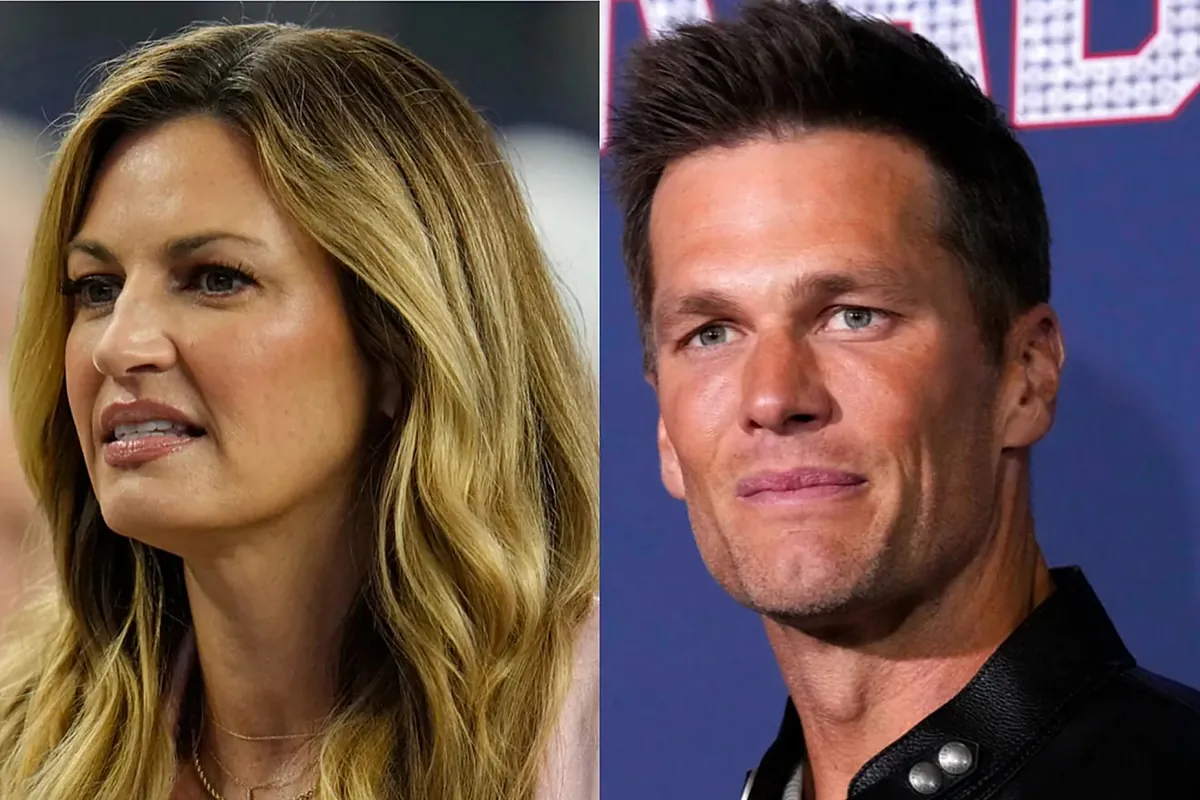

Erin Andrews Post Fox Career The Tom Brady Partnership Explained

May 16, 2025

Erin Andrews Post Fox Career The Tom Brady Partnership Explained

May 16, 2025