The Urgent Need For Crypto Tax Law Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Urgent Need for Crypto Tax Law Reform: A Cry for Clarity Amidst Market Volatility

The cryptocurrency market, a volatile landscape of decentralized finance and technological innovation, is desperately in need of comprehensive tax law reform. Current regulations, largely outdated and ill-equipped to handle the complexities of digital assets, are creating significant hurdles for both individual investors and businesses operating within this burgeoning sector. This lack of clarity is not only stifling innovation but also contributing to uncertainty and a potential exodus of crypto activity from jurisdictions with inadequate frameworks.

The Current Regulatory Landscape: A Patchwork of Confusion

Existing tax laws were designed for traditional financial instruments, failing to adequately address the unique characteristics of cryptocurrencies. This leads to a confusing and often contradictory regulatory environment. For example, the classification of cryptocurrencies as property, securities, or commodities varies across jurisdictions, resulting in inconsistent tax treatments. This ambiguity makes accurate tax reporting incredibly challenging, leading to:

- Increased Compliance Costs: Navigating the complex maze of existing regulations requires significant time and expense, often necessitating the engagement of specialized tax professionals. This disproportionately impacts smaller investors and businesses.

- Higher Risk of Audit: The lack of clear guidelines increases the likelihood of inadvertent errors and subsequent IRS audits, resulting in penalties and legal fees.

- Uncertainty and Inhibited Investment: The uncertainty surrounding tax implications discourages both individual and institutional investment, hindering the growth of the crypto industry.

Key Areas Requiring Reform:

Several crucial areas demand immediate attention from lawmakers aiming for effective crypto tax reform:

- Clear Definition of Crypto Assets: A clear and consistent definition of what constitutes a cryptocurrency, including stablecoins and NFTs, is paramount. This will establish a common understanding across jurisdictions and reduce ambiguity.

- Simplified Tax Reporting: The current reporting process is overly burdensome. Streamlined reporting mechanisms, potentially leveraging blockchain technology, are needed to simplify compliance and reduce the administrative burden.

- Harmonization of International Standards: Lack of international cooperation on crypto taxation creates inconsistencies and challenges for cross-border transactions. Harmonizing standards would promote global crypto adoption and reduce regulatory arbitrage.

- Addressing Staking and DeFi Activities: The rapid expansion of decentralized finance (DeFi) and staking rewards necessitates clear guidelines on how to tax income generated from these activities. Current regulations often fall short in this area.

- Fair and Equitable Taxation: The tax system should be designed to encourage innovation while ensuring fair and equitable taxation. Overly burdensome regulations could stifle the very innovation they aim to regulate.

The Way Forward: A Collaborative Approach

Addressing the urgent need for crypto tax law reform requires a collaborative effort involving policymakers, regulators, industry experts, and stakeholders. Open dialogue and a willingness to adapt to the rapidly evolving nature of the crypto market are crucial. This includes:

- Increased Education and Outreach: Government agencies should actively educate taxpayers about the intricacies of crypto taxation.

- Industry Collaboration: Collaboration between regulators and the crypto industry is essential to create a framework that balances regulatory needs with the innovative potential of the sector.

- Phased Implementation: A phased implementation of new regulations would allow stakeholders to adapt to the changes and minimize disruption.

Ignoring the need for comprehensive crypto tax law reform is not an option. A clear, consistent, and equitable framework is essential for fostering innovation, attracting investment, and ensuring the long-term growth of the cryptocurrency market. Failure to act decisively will only exacerbate existing issues and potentially hinder the global adoption of this transformative technology.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Urgent Need For Crypto Tax Law Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Grok 3 5 Upgrade Exclusive Release For Super Grok Subscribers Next Week

May 03, 2025

Grok 3 5 Upgrade Exclusive Release For Super Grok Subscribers Next Week

May 03, 2025 -

Legal Dispute James Dolan Targets Beyonce With Cease And Desist Over Sphere Performance

May 03, 2025

Legal Dispute James Dolan Targets Beyonce With Cease And Desist Over Sphere Performance

May 03, 2025 -

Aaron Judges 2023 Season A Year Of Extremes

May 03, 2025

Aaron Judges 2023 Season A Year Of Extremes

May 03, 2025 -

The Impact Of Prime Videos Expanded Shop The Show On Viewers And Show Production

May 03, 2025

The Impact Of Prime Videos Expanded Shop The Show On Viewers And Show Production

May 03, 2025 -

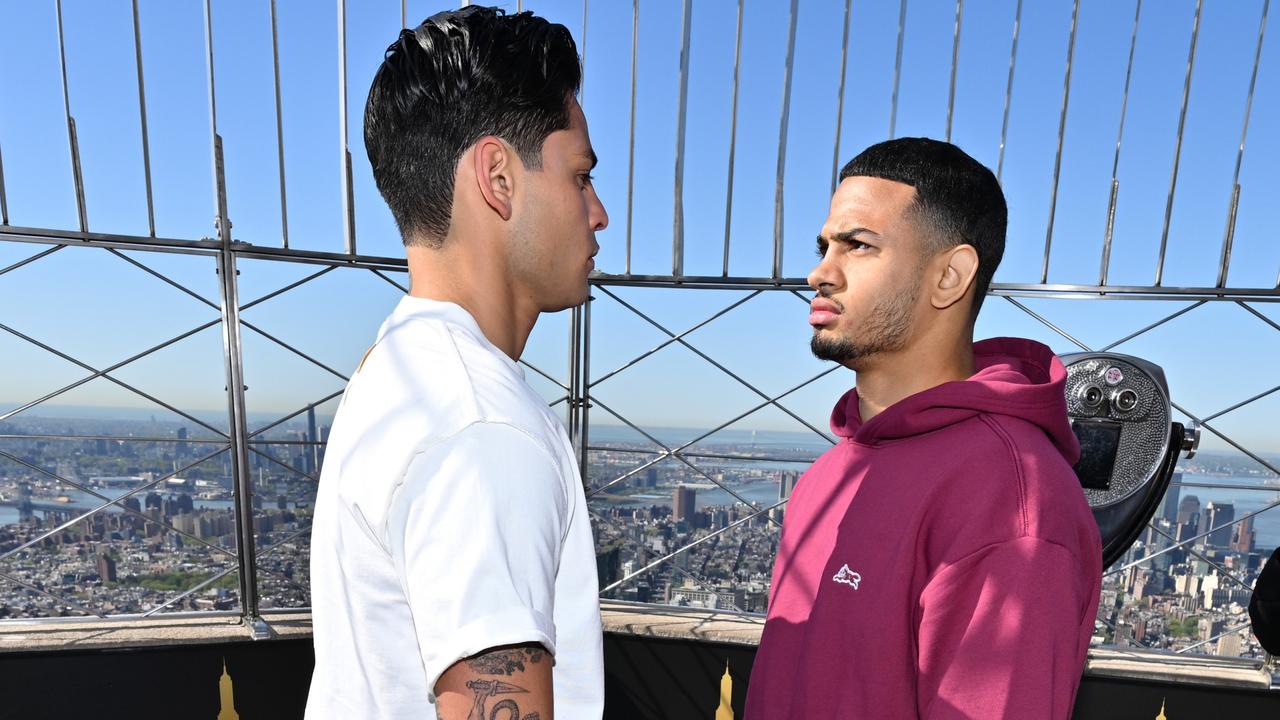

The Controversial Fighter Returns Your Ultimate Guide To The New York Event

May 03, 2025

The Controversial Fighter Returns Your Ultimate Guide To The New York Event

May 03, 2025

Latest Posts

-

Powerful 5 5 Magnitude Earthquake Shakes Eastern Taiwan

May 07, 2025

Powerful 5 5 Magnitude Earthquake Shakes Eastern Taiwan

May 07, 2025 -

Surprisingly Good High Quality Items On A Shoestring Budget

May 07, 2025

Surprisingly Good High Quality Items On A Shoestring Budget

May 07, 2025 -

Nuggets Eliminate Clippers Westbrook Adds Insult To Injury With Post Game 7 Actions

May 07, 2025

Nuggets Eliminate Clippers Westbrook Adds Insult To Injury With Post Game 7 Actions

May 07, 2025 -

Strong Earthquake Shakes Taiwan 5 9 Magnitude Tremor And Ongoing Aftershocks

May 07, 2025

Strong Earthquake Shakes Taiwan 5 9 Magnitude Tremor And Ongoing Aftershocks

May 07, 2025 -

Analyzing Mark Carneys Trip To Washington A Preliminary Assessment

May 07, 2025

Analyzing Mark Carneys Trip To Washington A Preliminary Assessment

May 07, 2025