The Urgent Need For Crypto Tax Reform: Beyond The 2014 Framework

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Urgent Need for Crypto Tax Reform: Beyond the 2014 Framework

The cryptocurrency landscape has exploded since 2014, the year the IRS first issued guidance on taxing digital assets. What was then a niche market is now a multi-trillion dollar global phenomenon, encompassing NFTs, DeFi, staking, and countless other innovations. Yet, the tax framework remains largely unchanged, creating a complex and often unfair system for millions of cryptocurrency investors and businesses. This outdated approach necessitates urgent reform.

The current system, based on the 2014 IRS Notice 2014-21, treats cryptocurrencies as property for tax purposes. While seemingly straightforward, this classification fails to account for the unique characteristics of digital assets, leading to several critical issues:

The Challenges of the Current Crypto Tax System

-

Complexity and ambiguity: Determining the cost basis of crypto assets, especially in scenarios involving staking rewards, airdrops, and DeFi yields, is incredibly complex. The lack of clear guidelines frequently leads to unintentional errors and penalties. Many taxpayers lack the expertise to navigate this intricate system accurately.

-

Lack of clarity on DeFi activities: Decentralized finance (DeFi) protocols introduce novel challenges. The numerous transactions, automated processes, and complex smart contracts make it incredibly difficult to track gains and losses accurately, especially for those who participate frequently in lending, borrowing, or yield farming.

-

Difficulties for businesses: Businesses operating in the crypto space face significant hurdles in accurately accounting for their transactions. The current regulations lack clarity on how to treat mining rewards, NFT sales, and other business-related activities. This often results in increased compliance costs and risks of substantial penalties.

-

International inconsistencies: The lack of harmonized international tax regulations for cryptocurrencies creates further complexities, especially for investors and businesses operating across borders. Differences in tax treatments across countries can lead to double taxation or tax avoidance opportunities.

The Urgent Need for Reform: A Call for Modernization

The current crypto tax framework is not only overly complex but also increasingly outdated and ill-suited to the modern crypto ecosystem. A significant overhaul is urgently needed to:

-

Simplify tax reporting: The IRS should explore streamlined reporting mechanisms, potentially leveraging blockchain technology to automate the process and reduce the burden on taxpayers.

-

Provide clearer guidance on DeFi: Specific guidelines are needed to clarify the tax implications of various DeFi activities, offering greater certainty to participants.

-

Develop tailored regulations for businesses: The IRS needs to create a more specific framework for crypto businesses, offering guidance on accounting for various activities and potentially allowing for deductions related to mining expenses or blockchain development.

-

Promote international cooperation: Collaborating internationally on crypto tax regulations will create a more consistent and fairer global framework, reducing compliance burdens and preventing tax arbitrage.

The Path Forward: Advocacy and Congressional Action

The need for crypto tax reform is not simply a technical matter; it's a matter of fairness and economic growth. The current system discourages participation in the crypto market and hinders innovation. Effective reform requires a multi-pronged approach:

-

Increased public awareness: Educating taxpayers about the complexities of crypto taxes is crucial. Clear and accessible resources are needed to help navigate the existing system and advocate for change.

-

Industry collaboration: Crypto businesses and advocacy groups must work together to present clear and concise proposals for reform to policymakers.

-

Congressional action: Ultimately, significant legislative changes are needed to update the 2014 framework and create a more equitable and sustainable system for the long-term growth of the cryptocurrency industry.

The future of cryptocurrency taxation hinges on timely and effective reform. Failure to act will not only create further uncertainty and hardship for taxpayers but will also stifle innovation and hinder the growth of this vital sector of the global economy. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Urgent Need For Crypto Tax Reform: Beyond The 2014 Framework. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Compartilhamento De Casas Guia Pratico Para Acesso A Praia E Campo

May 03, 2025

Compartilhamento De Casas Guia Pratico Para Acesso A Praia E Campo

May 03, 2025 -

Ethnic Minority Candidates Police Appointment Sparks Debate Following Interview Failure

May 03, 2025

Ethnic Minority Candidates Police Appointment Sparks Debate Following Interview Failure

May 03, 2025 -

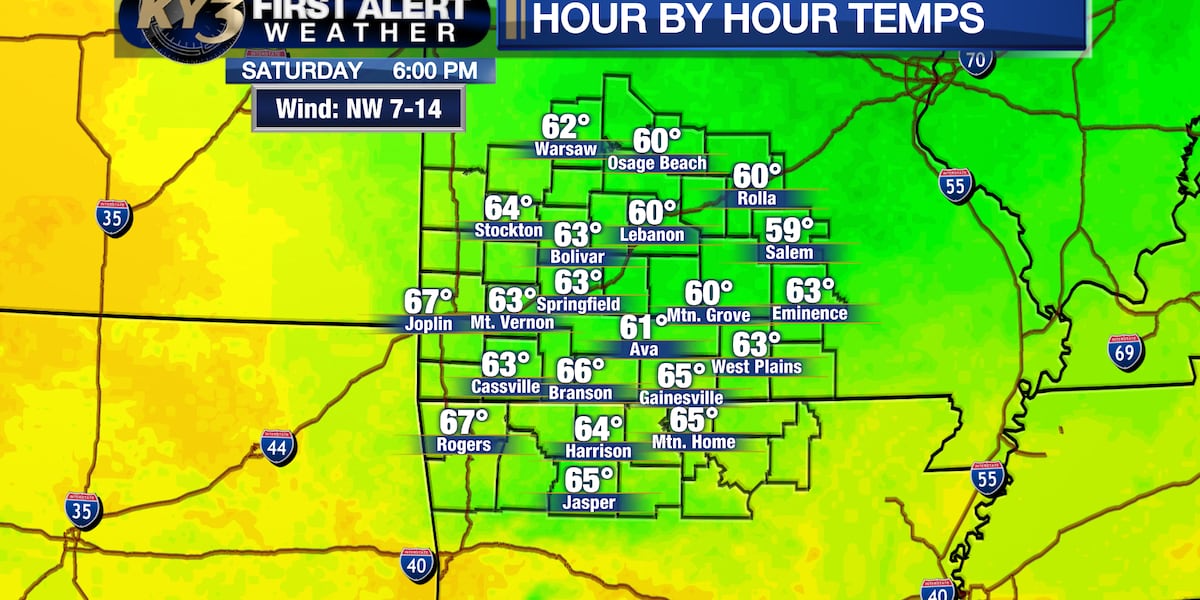

Rain And Thunderstorms Likely Friday First Alert Weather

May 03, 2025

Rain And Thunderstorms Likely Friday First Alert Weather

May 03, 2025 -

From Hit To Miss Why The Sequel To Movie Title Fails To Deliver

May 03, 2025

From Hit To Miss Why The Sequel To Movie Title Fails To Deliver

May 03, 2025 -

Match Report Paris Fcs Hard Fought Ligue 1 Promotion

May 03, 2025

Match Report Paris Fcs Hard Fought Ligue 1 Promotion

May 03, 2025

Latest Posts

-

Spotify App Ready To Challenge Apples New Rules

May 03, 2025

Spotify App Ready To Challenge Apples New Rules

May 03, 2025 -

Manchester City Vs Wolves Predicted Lineups Key Battles And Betting Odds

May 03, 2025

Manchester City Vs Wolves Predicted Lineups Key Battles And Betting Odds

May 03, 2025 -

Social Media Buzz Oklahoma Sooners Claim Sec Championship

May 03, 2025

Social Media Buzz Oklahoma Sooners Claim Sec Championship

May 03, 2025 -

North Koreas Lazarus Group Sells 4 600 Btc Impact On Bitcoin Market

May 03, 2025

North Koreas Lazarus Group Sells 4 600 Btc Impact On Bitcoin Market

May 03, 2025 -

Fernando Tatis Jr Mlb Performance Todays Baseball Predictions May 2nd

May 03, 2025

Fernando Tatis Jr Mlb Performance Todays Baseball Predictions May 2nd

May 03, 2025