The US Economy: Addressing Debt, Deficits, And Tax Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The US Economy: Navigating the Tricky Terrain of Debt, Deficits, and Tax Reform

The US economy, the world's largest, faces a complex interplay of challenges: burgeoning national debt, persistent budget deficits, and the ongoing impact of recent tax reforms. Understanding these intertwined issues is crucial for navigating the economic landscape and predicting future trends. This article delves into the current state of affairs, examining the root causes, potential consequences, and possible solutions.

The Mounting National Debt: A Looming Shadow

The US national debt, the total amount of money the government owes, has reached astronomical levels. Years of budget deficits – where spending exceeds revenue – have fueled this growth. While debt itself isn't inherently bad, especially when used to fund productive investments, the sheer scale of the US debt raises concerns about long-term economic stability. High debt levels can lead to increased interest payments, crowding out other essential government spending, and potentially impacting the nation's credit rating.

Persistent Budget Deficits: The Underlying Problem

Budget deficits are the primary driver of the escalating national debt. Factors contributing to these deficits include:

- Increased government spending: Spending on social security, Medicare, and Medicaid – programs vital to the aging population – continues to rise. Defense spending also remains a significant portion of the budget.

- Tax cuts: The 2017 Tax Cuts and Jobs Act significantly reduced corporate and individual income tax rates. While proponents argued it would stimulate economic growth, critics pointed to the potential for increased deficits. The long-term effects are still being debated.

- Economic downturns: Recessions lead to lower tax revenues and increased demand for social safety nets, exacerbating budget deficits.

The 2017 Tax Cuts and Jobs Act: A Mixed Legacy

The 2017 tax reform significantly altered the US tax code, aiming to boost economic activity. While it did lead to some short-term economic growth and increased corporate investment, its long-term effects are still unfolding. The reduction in corporate taxes, in particular, remains a subject of intense debate, with some arguing it led to increased profits without commensurate job creation or investment. Others maintain it fostered a more competitive business environment. The debate continues on whether the benefits outweighed the increased deficit.

Potential Solutions: A Path Forward

Addressing the intertwined issues of debt, deficits, and tax reform requires a multi-pronged approach. Proposed solutions include:

- Spending cuts: Identifying areas for government spending reductions is a politically challenging but potentially necessary step. This could involve reforming entitlement programs or finding efficiencies within existing government operations.

- Tax increases: Raising taxes on corporations or high-income earners could generate additional revenue to reduce the deficit. However, this approach faces political opposition and potential economic consequences.

- Economic growth: A robust and sustained economic expansion would increase tax revenues, helping to alleviate the deficit. Policies promoting innovation, infrastructure investment, and workforce development could contribute to this goal.

- Debt restructuring: While politically complex, exploring options for restructuring the national debt could potentially offer long-term solutions.

Conclusion: A Balancing Act

The US economy faces a significant challenge in balancing the need for fiscal responsibility with the demands for essential government services. Navigating the complex issues of debt, deficits, and tax reform requires careful consideration of competing priorities and a willingness to engage in difficult policy decisions. The path forward demands a comprehensive strategy encompassing spending reforms, tax policies, and economic growth initiatives. The long-term economic health and prosperity of the nation hinge on finding a sustainable solution.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The US Economy: Addressing Debt, Deficits, And Tax Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Court Rehires Illegally Fired Doge Employees Musk Responds

Mar 30, 2025

Court Rehires Illegally Fired Doge Employees Musk Responds

Mar 30, 2025 -

Watch Riyan Parags Breathtaking Catch And Wanindu Hasarangas Pushpa Celebration In Ipl 2025

Mar 30, 2025

Watch Riyan Parags Breathtaking Catch And Wanindu Hasarangas Pushpa Celebration In Ipl 2025

Mar 30, 2025 -

Warum Der Trauerflor Fc Bayern Erklaert Das Beileid

Mar 30, 2025

Warum Der Trauerflor Fc Bayern Erklaert Das Beileid

Mar 30, 2025 -

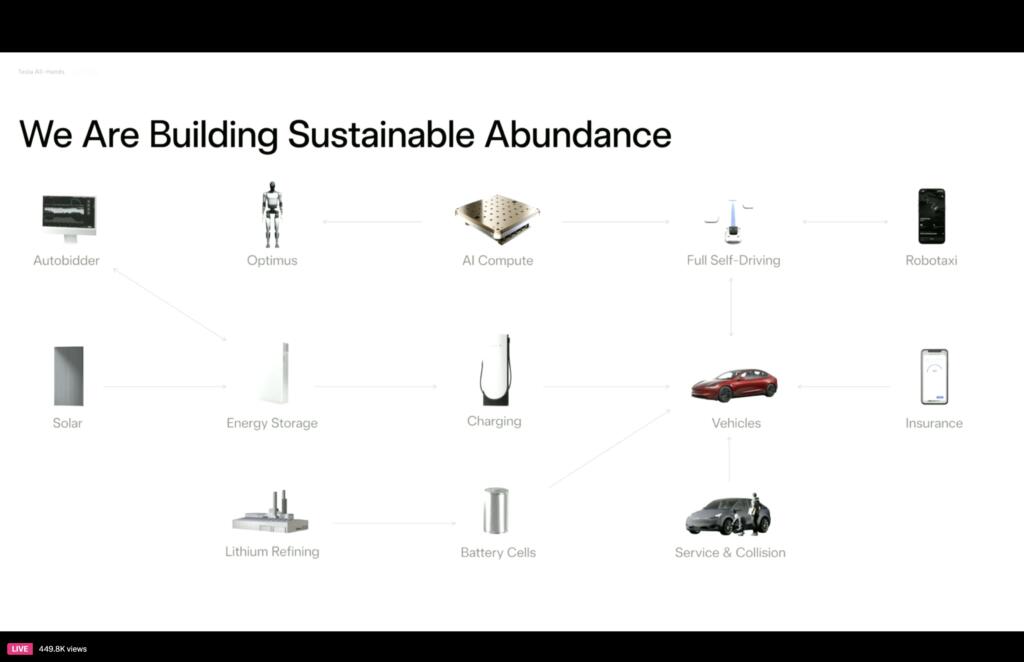

Nvidia Amd Google And Tesla Which Company Leads In Ai Chip Innovation

Mar 30, 2025

Nvidia Amd Google And Tesla Which Company Leads In Ai Chip Innovation

Mar 30, 2025 -

Can Bae Jun Ho And Yang Min Hyuks Korean Derby Happen At Stoke City And Queens Park Rangers

Mar 30, 2025

Can Bae Jun Ho And Yang Min Hyuks Korean Derby Happen At Stoke City And Queens Park Rangers

Mar 30, 2025