Today's Gold Rates In India: Record Highs Give Way To Price Correction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Gold Rates in India: Record Highs Give Way to Price Correction

Gold prices in India, which recently soared to record highs, have witnessed a significant correction today. This fluctuation leaves investors wondering about the future trajectory of the precious metal and its implications for the Indian market. Understanding these shifts is crucial for anyone considering gold investments, from seasoned traders to those looking to buy jewelry.

The unprecedented surge in gold prices over the past few weeks was driven by a confluence of factors. Global economic uncertainty, fueled by inflation concerns and geopolitical tensions, propelled investors towards safe-haven assets like gold. Simultaneously, a weakening rupee against the US dollar further inflated the cost of gold in India, pushing rates to unprecedented levels.

However, the recent price correction suggests a potential shift in market sentiment. While the exact reasons behind this drop are multifaceted, several key elements are likely at play:

H2: Factors Contributing to the Price Correction:

- Profit-booking: After reaching record highs, many investors chose to book profits, leading to a sell-off in the market. This is a common phenomenon in volatile markets like gold.

- Strengthening Rupee: A slight strengthening of the Indian rupee against the US dollar has marginally reduced the cost of gold imports, leading to a decrease in domestic prices.

- Central Bank Actions: The actions of central banks globally, particularly regarding interest rate hikes, influence investor behavior and can impact the demand for gold. Higher interest rates often make other investment options more attractive.

- Technical Corrections: Market analysts often point to technical corrections as a natural part of price fluctuations in any asset class. These corrections can be triggered by a variety of factors and represent a temporary pullback from recent highs.

H2: Current Gold Rates in Major Indian Cities:

Precise gold rates fluctuate throughout the day, varying across different cities and jewelers. It's essential to check with your local jeweler or reputable online sources for the most up-to-date information. However, we can offer a general overview based on current market trends:

- Mumbai: (Insert approximate current price per 10 grams of 24-karat gold)

- Delhi: (Insert approximate current price per 10 grams of 24-karat gold)

- Chennai: (Insert approximate current price per 10 grams of 24-karat gold)

- Kolkata: (Insert approximate current price per 10 grams of 24-karat gold)

H2: What Does This Mean for Investors?

The price correction doesn't necessarily signal a long-term bearish trend for gold. Many analysts believe gold will remain a valuable asset in the long run, given persistent global uncertainties. However, investors should adopt a cautious approach and consider diversifying their portfolios.

H3: Key Takeaways for Investors:

- Do your research: Thoroughly research before making any investment decisions.

- Diversify your portfolio: Don't put all your eggs in one basket.

- Consider long-term investments: Gold is often considered a long-term investment, rather than a short-term trading opportunity.

- Consult a financial advisor: Seek professional advice tailored to your individual financial situation.

H2: Looking Ahead:

The future direction of gold prices remains uncertain. Various factors, including global economic conditions, geopolitical events, and central bank policies, will continue to influence market dynamics. Keeping a close watch on these factors and consulting with financial experts will help investors navigate this dynamic market effectively. Stay informed about gold rates in India through reputable news sources and financial websites to make informed decisions about your investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Gold Rates In India: Record Highs Give Way To Price Correction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sandy Walsh Resmi Gabung Yokohama Marinos Kisah Transfer Kilat Sang Pemain

Apr 07, 2025

Sandy Walsh Resmi Gabung Yokohama Marinos Kisah Transfer Kilat Sang Pemain

Apr 07, 2025 -

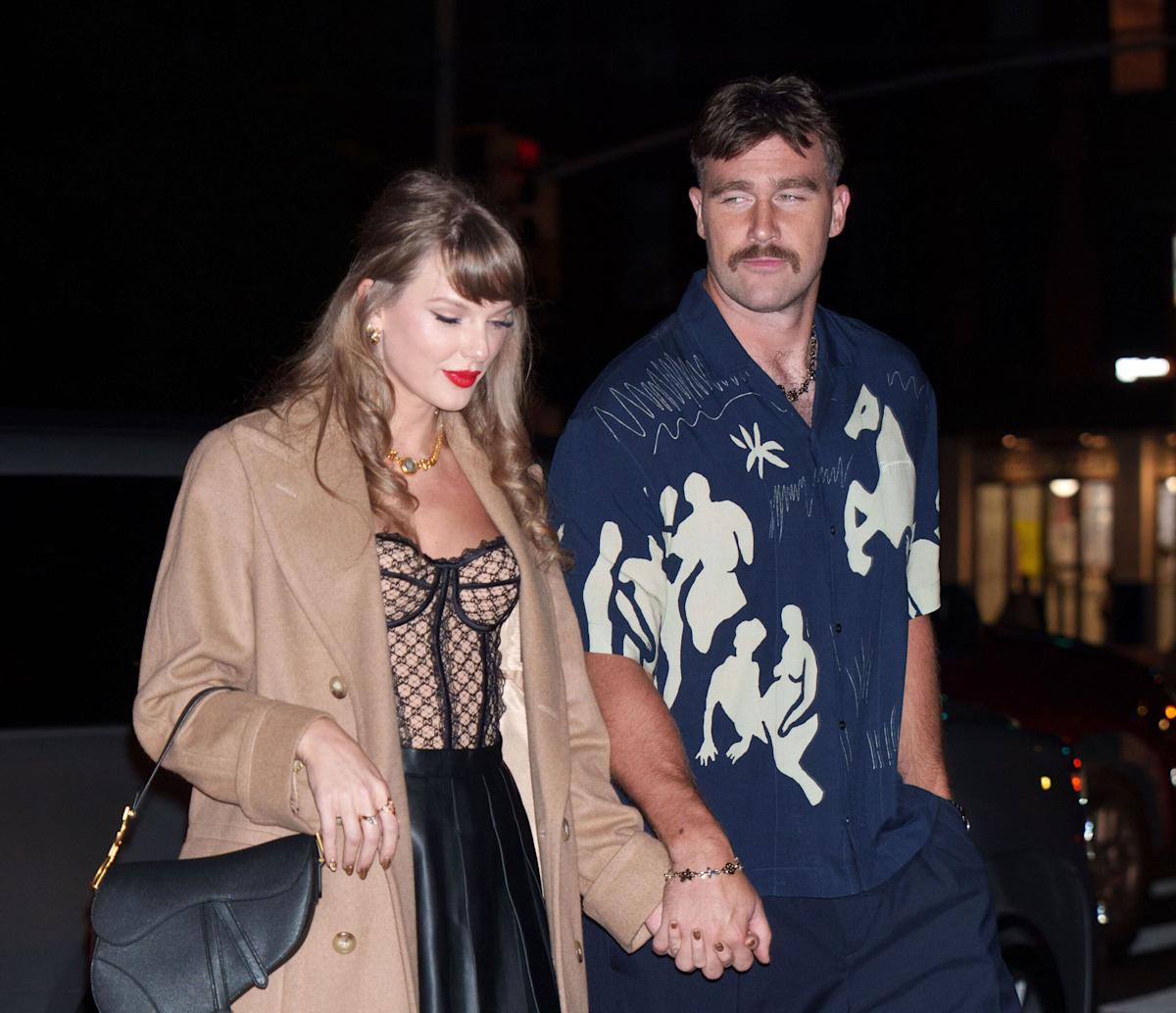

Report Taylor Swift And Travis Kelce Take A Break What We Know

Apr 07, 2025

Report Taylor Swift And Travis Kelce Take A Break What We Know

Apr 07, 2025 -

Three Month Setback Injury Crisis Hits Melbourne Storm

Apr 07, 2025

Three Month Setback Injury Crisis Hits Melbourne Storm

Apr 07, 2025 -

Live Updates Dow Futures Collapse Bear Market Looms Amid Tariff Chaos

Apr 07, 2025

Live Updates Dow Futures Collapse Bear Market Looms Amid Tariff Chaos

Apr 07, 2025 -

Trump Tariffs Trigger China Retaliation Sending Global Stocks Into Freefall

Apr 07, 2025

Trump Tariffs Trigger China Retaliation Sending Global Stocks Into Freefall

Apr 07, 2025