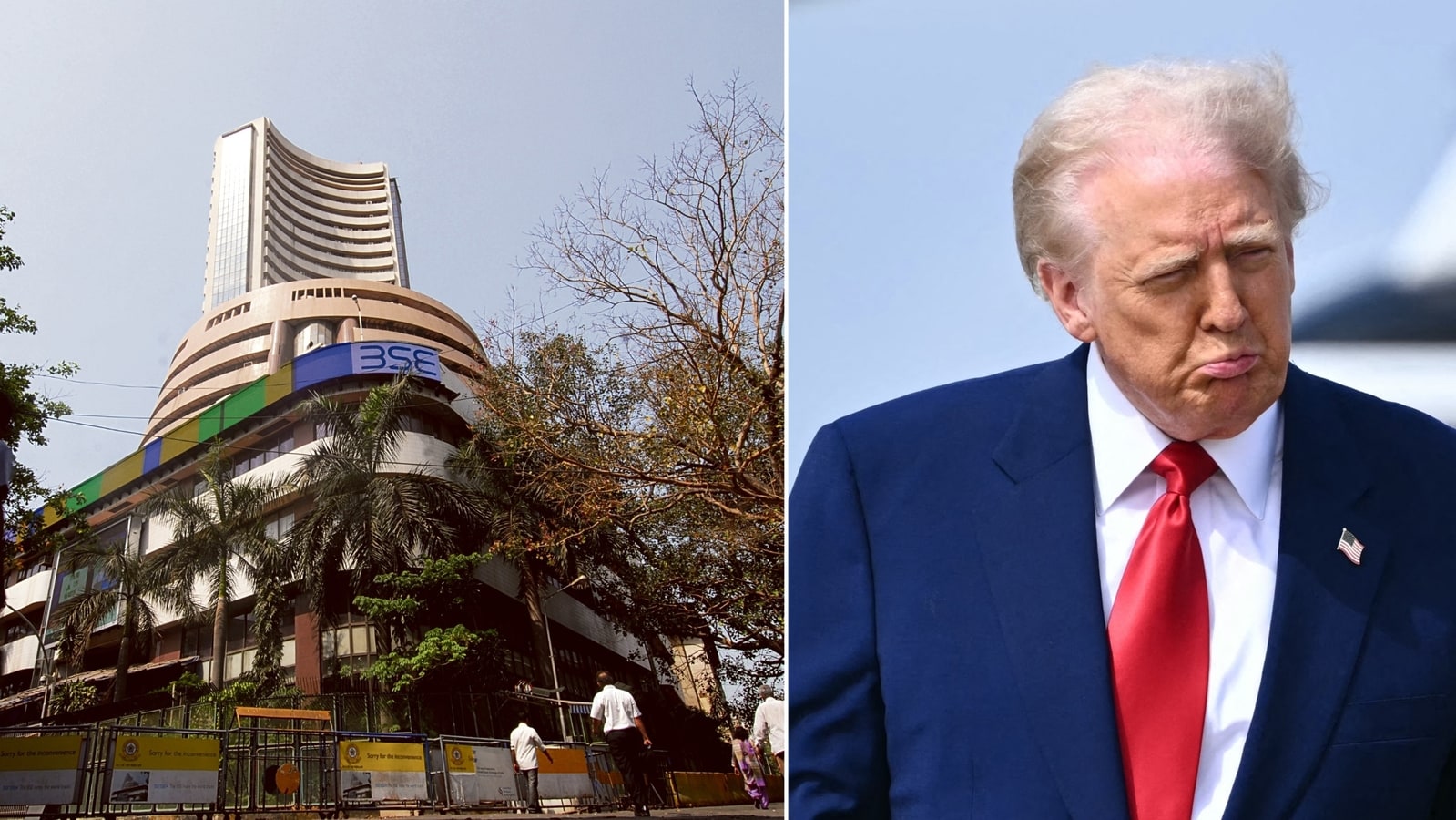

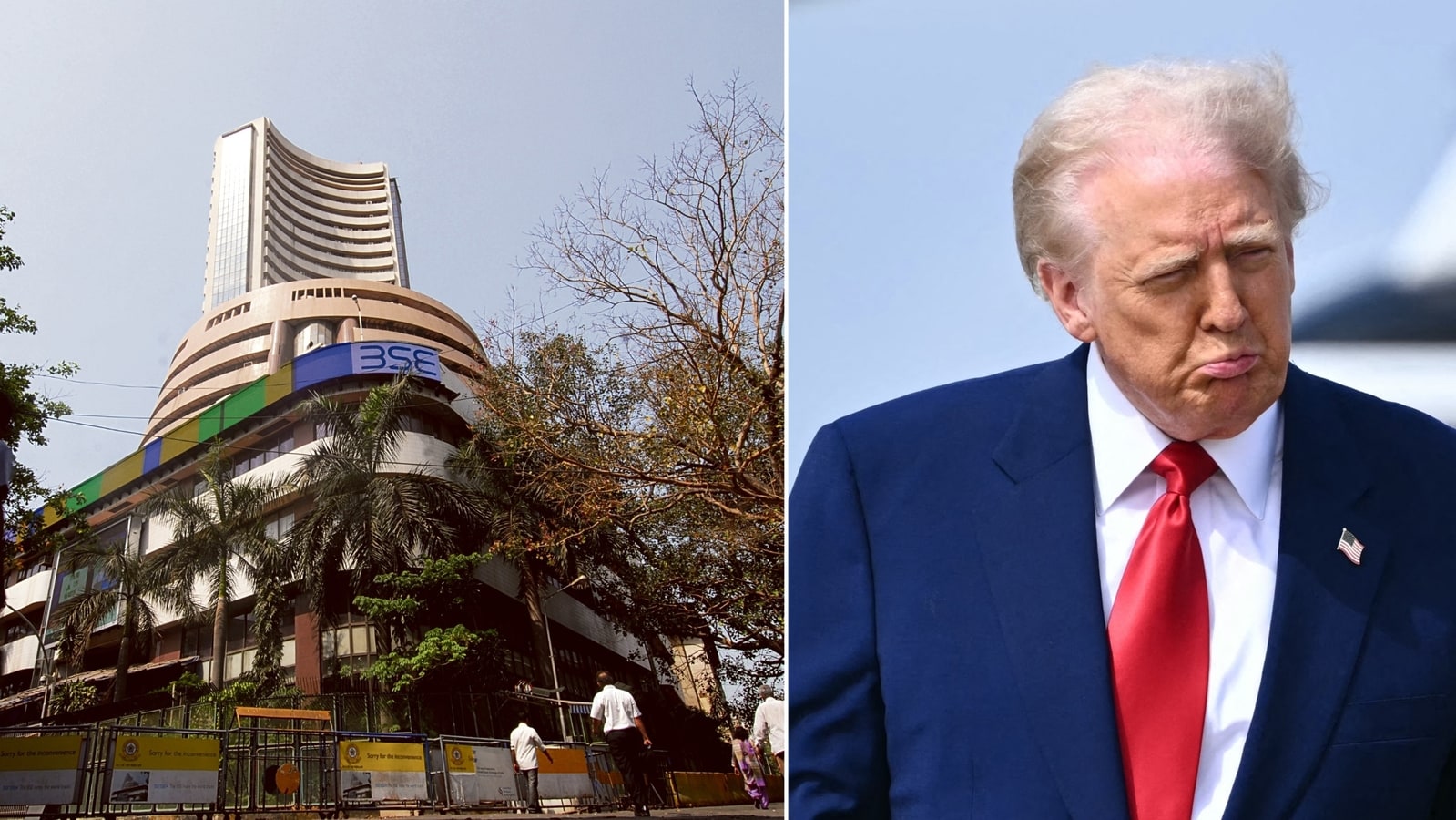

Today's Market Crash In India: Causes Behind The Sensex And Nifty Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Market Crash in India: Causes Behind the Sensex and Nifty Decline

India's stock markets experienced a significant downturn today, leaving investors reeling and sparking concerns about the nation's economic outlook. The Sensex and Nifty, key indicators of the Indian stock market's performance, plummeted, marking a dramatic fall that has sent ripples through the financial sector. Understanding the reasons behind this sharp decline is crucial for investors and economists alike. This article delves into the potential causes of today's market crash, examining both global and domestic factors.

Global Headwinds: A Perfect Storm?

Several global factors contributed to the negative sentiment impacting Indian markets. The ongoing uncertainty surrounding the global economy, fueled by persistent inflation in major economies and aggressive interest rate hikes by central banks, played a significant role. This creates a risk-averse environment, leading investors to pull back from emerging markets like India.

-

US Inflation and Interest Rates: The persistent inflation in the US and the subsequent aggressive interest rate hikes by the Federal Reserve continue to weigh heavily on global markets. Higher interest rates in the US make dollar-denominated assets more attractive, leading to capital flight from emerging markets.

-

Geopolitical Tensions: Ongoing geopolitical instability, including the war in Ukraine and rising tensions in other parts of the world, contributes to market volatility and investor uncertainty. This uncertainty often translates into a sell-off in riskier assets, including Indian stocks.

-

Global Recession Fears: Growing concerns about a potential global recession are further dampening investor sentiment. A global recession would likely negatively impact India's export-oriented sectors, leading to further declines in the stock market.

Domestic Factors Exacerbating the Decline:

While global headwinds played a significant role, several domestic factors also contributed to today's market crash.

-

Rupee Depreciation: The weakening of the Indian Rupee against the US dollar adds to inflationary pressures and makes imports more expensive. This can negatively impact businesses and consumer sentiment, leading to further market declines.

-

Foreign Institutional Investor (FII) Outflows: Significant outflows of investments by Foreign Institutional Investors (FIIs) have also put downward pressure on the Sensex and Nifty. FIIs often react to global economic trends and shifts in investor sentiment, leading to large-scale selling when risk appetite diminishes.

-

Rising Inflation in India: Persistent inflation within India itself erodes consumer purchasing power and increases the cost of doing business. This can negatively impact corporate profits and investor confidence.

-

Sector-Specific Concerns: Specific sector-related concerns, such as regulatory changes or disappointing corporate earnings, can also contribute to sector-specific declines, pulling down the overall market indices.

What's Next for the Indian Stock Market?

The immediate future of the Indian stock market remains uncertain. While the current decline is significant, it's important to remember that market fluctuations are a normal part of the investment cycle. However, the confluence of global and domestic factors suggests that the market may remain volatile in the short term.

Investors should carefully monitor the evolving economic situation, both globally and domestically, and consider diversifying their portfolios to mitigate risk. Seeking professional financial advice is crucial during periods of market uncertainty. The long-term outlook for India's economy remains positive, driven by its strong demographic dividend and ongoing economic reforms. However, navigating the short-term volatility requires careful planning and risk management.

Keywords: Sensex, Nifty, Indian Stock Market, Market Crash, India Economy, Global Recession, Inflation, Interest Rates, FII Outflows, Rupee Depreciation, Geopolitical Uncertainty, Investment, Stock Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Market Crash In India: Causes Behind The Sensex And Nifty Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australia South Korea Womens Football Match Live Commentary And Post Game Report

Apr 07, 2025

Australia South Korea Womens Football Match Live Commentary And Post Game Report

Apr 07, 2025 -

Ferraris Floor Update Vasseur Explains Suzuka Decision

Apr 07, 2025

Ferraris Floor Update Vasseur Explains Suzuka Decision

Apr 07, 2025 -

Will English Teams Stop Real Madrid And Psg Champions League Quarterfinal Showdown

Apr 07, 2025

Will English Teams Stop Real Madrid And Psg Champions League Quarterfinal Showdown

Apr 07, 2025 -

Brshlwnt Yeln Ghyab Iynyjw Martynyz En Mbarat Ryal Bytys Bsbb Isabt Edlyt

Apr 07, 2025

Brshlwnt Yeln Ghyab Iynyjw Martynyz En Mbarat Ryal Bytys Bsbb Isabt Edlyt

Apr 07, 2025 -

Jafy Yusjl Hdwrh Bqwt Fy Mbarath Rqm 100 Me Brshlwnt

Apr 07, 2025

Jafy Yusjl Hdwrh Bqwt Fy Mbarath Rqm 100 Me Brshlwnt

Apr 07, 2025