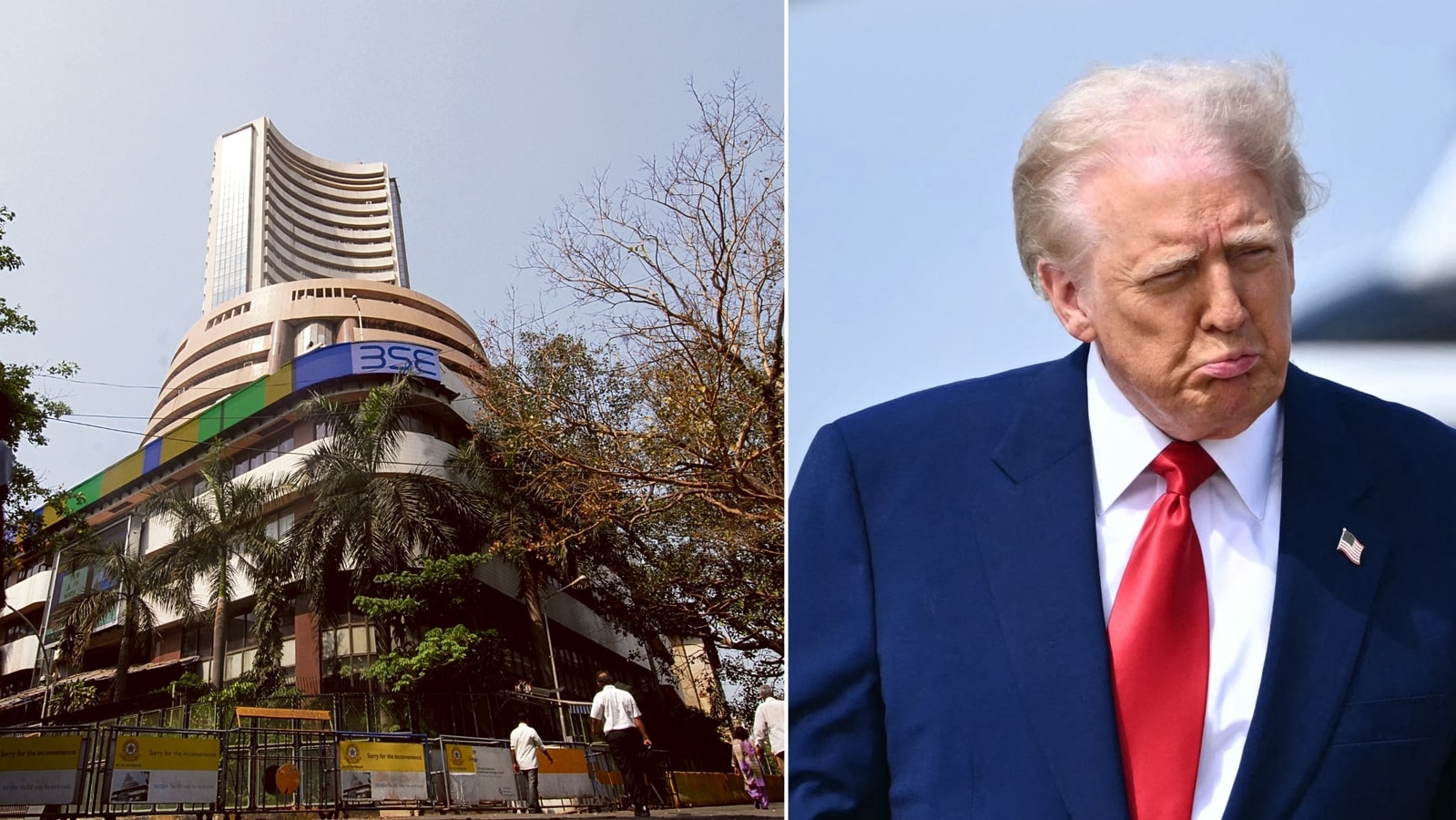

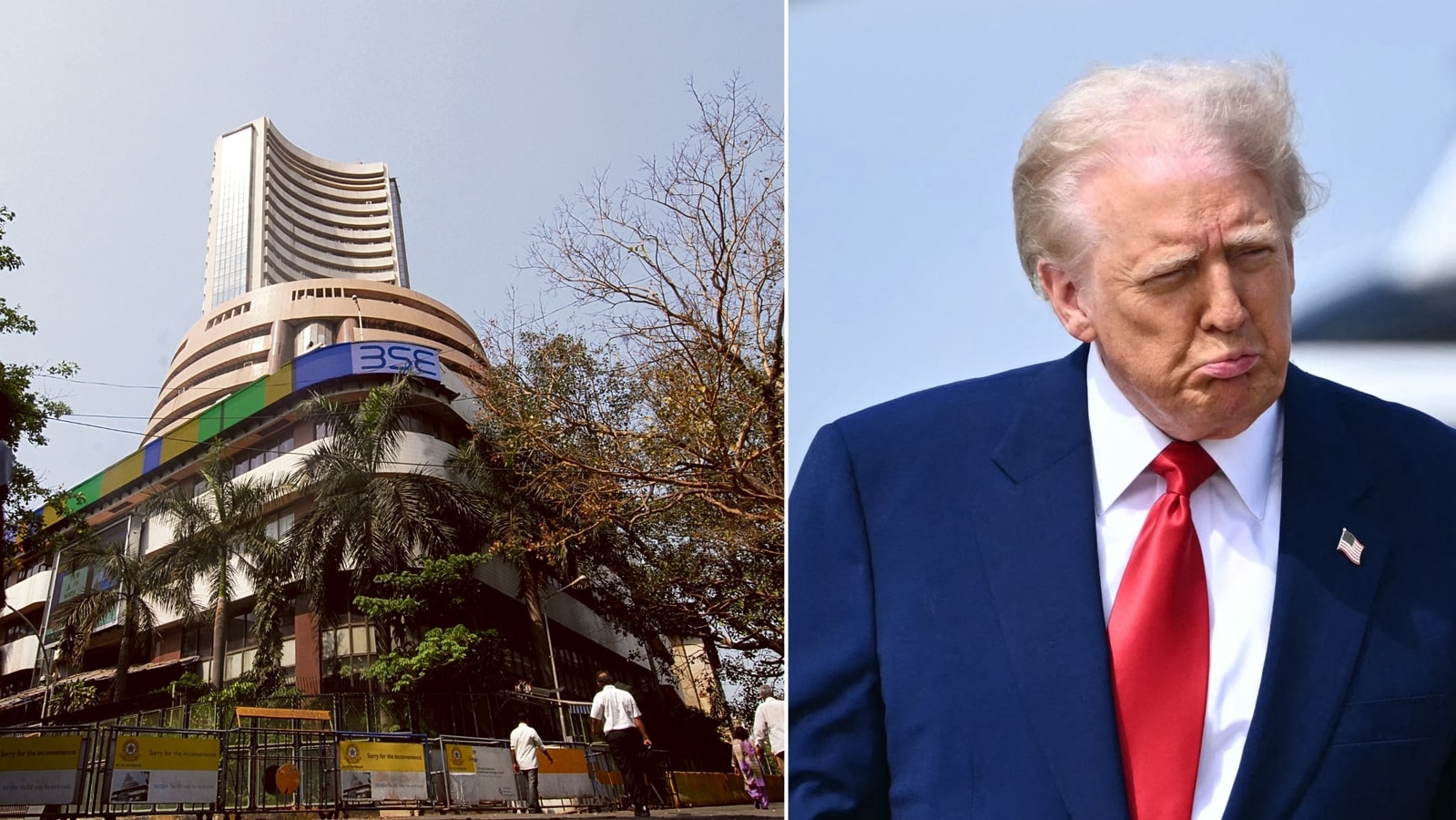

Today's Sharp Fall In Indian Markets: A Deep Dive Into The Sensex And Nifty's Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Sharp Fall in Indian Markets: A Deep Dive into the Sensex and Nifty's Decline

India's stock markets experienced a significant downturn today, leaving investors reeling and prompting urgent questions about the underlying causes. The Sensex and Nifty, key indicators of the Indian economy's health, plummeted, marking one of the sharpest single-day declines in recent months. This article delves into the potential factors behind this sudden market correction and explores what it means for investors.

Sensex and Nifty's Dramatic Plunge:

The Bombay Stock Exchange's Sensitive Index (Sensex) and the National Stock Exchange's Nifty 50 index both witnessed a considerable drop today, closing significantly lower than their opening values. While precise figures fluctuate based on final closing numbers, the magnitude of the fall is undeniable, prompting widespread concern among market analysts and individual investors alike. This sharp decline follows a period of relative stability, making the sudden drop all the more noteworthy.

Potential Factors Contributing to the Market Fall:

Several factors could be contributing to this dramatic market correction. Analyzing these is crucial to understanding the broader implications and potential future market trends.

-

Global Economic Uncertainty: Global headwinds, including persistent inflation in major economies, rising interest rates, and geopolitical tensions, continue to cast a shadow over global markets. India, while relatively insulated, is not immune to these external pressures. Concerns about a potential global recession are undoubtedly impacting investor sentiment.

-

Rupee Volatility: Fluctuations in the Indian Rupee's value against the US dollar can significantly influence the performance of the stock market. A weakening rupee can impact the profitability of Indian companies with significant foreign currency exposure.

-

Domestic Economic Concerns: While India's economy continues to grow, certain domestic factors may also be playing a role. Inflationary pressures, rising commodity prices, and potential regulatory changes can all contribute to investor apprehension.

-

Profit-Booking: It's crucial to consider the possibility of profit-booking by investors who have been holding positions for a considerable period. Taking profits after a period of growth is a standard market practice, and this activity can contribute to a temporary market downturn.

Impact on Investors and the Indian Economy:

The sharp fall in the Sensex and Nifty raises concerns for both individual investors and the overall Indian economy. Short-term losses are a reality for many, while the long-term impact remains to be seen.

-

Investor Sentiment: The market decline is likely to dampen investor sentiment in the short term. However, history suggests that Indian markets have a tendency to recover from such dips, though the timeframe for recovery remains unpredictable.

-

Economic Growth: While a single day's market fluctuation doesn't necessarily signal a broader economic crisis, sustained market weakness could potentially impact economic growth by reducing investor confidence and investment in various sectors.

Looking Ahead:

The coming days will be crucial in determining the extent and duration of this market correction. Close monitoring of global economic indicators, rupee stability, and domestic economic data will be vital for assessing the future trajectory of the Indian stock market. Investors are advised to exercise caution and consult with financial advisors before making any rash investment decisions. A well-diversified portfolio and a long-term investment strategy are generally recommended to mitigate the risks associated with market volatility. The situation warrants careful observation and informed decision-making. Further updates will be provided as the situation unfolds.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Sharp Fall In Indian Markets: A Deep Dive Into The Sensex And Nifty's Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

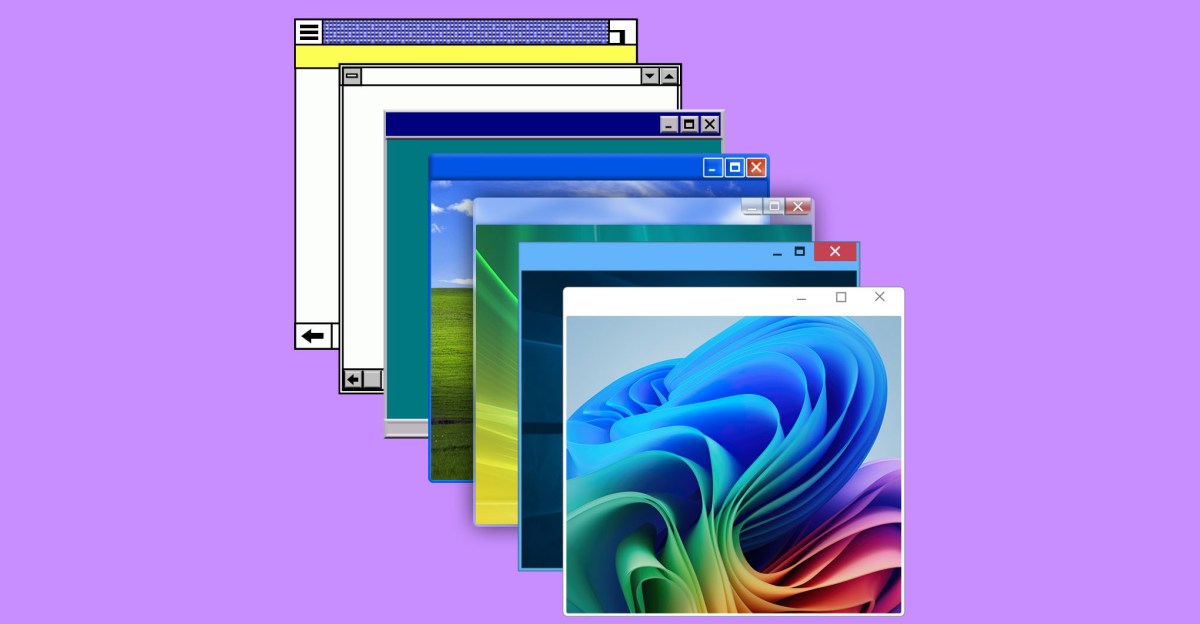

Microsofts 50 Year Journey Innovation Adaptation And Global Dominance

Apr 07, 2025

Microsofts 50 Year Journey Innovation Adaptation And Global Dominance

Apr 07, 2025 -

7 Inch Windows Mini Pc Ryzen 9 Performance Compared To Competitors

Apr 07, 2025

7 Inch Windows Mini Pc Ryzen 9 Performance Compared To Competitors

Apr 07, 2025 -

Rugby League News Wiliames New Coaching Role With Bulldogs Women

Apr 07, 2025

Rugby League News Wiliames New Coaching Role With Bulldogs Women

Apr 07, 2025 -

Web3 Gamings Wild Ride A Hamster Kombat Anniversary Review

Apr 07, 2025

Web3 Gamings Wild Ride A Hamster Kombat Anniversary Review

Apr 07, 2025 -

Ramnavami 2025 History Rituals And The Triumph Of Rama

Apr 07, 2025

Ramnavami 2025 History Rituals And The Triumph Of Rama

Apr 07, 2025