Tokenized Equities: Kraken Disrupts Wall Street With Blockchain Technology

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Kraken Disrupts Wall Street: Tokenized Equities Arrive

Kraken, a leading cryptocurrency exchange, is shaking up the financial world with its foray into tokenized equities. This groundbreaking move leverages blockchain technology to revolutionize the way we buy, sell, and trade stocks, potentially disrupting the traditional Wall Street model. The implications are vast, promising increased accessibility, reduced costs, and enhanced efficiency in the equities market.

What are Tokenized Equities?

Tokenized equities represent fractional ownership of a company's stock, recorded on a blockchain. Unlike traditional shares held in brokerage accounts, these digital tokens represent ownership rights and are traded on decentralized exchanges, offering several key advantages.

- Increased Liquidity: Tokenization fragments shares, making them more accessible to a wider range of investors. Smaller investments become feasible, opening up the market to a larger pool of capital.

- 24/7 Trading: Blockchain-based trading isn't limited by traditional market hours. This constant accessibility allows for global trading and potentially increased liquidity.

- Lower Transaction Costs: By eliminating intermediaries, tokenized equities can drastically reduce brokerage fees and other transaction costs.

- Improved Transparency and Security: The immutable nature of the blockchain enhances transparency and security, minimizing the risk of fraud and errors.

Kraken's Role in the Revolution

Kraken's entry into the tokenized securities market signifies a major step towards mainstream adoption. Their established reputation and technological prowess position them as a key player in this evolving landscape. By offering a secure and regulated platform for trading tokenized equities, Kraken aims to attract both institutional and retail investors. Their initiative directly challenges the traditional barriers to entry within the equities market, potentially democratizing access to investment opportunities.

The Future of Investing?

The move by Kraken highlights the growing convergence of fintech and blockchain technology. The potential benefits of tokenized equities are substantial, but challenges remain. Regulatory clarity is crucial for widespread adoption, and addressing scalability issues within blockchain networks is also paramount. However, the potential for increased efficiency, transparency, and accessibility makes this a significant development to watch closely.

Challenges and Considerations:

While the future looks bright, several hurdles need to be overcome:

- Regulatory Uncertainty: Governments worldwide are still grappling with the regulatory landscape for digital assets. Clear and consistent regulations are necessary to foster trust and encourage wider adoption.

- Security Concerns: While blockchain technology offers enhanced security, the platforms hosting tokenized equities must also implement robust security measures to prevent hacks and other cyber threats.

- Scalability Issues: Existing blockchain networks may struggle to handle the volume of transactions associated with a large-scale adoption of tokenized equities.

Conclusion:

Kraken's launch of tokenized equities marks a pivotal moment for the financial industry. This innovative approach leverages the power of blockchain technology to create a more efficient, transparent, and accessible equities market. While challenges remain, the potential for disruption is undeniable, and Kraken’s involvement suggests a significant shift towards a decentralized future of investing. The coming years will be crucial in determining how this technology reshapes the financial landscape. Stay tuned for further developments in this rapidly evolving space. Keep an eye on Kraken and other players as they pave the way for the next generation of investment platforms.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tokenized Equities: Kraken Disrupts Wall Street With Blockchain Technology. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Martin Lewis Urgent Energy Bill Warning Act Today To Save Money

May 23, 2025

Martin Lewis Urgent Energy Bill Warning Act Today To Save Money

May 23, 2025 -

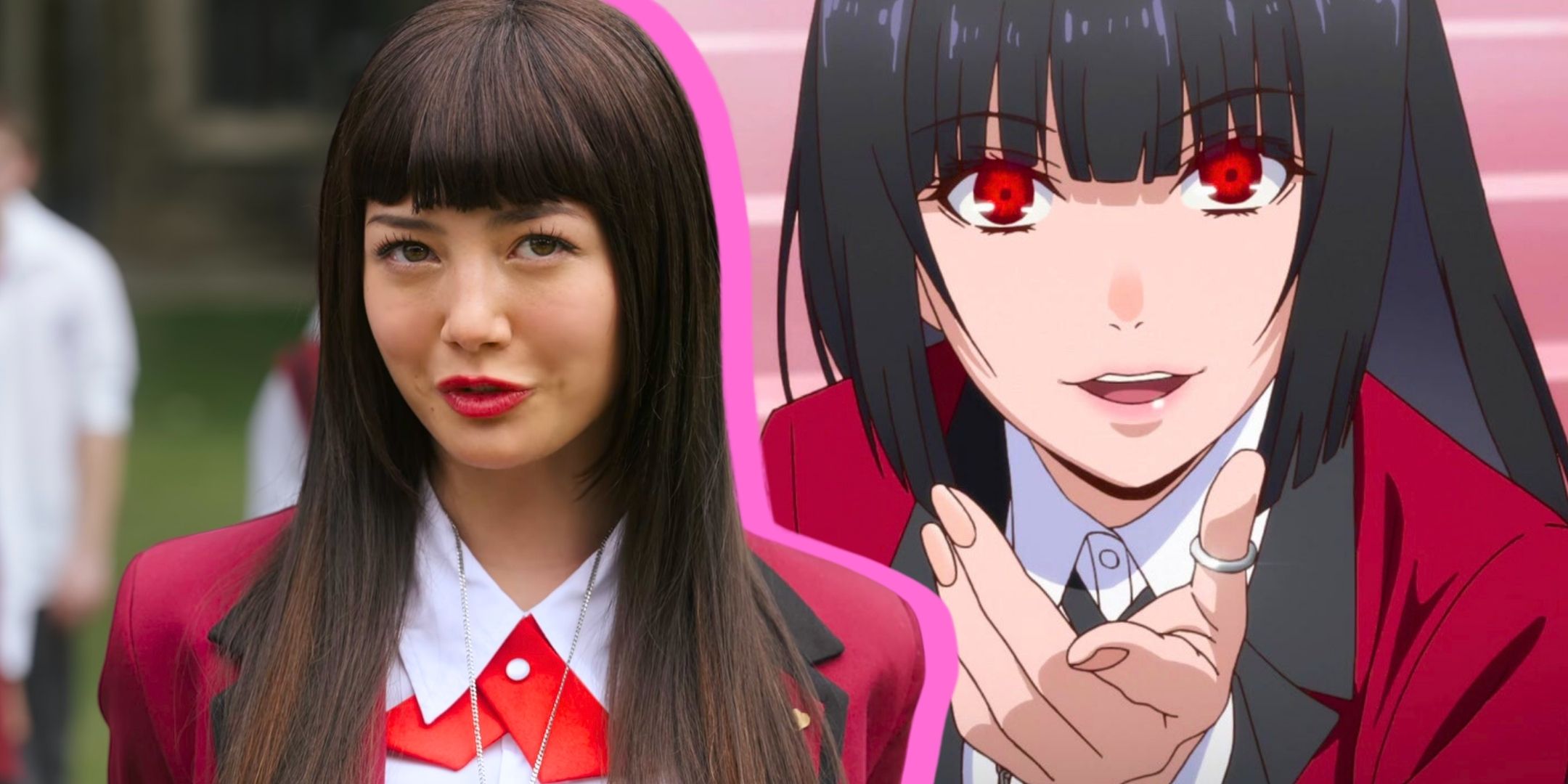

Netflixs Controversial Anime Adaptation A Streaming Success Despite Rotten Tomatoes Backlash

May 23, 2025

Netflixs Controversial Anime Adaptation A Streaming Success Despite Rotten Tomatoes Backlash

May 23, 2025 -

Alex Marquez On Silverstone A Track Better Suited To His Style But Marc Remains A Force

May 23, 2025

Alex Marquez On Silverstone A Track Better Suited To His Style But Marc Remains A Force

May 23, 2025 -

Warren Buffett Y Apple El Magnate Reduce Su Participacion En Un 13 Explicacion

May 23, 2025

Warren Buffett Y Apple El Magnate Reduce Su Participacion En Un 13 Explicacion

May 23, 2025 -

Stephen A Smith Criticizes Popular Cnn Anchors Behavior

May 23, 2025

Stephen A Smith Criticizes Popular Cnn Anchors Behavior

May 23, 2025

Latest Posts

-

Ftse 100 Trading Impact Of Increased Retail Sales And Lower Ofgem Price Cap

May 24, 2025

Ftse 100 Trading Impact Of Increased Retail Sales And Lower Ofgem Price Cap

May 24, 2025 -

Tom Cruises Viral Popcorn Eating Habit His Reaction Revealed

May 24, 2025

Tom Cruises Viral Popcorn Eating Habit His Reaction Revealed

May 24, 2025 -

Tom Cruise Responds To Viral Video Of His Popcorn Eating Method

May 24, 2025

Tom Cruise Responds To Viral Video Of His Popcorn Eating Method

May 24, 2025 -

Elon Musks Robotaxi Vision A Million Autonomous Vehicles On Us Roads By 2026

May 24, 2025

Elon Musks Robotaxi Vision A Million Autonomous Vehicles On Us Roads By 2026

May 24, 2025 -

Space Based Crystal Growth Improving Drug Efficacy And Safety

May 24, 2025

Space Based Crystal Growth Improving Drug Efficacy And Safety

May 24, 2025