Tokenized Equities On Kraken: Wall Street Goes Onchain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tokenized Equities on Kraken: Wall Street Goes Onchain

Kraken's foray into tokenized equities marks a seismic shift in the intersection of traditional finance and decentralized technology. The move signals a potential revolution in how we own and trade assets, bringing the efficiency and transparency of blockchain to the often opaque world of Wall Street. This groundbreaking development allows investors to access fractional ownership of blue-chip companies through easily transferable digital tokens, blurring the lines between traditional finance and the burgeoning DeFi ecosystem.

The launch of this service on Kraken, a well-established and regulated cryptocurrency exchange, adds a significant layer of legitimacy to the burgeoning market for tokenized assets. This isn't some obscure experiment; this is a major player bringing the future of finance to the present.

What are Tokenized Equities?

Tokenized equities represent the fractional ownership of company shares, encoded as digital tokens on a blockchain. Unlike traditional shares, these tokens offer several key advantages:

- 24/7 trading: Forget waiting for market openings. Tokenized equities can be traded anytime, anywhere, globally.

- Increased liquidity: The fractional nature and ease of transferability significantly boost liquidity compared to traditional stock markets.

- Lower transaction costs: Blockchain technology can reduce the fees associated with brokerage and transfer agents.

- Enhanced transparency: All transactions are recorded on a public, immutable ledger, fostering greater transparency and accountability.

- Programmability: Smart contracts can automate various aspects of ownership and trading, opening doors to innovative financial instruments.

Kraken's Strategic Move and its Implications

Kraken's decision to offer tokenized equities reflects a broader trend among established financial institutions to embrace blockchain technology. By offering this service, Kraken positions itself at the forefront of this evolution, capitalizing on the growing demand for more efficient and transparent financial markets.

This move has several important implications:

- Increased accessibility: Investing in blue-chip companies becomes accessible to a broader range of investors, including those in emerging markets previously excluded from traditional stock markets.

- Innovation in finance: Tokenization opens up possibilities for innovative financial products and services, fostering competition and efficiency.

- Regulatory challenges: The emergence of tokenized equities also presents regulatory challenges. Clear guidelines and frameworks are needed to ensure compliance and protect investors.

Challenges and Future Outlook

While the potential benefits are significant, the widespread adoption of tokenized equities faces challenges:

- Regulatory uncertainty: The regulatory landscape for tokenized securities remains unclear in many jurisdictions, hindering broader adoption.

- Technological scalability: Existing blockchain technologies may need further development to handle the volume of transactions expected in a mass-market scenario for tokenized equities.

- Security concerns: Robust security measures are essential to protect against potential hacks and vulnerabilities.

Conclusion: A New Era of Investing?

Kraken's launch of tokenized equities represents a watershed moment in the financial world. While challenges remain, the potential benefits of increased accessibility, transparency, and efficiency are undeniable. This move signifies a significant step towards a future where traditional finance and decentralized technology converge, creating a more efficient and inclusive financial ecosystem. The onchain revolution has begun, and Kraken is leading the charge. The coming years will be crucial in determining the long-term impact of this paradigm shift on the global financial landscape. Stay tuned for further developments as this innovative technology reshapes the future of investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tokenized Equities On Kraken: Wall Street Goes Onchain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Trump Price Surge A 12 Increase Explained

May 24, 2025

Official Trump Price Surge A 12 Increase Explained

May 24, 2025 -

Slam Dunk Festival 2025 10 Must See Bands

May 24, 2025

Slam Dunk Festival 2025 10 Must See Bands

May 24, 2025 -

Programas De Intercambio De Casas Explore A Praia E O Campo Com Custo Baixo

May 24, 2025

Programas De Intercambio De Casas Explore A Praia E O Campo Com Custo Baixo

May 24, 2025 -

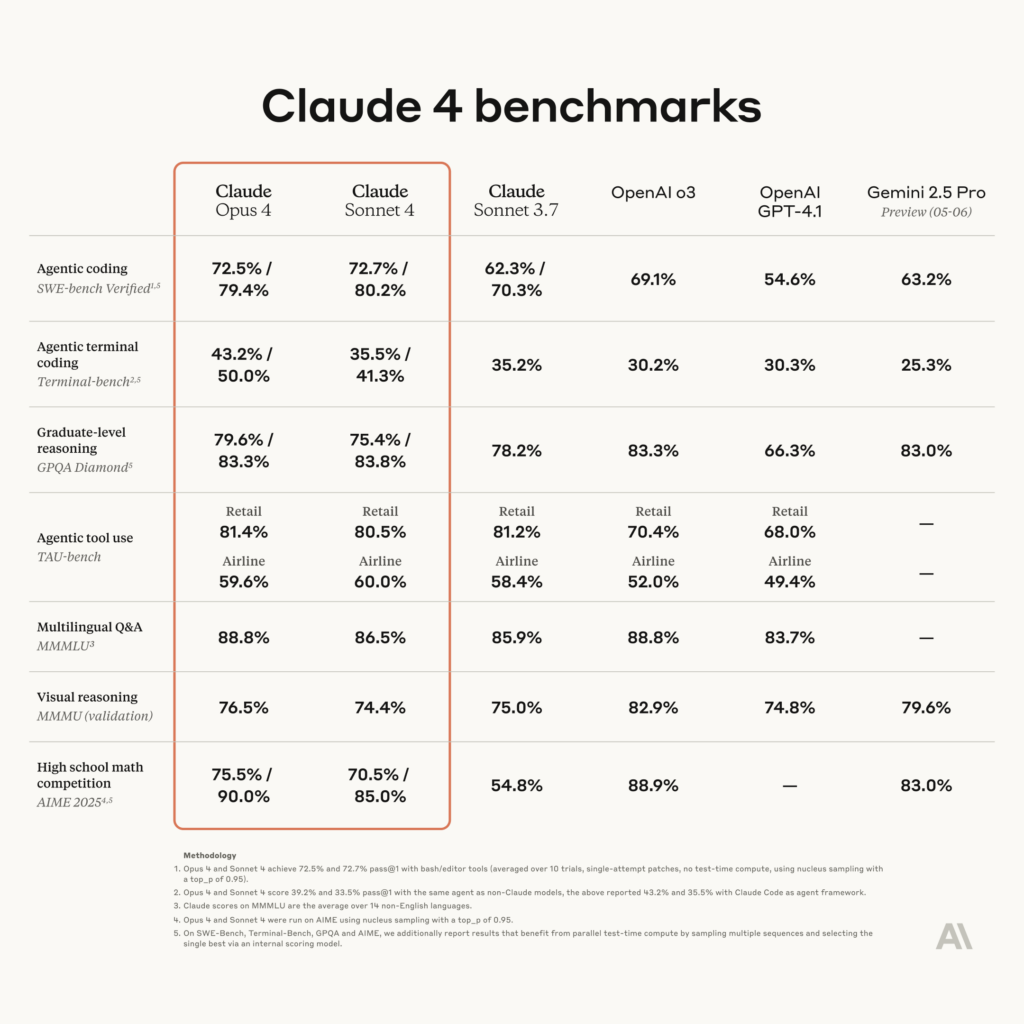

Anthropics Claude 4 Exploring The New Sonnet And Opus Agentic Coding Features

May 24, 2025

Anthropics Claude 4 Exploring The New Sonnet And Opus Agentic Coding Features

May 24, 2025 -

The Four Seasons Mash Icons Parkinsons Journey Revealed

May 24, 2025

The Four Seasons Mash Icons Parkinsons Journey Revealed

May 24, 2025