Top AI Stock Down 25% — Should You Buy Before The April 17 Deadline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Top AI Stock Down 25% — Should You Buy Before the April 17 Deadline?

Artificial intelligence (AI) is booming, but not all AI stocks are created equal. One of the top performers in the sector, [Insert Stock Ticker Symbol Here] (let's call it "XYZ Corp" for this article), has experienced a dramatic 25% drop in share price, sparking considerable investor concern and presenting a crucial question: is this a buying opportunity, or a sign of further trouble? With a looming deadline of April 17th (the deadline needs to be specified and confirmed – replace this with the actual relevant deadline), many investors are scrambling to decide.

The Plunge: What Caused XYZ Corp's Stock Drop?

The recent 25% decline in XYZ Corp's stock price isn't due to a single event. Instead, it's a confluence of factors contributing to investor apprehension. These include:

- Market-wide tech sell-off: The broader tech sector has seen significant corrections recently, impacting even leading companies. XYZ Corp, being a prominent AI player, hasn't been immune to this trend.

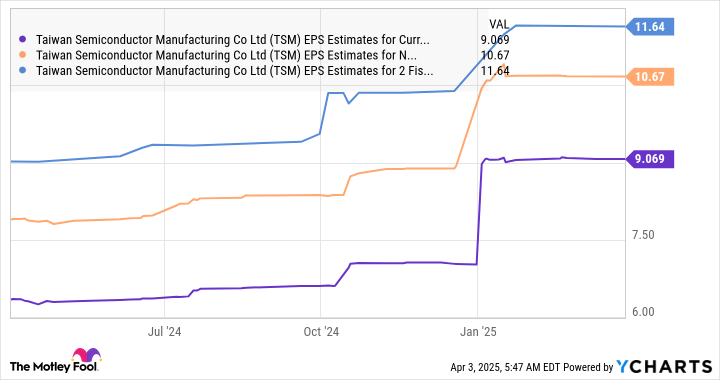

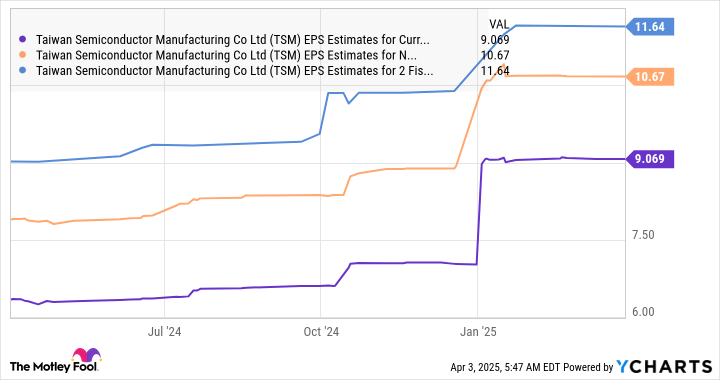

- Concerns about future earnings: Analysts' forecasts for XYZ Corp's upcoming quarterly earnings reports have been revised downward, leading some investors to take profits or reduce their positions. Uncertainty surrounding the company's future revenue growth is a major contributing factor.

- Increased competition: The AI market is rapidly evolving, with new competitors constantly emerging. This increased competition could potentially impact XYZ Corp's market share and profitability in the long term.

- April 17th Deadline: The significance of this date needs further clarification (add specific details, e.g., "option expiry date," "merger deadline," etc.). This impending deadline adds another layer of uncertainty, influencing investor decisions.

Should You Buy the Dip? Analyzing the Risks and Rewards

The 25% drop presents a compelling opportunity for some investors, but it's crucial to weigh the risks carefully before making any decisions.

Potential Rewards:

- Discounted entry point: The significant price drop offers a potentially attractive entry point for long-term investors who believe in XYZ Corp's long-term prospects.

- Strong fundamentals (if applicable): If XYZ Corp's underlying business remains strong despite the recent downturn, this could represent a buying opportunity. Review their financial statements and recent news for confirmation.

- AI market growth: The overall AI market is still experiencing significant growth, and XYZ Corp is well-positioned to benefit from this trend if they can overcome current challenges.

Potential Risks:

- Further price declines: There's always a risk that the stock price could fall further, especially given the April 17th deadline and ongoing market volatility.

- Uncertain future earnings: The uncertainty surrounding future earnings makes predicting the stock's future performance challenging.

- Increased competition: The competitive landscape in the AI sector is intense, and XYZ Corp's ability to maintain its market share is not guaranteed.

Before You Invest: Due Diligence is Key

Before investing in XYZ Corp or any other stock, conduct thorough due diligence. This includes:

- Reviewing financial statements: Examine the company's financial health, including revenue, profit margins, and debt levels.

- Analyzing industry trends: Understand the broader AI market and XYZ Corp's competitive position within it.

- Considering your risk tolerance: Investing in stocks always involves risk. Make sure the potential rewards align with your own risk tolerance.

- Seeking professional advice: Consult with a qualified financial advisor before making any significant investment decisions.

Conclusion: A Calculated Risk?

The decision of whether to buy XYZ Corp stock before the April 17th deadline is a complex one, requiring careful consideration of the risks and rewards involved. While the 25% drop presents a potentially attractive entry point, the underlying uncertainties warrant thorough due diligence and a clear understanding of your investment goals and risk tolerance. Remember, this is not financial advice; always conduct your own research and consult with a financial professional before investing.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Top AI Stock Down 25% — Should You Buy Before The April 17 Deadline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sky Sports Accused Of Artificial Crowd Noise During Liverpool Everton Derby

Apr 07, 2025

Sky Sports Accused Of Artificial Crowd Noise During Liverpool Everton Derby

Apr 07, 2025 -

Starlink Secures Bangladesh License Expanding Global Broadband Coverage

Apr 07, 2025

Starlink Secures Bangladesh License Expanding Global Broadband Coverage

Apr 07, 2025 -

Llama 2 On Workers Ai Metas Powerful Language Model Gets Easier To Use

Apr 07, 2025

Llama 2 On Workers Ai Metas Powerful Language Model Gets Easier To Use

Apr 07, 2025 -

Uncharacteristic Performance Steph Curry Scores Only 3 Points In Loss To Rockets

Apr 07, 2025

Uncharacteristic Performance Steph Curry Scores Only 3 Points In Loss To Rockets

Apr 07, 2025 -

Space X Starship And The Future Of Next Day Package Delivery A Realistic Assessment

Apr 07, 2025

Space X Starship And The Future Of Next Day Package Delivery A Realistic Assessment

Apr 07, 2025