Top Dividend Stock Picks: Jefferies And BTIG Suggest 2 For High-Yield Income

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Top Dividend Stock Picks: Jefferies and BTIG Point to High-Yield Income Opportunities

High-yield dividend stocks are increasingly attractive to investors seeking stable income streams in uncertain economic times. Two prominent investment firms, Jefferies and BTIG, recently highlighted compelling opportunities in this sector, recommending two stocks specifically poised for strong dividend payouts. This article will delve into their recommendations, examining why these companies are considered attractive and the potential risks involved.

Jefferies' Top Pick: A Deep Dive into [Insert Company Name Here - e.g., Company A]

Jefferies, a global investment bank, recently singled out [Insert Company Name Here - e.g., Company A] as a top dividend stock pick. Their recommendation is based on several key factors:

-

Strong Dividend History: [Insert Company Name Here - e.g., Company A] boasts a long and consistent history of dividend payments, demonstrating a commitment to returning value to shareholders. This stability is crucial for investors seeking reliable income. Specifically, [mention specific data points about dividend history – e.g., "The company has increased its dividend annually for the past X years, with a current yield of Y%"].

-

Robust Financial Performance: Jefferies points to [Insert Company Name Here - e.g., Company A]'s strong financial performance as a cornerstone of its dividend sustainability. [Provide specific data like revenue growth, earnings per share, etc. – e.g., "The company reported a Y% increase in revenue last quarter, driven by strong performance in [specific sector/business unit]. Earnings per share also exceeded expectations, further solidifying its dividend payout capacity."]

-

Growth Potential: Beyond its current dividend strength, Jefferies suggests that [Insert Company Name Here - e.g., Company A] possesses significant growth potential, potentially leading to further dividend increases in the future. [Explain the growth potential, e.g., "The company's expansion into new markets, coupled with its innovative product pipeline, positions it for continued growth and enhanced shareholder returns."]

Potential Risks: While the outlook for [Insert Company Name Here - e.g., Company A] appears positive, investors should be aware of potential risks, including [mention specific potential risks – e.g., "sector-specific headwinds," "increased competition," "interest rate sensitivity," etc.]. Thorough due diligence is essential before investing.

BTIG's Recommendation: Exploring the Potential of [Insert Company Name Here - e.g., Company B]

BTIG, another reputable investment firm, also highlighted a compelling dividend stock opportunity: [Insert Company Name Here - e.g., Company B]. Their rationale centers on:

-

High Dividend Yield: [Insert Company Name Here - e.g., Company B] currently offers a significantly high dividend yield, making it particularly attractive to income-focused investors. [Provide specific yield data – e.g., "With a current yield of Z%, Company B stands out in the current market environment."]

-

Stable Cash Flow: BTIG emphasizes [Insert Company Name Here - e.g., Company B]'s consistent and reliable cash flow generation, which provides a strong foundation for its dividend payments. [Provide supporting data – e.g., "The company's strong free cash flow allows for comfortable dividend payments and potential future increases."]

-

Defensive Business Model: The firm highlights [Insert Company Name Here - e.g., Company B]'s defensive business model, making it relatively resilient to economic downturns. [Explain why the business model is considered defensive – e.g., "Its focus on essential goods/services provides a degree of protection during economic uncertainty."]

Potential Risks: As with any investment, there are inherent risks associated with [Insert Company Name Here - e.g., Company B]. Investors should carefully consider factors such as [mention specific potential risks – e.g., "regulatory changes," "dependence on specific markets," "geographical concentration," etc.] before making an investment decision.

Disclaimer: Investing in Dividend Stocks

Investing in dividend stocks involves inherent risks. Dividend payments are not guaranteed, and the value of your investment can fluctuate. This article is for informational purposes only and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions. Always conduct thorough due diligence before investing in any stock.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Top Dividend Stock Picks: Jefferies And BTIG Suggest 2 For High-Yield Income. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Amazon Stock A Smart Long Term Buy In 2024

May 12, 2025

Is Amazon Stock A Smart Long Term Buy In 2024

May 12, 2025 -

From Captain To Legend Virat Kohlis Test Cricket Retirement Announced

May 12, 2025

From Captain To Legend Virat Kohlis Test Cricket Retirement Announced

May 12, 2025 -

Business Telecoms Reshaped Virgin Media O2 And Daisys 3 Billion Union

May 12, 2025

Business Telecoms Reshaped Virgin Media O2 And Daisys 3 Billion Union

May 12, 2025 -

Pittsburgh Area Pet Owners Learn Fate Of Ashes In Funeral Home Case

May 12, 2025

Pittsburgh Area Pet Owners Learn Fate Of Ashes In Funeral Home Case

May 12, 2025 -

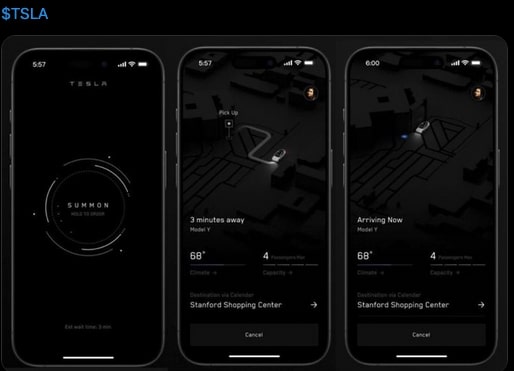

Next Big Future Predicts Teslas June Launch Of Supervised And Unsupervised Ridesharing In Austin

May 12, 2025

Next Big Future Predicts Teslas June Launch Of Supervised And Unsupervised Ridesharing In Austin

May 12, 2025

Latest Posts

-

Kohli Retirement Announcement Full Text Of Emotional Social Media Post

May 12, 2025

Kohli Retirement Announcement Full Text Of Emotional Social Media Post

May 12, 2025 -

Unlock Screen Times Potential A Guide To I Phones Digital Health Features

May 12, 2025

Unlock Screen Times Potential A Guide To I Phones Digital Health Features

May 12, 2025 -

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

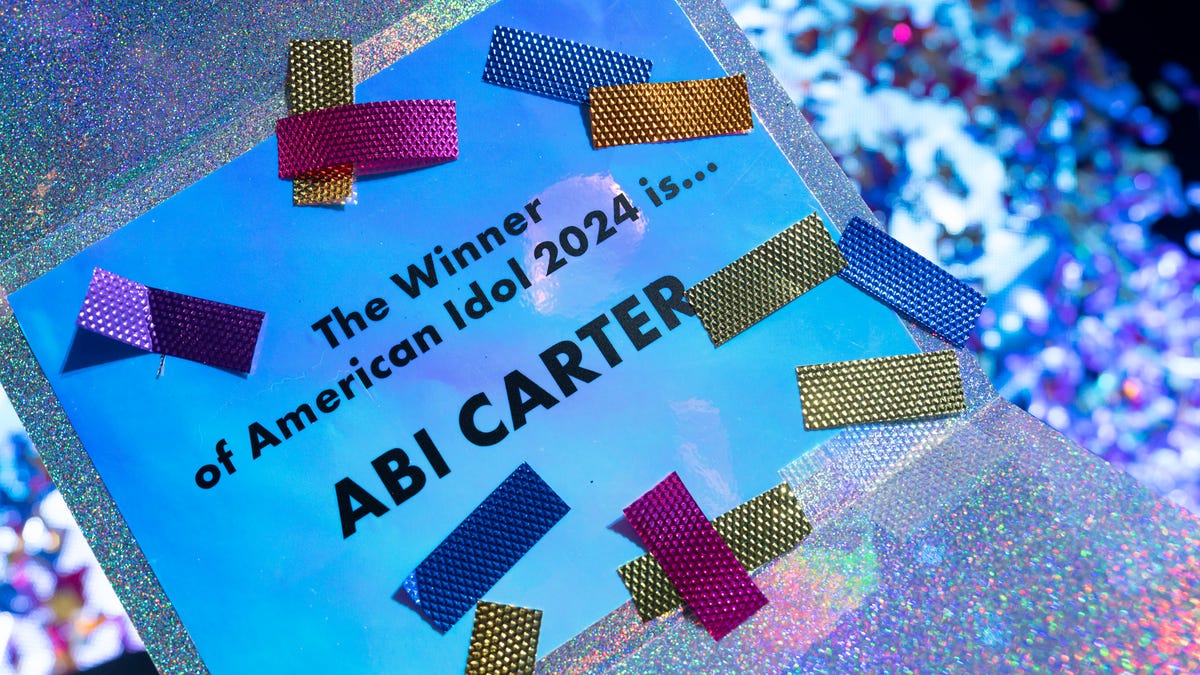

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025