Toronto-Dominion Bank (TD) Cuts 2% Of Staff, Shrinks $3 Billion Portfolio

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Cuts 2% of Workforce, Shrinks Investment Portfolio by $3 Billion: A Deeper Dive

Toronto-Dominion Bank (TD) announced significant restructuring measures today, impacting both its workforce and investment portfolio. The move, designed to streamline operations and navigate a challenging economic climate, involves a reduction of approximately 2% of its workforce and a $3 billion shrinkage of its investment portfolio. This news sent ripples through the financial markets and sparked intense discussion regarding the future direction of the Canadian banking giant.

Layoffs Impacting Thousands:

The 2% workforce reduction translates to thousands of employees across TD's various branches and departments. While the exact number remains undisclosed, the bank assures affected employees will receive comprehensive support packages including severance pay and outplacement services. This strategic workforce adjustment, according to TD, is aimed at increasing efficiency and aligning the company's structure with its long-term strategic goals. The specific departments impacted have not been publicly revealed, leading to speculation across various media outlets.

$3 Billion Portfolio Reduction: A Cautious Approach?

Simultaneously, TD announced a significant reduction of its investment portfolio, shedding a substantial $3 billion in assets. This move reflects a more cautious approach to risk management in the face of growing economic uncertainty. Industry analysts suggest this decision is a proactive measure to bolster the bank's capital reserves and mitigate potential losses in a volatile market. The types of assets divested haven't been specified, leaving room for interpretation regarding the bank’s strategic priorities.

Navigating Economic Headwinds:

The actions taken by TD are not isolated incidents. Many financial institutions across North America are grappling with rising interest rates, inflation, and a potential recession. TD's decision to restructure its workforce and portfolio can be viewed within this broader context of financial sector adaptation. The bank aims to strengthen its financial position and improve its resilience against future economic shocks.

Investor Reaction and Future Outlook:

The stock market’s initial reaction to the announcement was mixed. While some analysts see the restructuring as a necessary step for long-term stability, others express concern about the potential impact on customer service and future growth. The coming weeks will be crucial in observing the market's overall sentiment towards TD’s strategic repositioning. The long-term effects of these decisions on TD's profitability and market share remain to be seen.

Key Takeaways:

- Workforce Reduction: Approximately 2% of TD's workforce will be impacted by layoffs.

- Portfolio Shrinkage: TD has reduced its investment portfolio by $3 billion.

- Economic Context: These actions are part of a broader trend within the financial sector to navigate economic uncertainty.

- Strategic Repositioning: TD aims to increase efficiency, strengthen its capital reserves, and improve resilience.

- Uncertain Future: The long-term impact of these decisions on TD's performance remains to be seen.

TD Bank's strategic decisions highlight the challenges faced by large financial institutions in today's complex economic environment. The coming months will be critical in determining the success of this restructuring and its overall impact on the bank's future. Further updates and analysis will be provided as more information becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Toronto-Dominion Bank (TD) Cuts 2% Of Staff, Shrinks $3 Billion Portfolio. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hayley Atwell Mission Impossible Delay Caused By Unexpected Wildlife Encounter

May 23, 2025

Hayley Atwell Mission Impossible Delay Caused By Unexpected Wildlife Encounter

May 23, 2025 -

Is An Ipo In The Cards Analyzing Circle Bitkub And Blockchain Coms Public Offering Prospects

May 23, 2025

Is An Ipo In The Cards Analyzing Circle Bitkub And Blockchain Coms Public Offering Prospects

May 23, 2025 -

Financiamento De Cotas De Casas Como Ter Acesso A Imoveis De Luxo Com Investimento Menor

May 23, 2025

Financiamento De Cotas De Casas Como Ter Acesso A Imoveis De Luxo Com Investimento Menor

May 23, 2025 -

Sparks Player Grades Analyzing Two Games Of Contrasting Results

May 23, 2025

Sparks Player Grades Analyzing Two Games Of Contrasting Results

May 23, 2025 -

Public Health Alert Milk Pulled From Shelves Due To Lethal Bacteria

May 23, 2025

Public Health Alert Milk Pulled From Shelves Due To Lethal Bacteria

May 23, 2025

Latest Posts

-

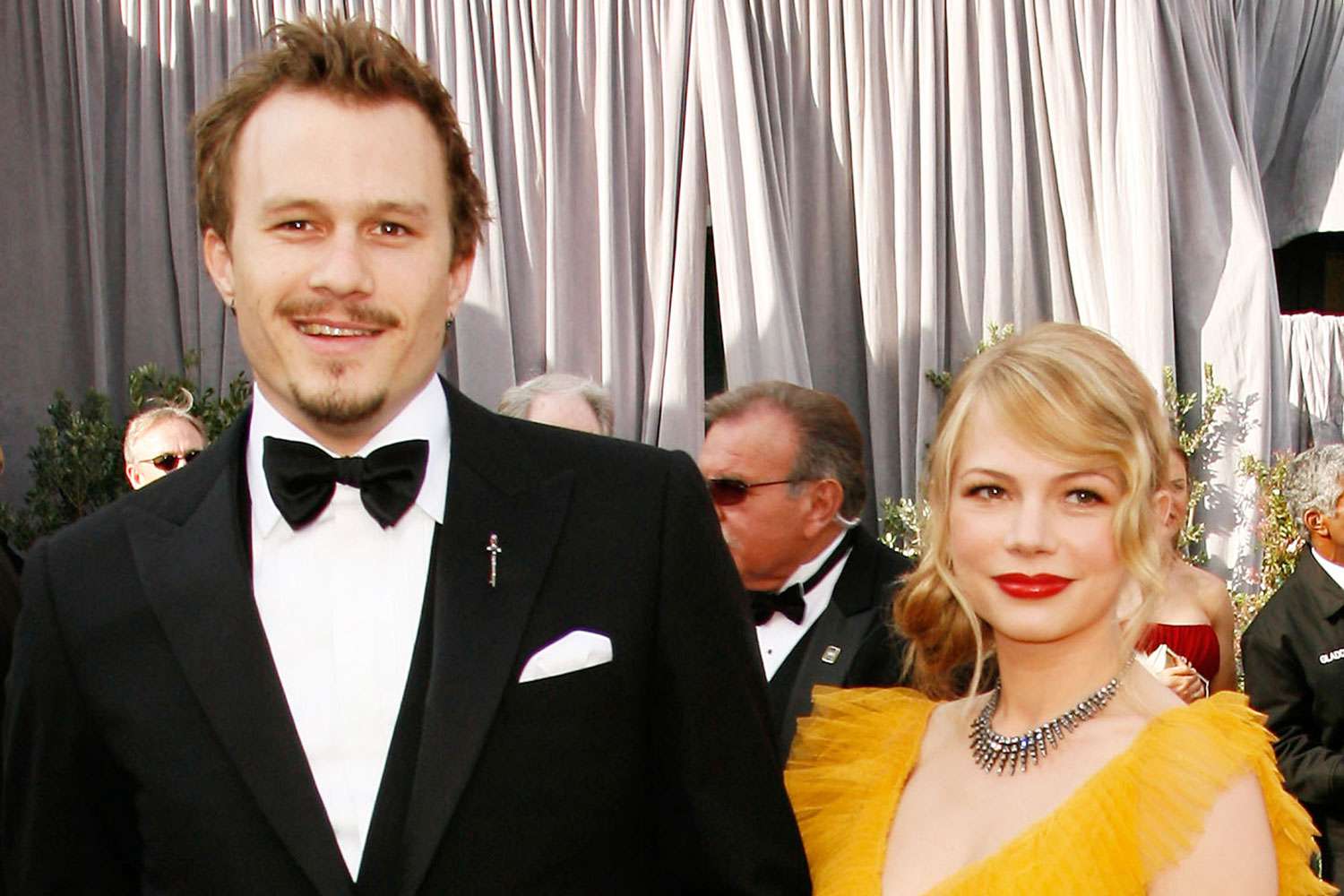

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025

Heath Ledgers Daughter Matilda Michelle Williams Shares Poignant Reflections On Family

May 23, 2025 -

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025

Woodlands And Tuas Checkpoints Ica Advises Travelers To Prepare For Heavy Traffic This June

May 23, 2025 -

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025

Nhl Forward Tom Eisenhuth Retires Due To Persistent Injuries

May 23, 2025 -

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025

Hulus Upcoming Zombie Film 18 Year Olds Fight The Undead

May 23, 2025 -

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025

First Successful Flight Test Venus Aerospaces Revolutionary Rde Engine

May 23, 2025