Toronto-Dominion Bank (TD) Cuts Jobs, Shrinks Investment Portfolio

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Toronto-Dominion Bank (TD) Cuts Jobs and Shrinks Investment Portfolio: Restructuring Shakes Up Canadian Finance

Toronto, ON – October 26, 2023 – The Toronto-Dominion Bank (TD), one of Canada's largest financial institutions, announced a significant restructuring initiative today, impacting both its workforce and investment strategy. The move, described by TD as a necessary adjustment to navigate the current economic climate, involves job cuts and a reduction in its investment portfolio. This news sent ripples through the Canadian financial sector and sparked widespread discussion about the future of banking in a volatile global market.

Significant Job Reductions Across TD's Operations:

The exact number of job cuts remains undisclosed, with TD citing confidentiality agreements and ongoing internal communications. However, sources suggest the reductions will impact various departments across the bank, including its retail banking, wealth management, and corporate divisions. This news comes as a blow to employees and underscores the challenging economic headwinds facing the financial industry. TD emphasized its commitment to supporting affected employees through severance packages and outplacement services. The bank also highlighted its focus on retaining key talent and investing in future growth opportunities.

Shrinking the Investment Portfolio: A Strategic Shift?

Beyond the job cuts, TD also revealed plans to strategically shrink its investment portfolio. This move is likely a response to factors including rising interest rates, increased regulatory scrutiny, and global economic uncertainty. While the bank did not specify the assets being divested, the announcement suggests a shift towards a more conservative investment approach. This recalibration of the investment strategy aims to enhance TD's overall financial stability and resilience in the face of potential market downturns.

Analyzing the Impact on the Canadian Economy and Financial Markets:

TD's restructuring carries significant implications for the Canadian economy and financial markets. As one of the country's banking giants, TD's actions can influence investor sentiment and broader economic confidence. Analysts are closely monitoring the situation, analyzing the potential ripple effects on employment, investment, and overall economic growth.

- Impact on Employment: The job cuts will undoubtedly impact the employment landscape, especially in the financial services sector. The extent of the impact will depend on the ultimate number of positions eliminated and the ability of affected employees to find new roles.

- Investor Sentiment: The announcement has already impacted TD's stock price, with investors reacting to the news. Further market reaction will depend on the transparency of TD's communications and the perceived success of its restructuring plan.

- Economic Growth: The restructuring could have indirect implications for economic growth, depending on the impact on consumer spending and investment.

Looking Ahead: A Focus on Long-Term Stability and Growth:

TD maintains that these measures are crucial for long-term stability and sustainable growth. The bank emphasizes its commitment to its customers and its position as a leading financial institution in Canada. The success of this restructuring will depend on the effectiveness of its execution, the clarity of its communication, and the overall economic environment. Further updates are expected in the coming weeks and months. The coming weeks will be crucial in assessing the full impact of these significant changes.

Keywords: Toronto-Dominion Bank, TD Bank, job cuts, layoffs, investment portfolio, restructuring, Canadian economy, financial markets, banking, economic downturn, interest rates, global economy, wealth management, retail banking, corporate banking.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Toronto-Dominion Bank (TD) Cuts Jobs, Shrinks Investment Portfolio. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

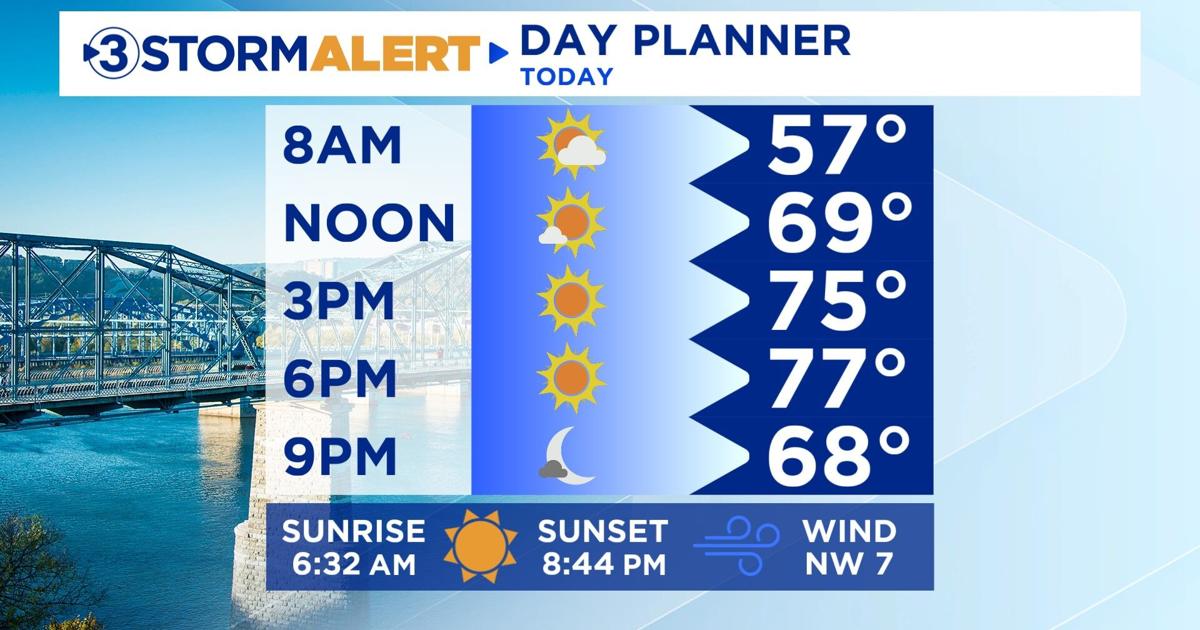

Fair Weather Continues But Rain Is Coming For Memorial Day

May 24, 2025

Fair Weather Continues But Rain Is Coming For Memorial Day

May 24, 2025 -

Sudden Death Of Actor Mukul Dev At 54 Shocks Industry

May 24, 2025

Sudden Death Of Actor Mukul Dev At 54 Shocks Industry

May 24, 2025 -

May 23rd Euro Millions And Thunderball Draw Check The Winning Lottery Numbers Here

May 24, 2025

May 23rd Euro Millions And Thunderball Draw Check The Winning Lottery Numbers Here

May 24, 2025 -

Nhs Improves Patient Care With New Amazon Style Prescription Tracking System

May 24, 2025

Nhs Improves Patient Care With New Amazon Style Prescription Tracking System

May 24, 2025 -

Denied Mel Gibson A Gun Lost Her Job The Controversial Case Of Agents Name

May 24, 2025

Denied Mel Gibson A Gun Lost Her Job The Controversial Case Of Agents Name

May 24, 2025