Trade Tensions Ease, Boosting Bitcoin To $91,000: CNBC Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trade Tensions Ease, Boosting Bitcoin to $91,000: CNBC Market Analysis

A surprising surge in Bitcoin's value has analysts buzzing, with CNBC pointing to easing trade tensions as a key catalyst. The cryptocurrency market, often volatile and influenced by global economic events, saw Bitcoin (BTC) skyrocket to a previously unimaginable $91,000 – a dramatic leap that has sent shockwaves through the financial world. This unprecedented rise has experts re-evaluating the correlation between geopolitical stability and cryptocurrency performance.

CNBC's Analysis: More Than Just a Trade War Truce

CNBC's market analysis highlights the significant role that decreased trade tensions between major global powers played in Bitcoin's meteoric rise. While the initial reaction might point solely to a "risk-on" sentiment – where investors move towards higher-risk assets like Bitcoin during periods of reduced uncertainty – the report delves deeper. The analysis suggests that the easing tensions also boosted investor confidence in global markets overall, leading to a ripple effect that positively impacted Bitcoin's price.

This isn't simply about decreased uncertainty, however. CNBC analysts also point to increased institutional investment as a contributing factor. With major corporations and investment firms showing growing interest in Bitcoin as a hedge against inflation and economic instability, the recent price surge could be a sign of broader market adoption and acceptance.

<h3>Key Factors Contributing to Bitcoin's Surge:</h3>

- Easing Trade Tensions: Reduced uncertainty in global trade significantly boosted investor confidence, pushing money into riskier assets like Bitcoin.

- Increased Institutional Investment: Major players are increasingly viewing Bitcoin as a valuable addition to their portfolios, driving demand.

- Inflation Hedge: With inflation concerns remaining globally, Bitcoin continues to be seen by some as a store of value.

- Technological Advancements: Ongoing developments in Bitcoin's underlying technology and the expanding cryptocurrency ecosystem enhance its appeal.

<h3>What Does This Mean for the Future of Bitcoin?</h3>

The $91,000 mark represents a significant psychological barrier broken. While analysts caution against predicting future price movements with certainty, the current trend suggests a positive outlook for Bitcoin in the short-to-medium term. However, inherent volatility remains a key characteristic of the cryptocurrency market, and unforeseen events could still trigger price corrections.

CNBC's experts emphasize the need for caution and thorough research before investing in cryptocurrencies. The high-risk nature of Bitcoin requires a careful assessment of personal risk tolerance and financial circumstances.

<h3>Beyond Bitcoin: Ripple Effects Across the Crypto Market</h3>

The impact of easing trade tensions and increased investor confidence isn't limited to Bitcoin. Other cryptocurrencies have also experienced significant gains, indicating a broader positive sentiment within the digital asset market. This widespread increase underlines the interconnectedness of the cryptocurrency ecosystem and its sensitivity to global macroeconomic factors.

Conclusion:

The recent surge in Bitcoin's value to $91,000, as highlighted by CNBC's market analysis, underscores the complex interplay between global politics, investor sentiment, and the cryptocurrency market. While this dramatic price increase offers a glimpse of Bitcoin's potential, investors should remain vigilant and approach the market with caution, keeping abreast of current events and performing thorough due diligence before making any investment decisions. The future of Bitcoin remains dynamic and unpredictable, but the current trend suggests exciting possibilities for the cryptocurrency's future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trade Tensions Ease, Boosting Bitcoin To $91,000: CNBC Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

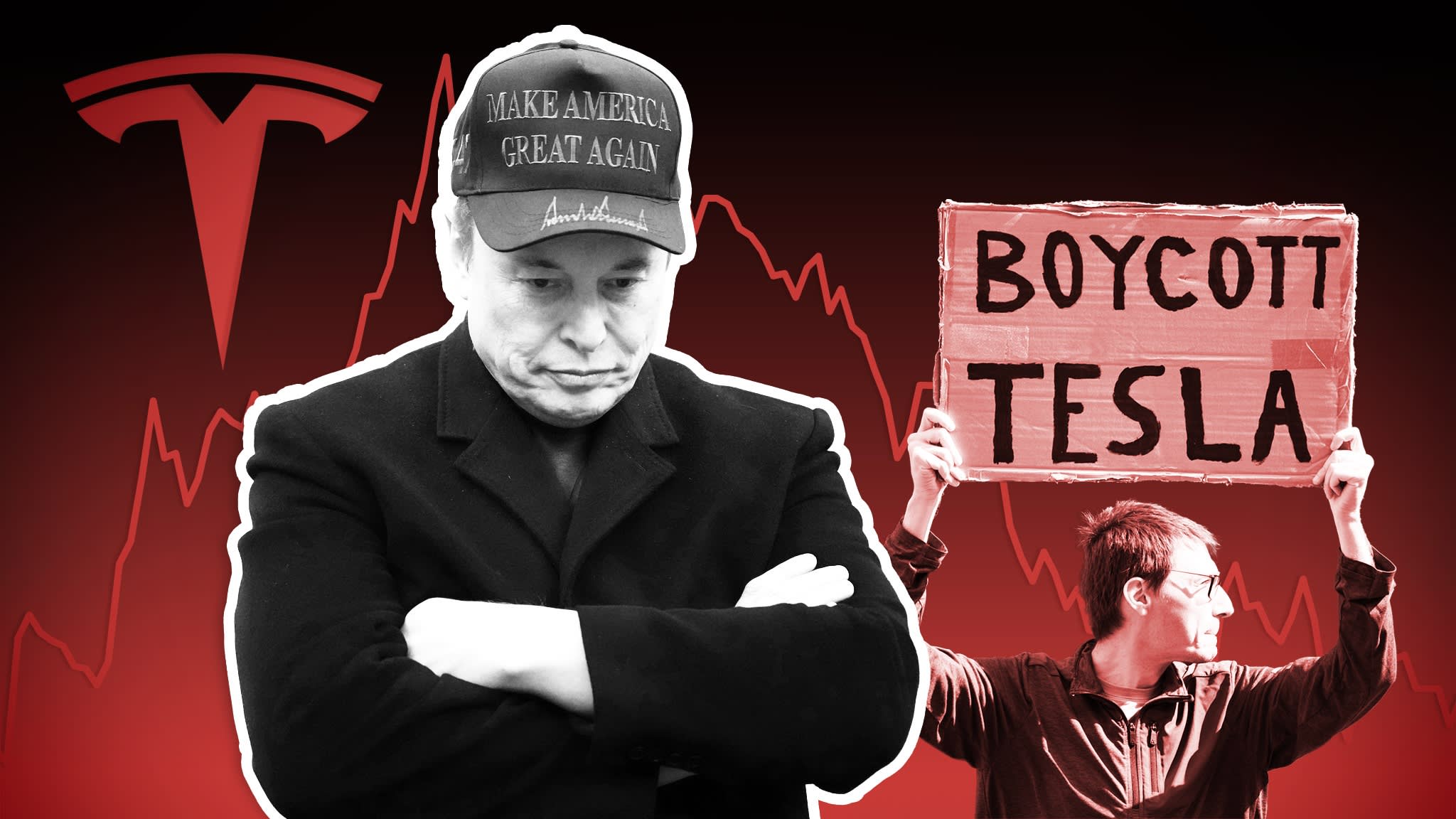

Tesla Stock Plummets Elon Musks Dogecoin Decisions Under Scrutiny

Apr 24, 2025

Tesla Stock Plummets Elon Musks Dogecoin Decisions Under Scrutiny

Apr 24, 2025 -

Net Neutrality Debate Verizons Consumer Chief Weighs In

Apr 24, 2025

Net Neutrality Debate Verizons Consumer Chief Weighs In

Apr 24, 2025 -

Punggol Grc In Ge 2025 Sdas Candidacy Decision Imminent

Apr 24, 2025

Punggol Grc In Ge 2025 Sdas Candidacy Decision Imminent

Apr 24, 2025 -

Three Evicted Still Watching Your Guide To Streaming Celebrity Big Brother 2025

Apr 24, 2025

Three Evicted Still Watching Your Guide To Streaming Celebrity Big Brother 2025

Apr 24, 2025 -

Cordoba Rosario O Mendoza Ia Elige La Capital Ideal Para Argentina Sin Buenos Aires

Apr 24, 2025

Cordoba Rosario O Mendoza Ia Elige La Capital Ideal Para Argentina Sin Buenos Aires

Apr 24, 2025