Trade War Fallout: Aussie Dollar Plummets On US-China Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trade War Fallout: Aussie Dollar Plummets on US-China Tensions

The Australian dollar has taken a significant hit, plummeting to its lowest point in months amidst escalating US-China trade tensions. This sharp decline reflects Australia's precarious position as a major trading partner with both economic giants, leaving its currency vulnerable to the volatile geopolitical climate. The ongoing trade war, marked by escalating tariffs and retaliatory measures, has created a ripple effect across global markets, with the Aussie dollar bearing the brunt of the uncertainty.

Understanding the Aussie Dollar's Vulnerability

Australia's economy is heavily reliant on exports to China, its largest trading partner. A significant portion of Australian commodities, including iron ore, coal, and agricultural products, find their way into the Chinese market. The ongoing trade dispute between the US and China disrupts these crucial trade flows, impacting demand for Australian goods and consequently weakening the Australian dollar (AUD). The uncertainty surrounding future trade relations adds further pressure, making investors hesitant to hold AUD.

The Impact of US-China Trade Tensions

The US-China trade war isn't just about tariffs; it's about broader geopolitical maneuvering that significantly impacts global economic stability. The uncertainty surrounding future trade agreements creates a climate of fear and speculation, driving investors towards safer havens like the US dollar or the Japanese yen. This flight to safety directly contributes to the AUD's decline.

Key Factors Contributing to the Aussie Dollar's Fall:

- Reduced Demand for Australian Exports: China's slowing economic growth, partly fueled by the trade war, reduces its demand for Australian goods, leading to lower export revenues.

- Investor Sentiment: Negative investor sentiment towards the global economy, exacerbated by the trade war, pushes investors away from riskier assets like the AUD.

- Rising US Dollar: The US dollar often strengthens during periods of global economic uncertainty, making the AUD relatively weaker.

- Commodity Prices: Fluctuations in commodity prices, particularly iron ore, significantly impact Australia's export earnings and the AUD's value.

What Lies Ahead for the Australian Dollar?

The future of the AUD remains uncertain. The outcome of the ongoing US-China trade negotiations will play a crucial role in determining its trajectory. A resolution to the trade dispute could lead to a rebound, while further escalation could trigger a more pronounced decline. Other factors, including domestic economic performance and global interest rate movements, will also influence the AUD's value in the coming months.

For investors: The current situation calls for caution. Those holding AUD should closely monitor developments in the US-China trade war and consider diversifying their portfolios to mitigate risk. The volatility presents both opportunities and challenges, requiring a strategic approach to investment decisions.

Looking Ahead: The Australian government is actively working to diversify its trade relationships and reduce its dependence on China. However, the immediate future for the Australian dollar remains tied to the fluctuating fortunes of the US-China trade war, making it a crucial factor to watch for economists and investors alike. The ongoing situation highlights the interconnected nature of the global economy and the significant impact of geopolitical events on individual national currencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trade War Fallout: Aussie Dollar Plummets On US-China Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tasmanian Devils Face Setback Crucial Hobart Stadium Vote Looms

Apr 08, 2025

Tasmanian Devils Face Setback Crucial Hobart Stadium Vote Looms

Apr 08, 2025 -

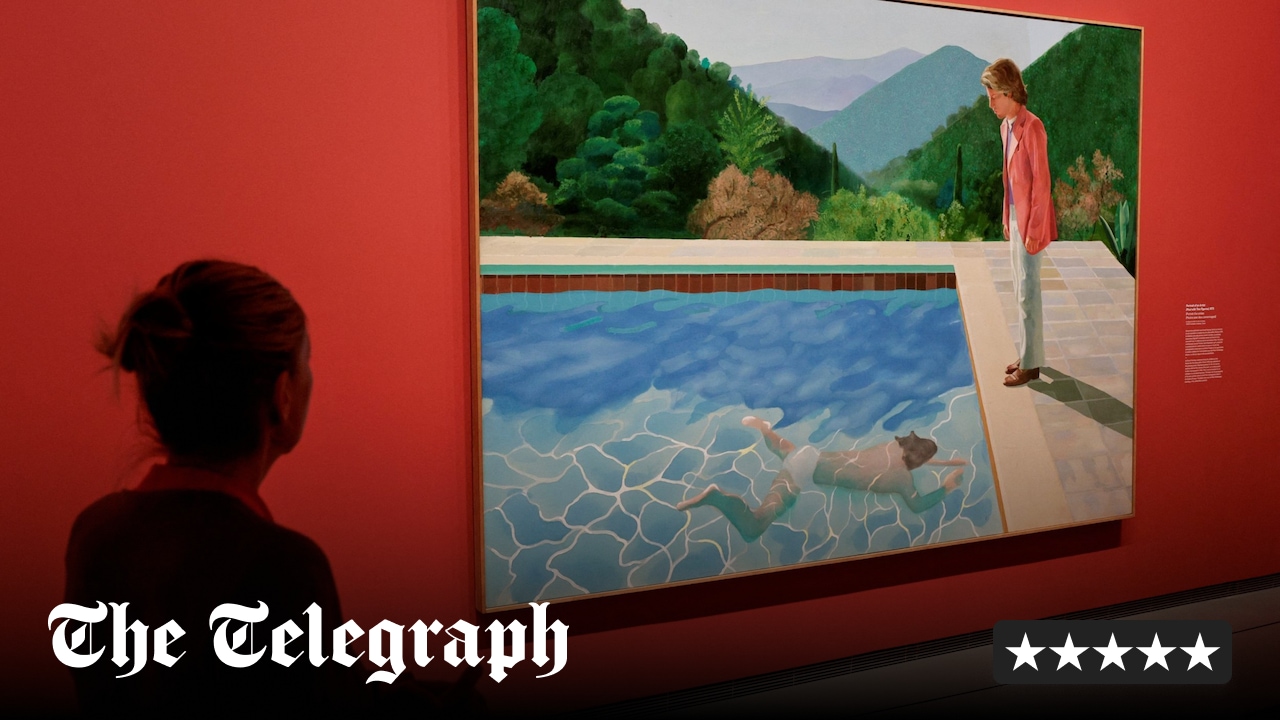

Fondation Louis Vuitton A New Perspective On David Hockneys Work

Apr 08, 2025

Fondation Louis Vuitton A New Perspective On David Hockneys Work

Apr 08, 2025 -

Quantum Mechanics A Potential Solution For Joystick Drift

Apr 08, 2025

Quantum Mechanics A Potential Solution For Joystick Drift

Apr 08, 2025 -

Wazir Xs Comeback Exchange To Be Rebooted Following Massive Cyberattack

Apr 08, 2025

Wazir Xs Comeback Exchange To Be Rebooted Following Massive Cyberattack

Apr 08, 2025 -

Capital Structure Restructuring Standard Chartereds Share Buyback Plan

Apr 08, 2025

Capital Structure Restructuring Standard Chartereds Share Buyback Plan

Apr 08, 2025