Trade War Turbulence: The Aussie Dollar's Sharp Decline Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trade War Turbulence: The Aussie Dollar's Sharp Decline Explained

The Australian dollar (AUD) has experienced a significant downturn recently, leaving investors and economists scrambling for answers. This sharp decline isn't an isolated incident; it's intricately linked to the escalating global trade war and its ripple effects on the Australian economy. Understanding this connection is crucial for navigating the current market volatility.

The Impact of Global Trade Tensions:

The AUD, often referred to as the "Aussie," is considered a commodity currency, meaning its value is heavily influenced by the prices of raw materials like iron ore and coal, key Australian exports. The ongoing trade war between the US and China, two of Australia's largest trading partners, has created significant uncertainty in global markets. This uncertainty directly impacts demand for Australian commodities, leading to a decrease in export revenue and subsequently weakening the AUD.

China's Reduced Demand: A Major Factor:

China's slowing economic growth, further exacerbated by the trade war, has significantly reduced its demand for Australian resources. This reduced demand translates to lower prices for Australian exports, impacting the country's trade balance and putting downward pressure on the AUD. The reliance of the Australian economy on Chinese demand makes it particularly vulnerable to shifts in the Sino-American relationship.

Increased Risk Aversion:

The escalating trade tensions have fostered a climate of increased risk aversion among global investors. Investors are moving away from riskier assets, including commodity currencies like the AUD, and seeking refuge in safer havens like the US dollar (USD) or Japanese yen (JPY). This flight to safety further contributes to the AUD's decline.

What Does This Mean for Investors?

The weakening AUD presents both challenges and opportunities for investors. While it might be challenging for Australian exporters, it could benefit importers and those seeking to invest overseas. However, the volatility makes accurate forecasting difficult, highlighting the importance of diversification and careful risk management.

H2: Potential Scenarios and Future Outlook:

Several scenarios could unfold depending on the resolution (or lack thereof) of the trade war. A de-escalation could lead to a rebound in the AUD, while prolonged tensions might result in further depreciation. Several key factors will influence the future trajectory of the Aussie dollar:

- Resolution of US-China Trade Disputes: A significant breakthrough in trade negotiations could significantly boost investor confidence and strengthen the AUD.

- Global Economic Growth: Stronger global economic growth would increase demand for Australian commodities, positively impacting the AUD.

- Interest Rate Differentials: The Reserve Bank of Australia's monetary policy decisions regarding interest rates will play a crucial role in shaping the AUD's value.

- Commodity Prices: Fluctuations in the prices of iron ore, coal, and other key Australian exports will continue to be a major driver of the AUD's performance.

H2: Strategies for Navigating the Volatility:

Investors should adopt a cautious approach, closely monitoring developments in the trade war and global economic conditions. Diversification across different asset classes is crucial to mitigate risk. Staying informed about macroeconomic indicators and seeking professional financial advice are essential steps in navigating this period of uncertainty.

The ongoing trade war presents a significant challenge to the Australian economy and its currency. Understanding the underlying factors driving the AUD's decline is crucial for investors and businesses alike to make informed decisions and mitigate potential risks. The future of the Aussie dollar remains intertwined with the unpredictable landscape of global trade relations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trade War Turbulence: The Aussie Dollar's Sharp Decline Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoin Btc Price Prediction Trade Tensions Dampen Bullish Momentum

Apr 07, 2025

Bitcoin Btc Price Prediction Trade Tensions Dampen Bullish Momentum

Apr 07, 2025 -

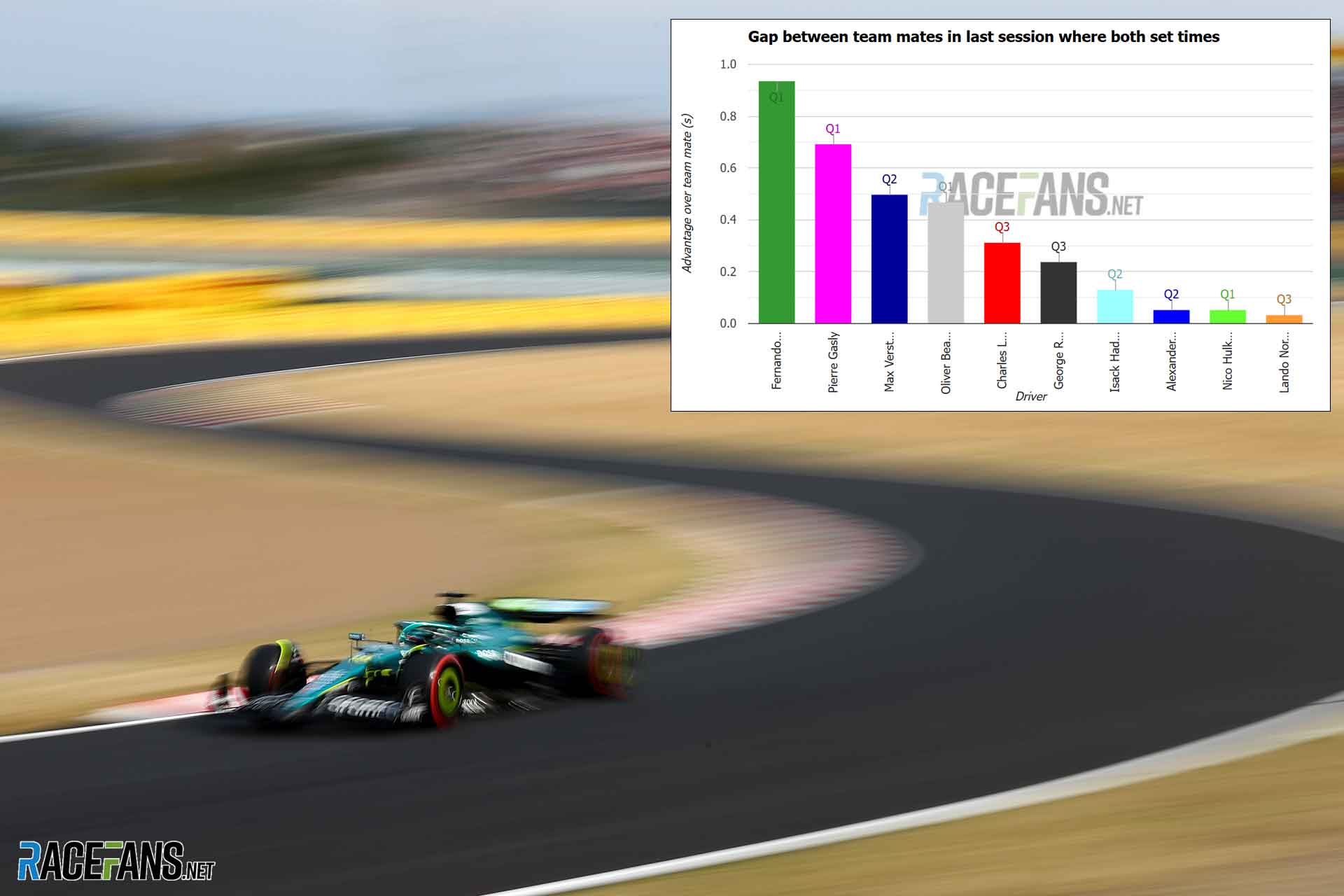

Wind Speed Fluctuation 12kph Increase Impacts Strolls F1 Qualifying Performance

Apr 07, 2025

Wind Speed Fluctuation 12kph Increase Impacts Strolls F1 Qualifying Performance

Apr 07, 2025 -

Ram Mandir Surya Tilak Ceremony Complete Guide To The 2025 Event

Apr 07, 2025

Ram Mandir Surya Tilak Ceremony Complete Guide To The 2025 Event

Apr 07, 2025 -

Clippers Star Kawhi Leonard Hints At Injury Concerns For Upcoming Games

Apr 07, 2025

Clippers Star Kawhi Leonard Hints At Injury Concerns For Upcoming Games

Apr 07, 2025 -

Who Wins Lehecka Or Korda Atp Monte Carlo Masters 2025 Prediction

Apr 07, 2025

Who Wins Lehecka Or Korda Atp Monte Carlo Masters 2025 Prediction

Apr 07, 2025