Trading Avalanche (AVAX): Navigating The Current Resistance And Potential Pullback

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trading Avalanche (AVAX): Navigating the Current Resistance and Potential Pullback

Avalanche (AVAX), the popular Layer-1 blockchain platform, has recently encountered significant resistance, prompting concerns among traders about a potential pullback. This article delves into the current market dynamics surrounding AVAX, analyzing the factors contributing to the resistance and exploring potential scenarios for the future price action. Understanding these dynamics is crucial for both seasoned and novice traders looking to navigate the AVAX market effectively.

Current Market Resistance for AVAX:

AVAX has been grappling with a strong resistance level, preventing it from breaking through to new all-time highs. Several factors contribute to this resistance:

-

Overall Crypto Market Sentiment: The broader cryptocurrency market's recent volatility and uncertainty have impacted AVAX's price, creating a headwind for bullish momentum. A general risk-off sentiment often translates into lower prices across the board.

-

Profit-Taking: After a considerable price surge, many investors are likely engaging in profit-taking, selling off their AVAX holdings to secure their gains. This selling pressure contributes to the current resistance.

-

Technical Indicators: Various technical indicators, including moving averages and relative strength index (RSI), suggest that AVAX is currently overbought. This indicates a potential correction or pullback is imminent. Traders should carefully monitor these indicators for signals of a potential trend reversal.

-

Competition in the L1 Market: The Layer-1 blockchain space is highly competitive. New projects and innovations constantly challenge existing platforms like Avalanche, potentially affecting its market share and price.

Potential Pullback Scenarios and Strategies:

While a pullback is a possibility, it's crucial to avoid panic selling. A well-managed pullback can present excellent buying opportunities for long-term investors. Here are some potential scenarios and strategies to consider:

-

Short-Term Pullback: A relatively minor pullback could consolidate AVAX's price before resuming its upward trajectory. This scenario would be beneficial for long-term holders, allowing them to average down their cost basis if they choose to buy more.

-

Significant Correction: A more significant correction could occur if broader market conditions worsen or if negative news impacts AVAX specifically. This scenario necessitates a more cautious approach, with traders possibly employing stop-loss orders to mitigate potential losses.

-

Trading Strategies: Traders might employ strategies like swing trading or day trading to capitalize on short-term price fluctuations during a pullback. However, this requires a high degree of market understanding and risk management.

Navigating the Uncertainty:

Successfully navigating the current market uncertainty requires a blend of technical analysis, fundamental analysis, and risk management.

-

Fundamental Analysis: Analyzing Avalanche's technological advancements, adoption rate, and overall ecosystem health is crucial for long-term investment decisions. A strong fundamental outlook can counterbalance short-term price volatility.

-

Technical Analysis: Closely monitoring technical indicators like RSI, MACD, and moving averages helps to identify potential support and resistance levels, providing insights into potential price movements.

-

Risk Management: Implementing stop-loss orders and diversifying your portfolio are vital for mitigating risk. Never invest more than you can afford to lose.

Conclusion:

The current resistance faced by AVAX presents both challenges and opportunities for traders. By understanding the underlying factors contributing to this resistance, considering potential pullback scenarios, and implementing robust risk management strategies, investors can navigate this period effectively. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trading Avalanche (AVAX): Navigating The Current Resistance And Potential Pullback. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stuck On The Helldivers 2 Password Tips And Hints For Solving The Puzzle

May 14, 2025

Stuck On The Helldivers 2 Password Tips And Hints For Solving The Puzzle

May 14, 2025 -

Landlord Tenant Disputes Rise Amidst Winnipegs Extreme Heat And Ac Problems

May 14, 2025

Landlord Tenant Disputes Rise Amidst Winnipegs Extreme Heat And Ac Problems

May 14, 2025 -

Will Eli Lillys Mounjaro Dethrone Novo Nordisk As The Weight Loss Market Leader

May 14, 2025

Will Eli Lillys Mounjaro Dethrone Novo Nordisk As The Weight Loss Market Leader

May 14, 2025 -

Moodengs All Time High Analysis Of Binance Listing Impact

May 14, 2025

Moodengs All Time High Analysis Of Binance Listing Impact

May 14, 2025 -

Chegg Layoffs 22 Job Cuts As Ai Impacts Student Learning

May 14, 2025

Chegg Layoffs 22 Job Cuts As Ai Impacts Student Learning

May 14, 2025

Latest Posts

-

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025

Green Bay Packers 2025 Schedule Primetime Matchups And Key Dates Revealed

May 14, 2025 -

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025

Thai Virologists Warning Adapt Vaccination Strategy To Combat Covid 19 Surge

May 14, 2025 -

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025

Family Resemblance Lauren Sanchezs Daughter 17 And Siblings Striking Photos

May 14, 2025 -

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025

13 Year Old Among Three Investigated For Kpod Vape Related Offenses Hsa

May 14, 2025 -

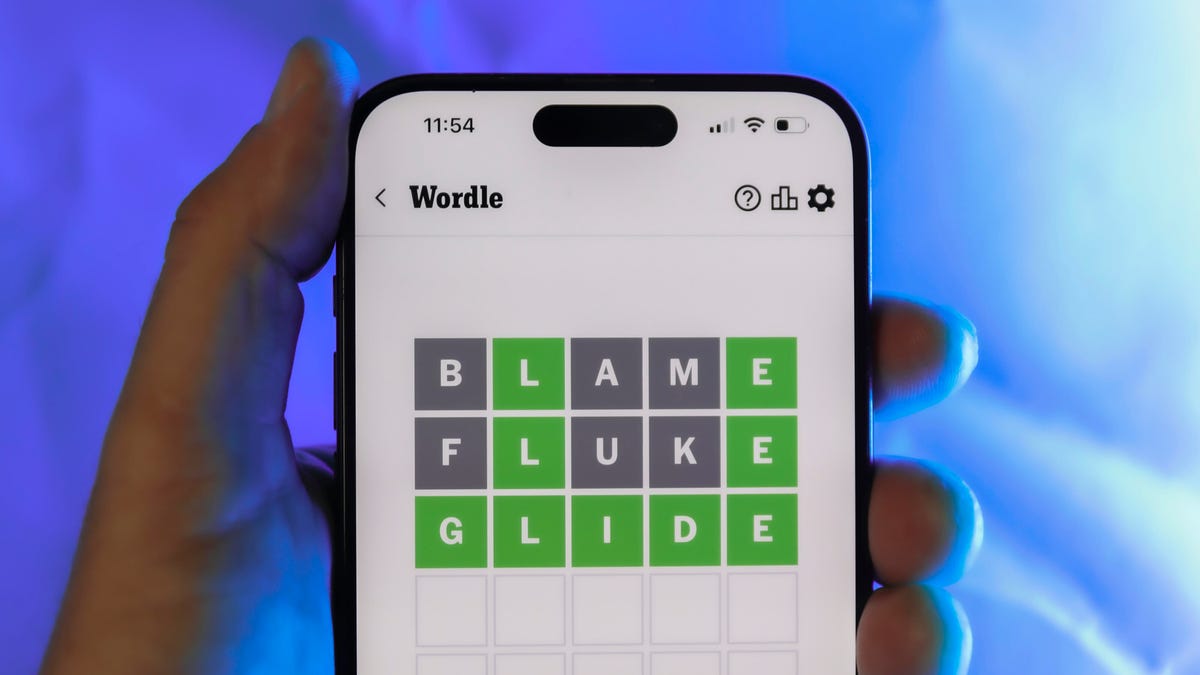

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025

Wordle 1425 For May 14 Clues Answer And Strategy Guide

May 14, 2025