Trading Hamster Kombat (HMSTR): Navigating Oversold Conditions And Potential Rebounds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trading Hamster Kombat (HMSTR): Navigating Oversold Conditions and Potential Rebounds

The cryptocurrency market is a rollercoaster, and Hamster Kombat (HMSTR) is no exception. Recently experiencing a significant downturn, many investors are wondering: is this the bottom, or is there further downside? Understanding oversold conditions and identifying potential rebound opportunities is crucial for navigating this volatile asset. This article will delve into the current state of HMSTR, analyzing technical indicators and exploring potential strategies for traders.

Understanding Hamster Kombat (HMSTR) and its Recent Volatility

Hamster Kombat, a meme coin with a playful aesthetic, has captivated the crypto community. While its inherent value is debatable, its price action is heavily influenced by market sentiment and social media trends. Recent negative news, combined with broader market corrections, has sent HMSTR prices plummeting. This volatility presents both significant risk and potentially lucrative reward for shrewd investors.

Identifying Oversold Conditions: Technical Analysis in Action

Several technical indicators suggest that HMSTR might be oversold. Analyzing these can help determine if the current price represents a buying opportunity.

-

Relative Strength Index (RSI): A commonly used momentum indicator, the RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI below 30 often signals an oversold market. Traders should look for RSI readings in this territory for potential entry points. However, it's crucial to note that RSI can remain below 30 for extended periods in bear markets.

-

Moving Average Convergence Divergence (MACD): The MACD compares two moving averages to identify changes in momentum. A bearish crossover (the fast moving average crossing below the slow moving average) followed by a divergence (price making lower lows while the MACD forms higher lows) can signal a potential reversal. Analyzing the MACD alongside the RSI provides a more comprehensive picture.

-

Stochastic Oscillator: Another momentum indicator, the stochastic oscillator measures the closing price relative to its price range over a given period. Similar to the RSI, readings below 20 often indicate an oversold condition.

Caution: Oversold Doesn't Automatically Mean Rebound

It's critical to understand that an oversold condition doesn't guarantee an immediate price rebound. The cryptocurrency market is influenced by many factors, including broader economic conditions, regulatory changes, and overall investor sentiment. A prolonged bear market can keep an asset in oversold territory for a considerable time.

Strategies for Navigating Oversold HMSTR

Traders considering entering HMSTR at these levels should employ risk management strategies:

-

Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals regardless of price helps mitigate risk. This strategy minimizes the impact of buying at a potentially unsustainable low.

-

Stop-Loss Orders: Setting a stop-loss order helps limit potential losses if the price continues to decline. This is a crucial risk management tool for any volatile asset like HMSTR.

-

Position Sizing: Only invest an amount you're comfortable losing. Never invest more than you can afford to lose in any single trade.

Conclusion: Proceed with Caution and Due Diligence

While technical indicators suggest HMSTR might be oversold, this isn't a guarantee of a price reversal. Thorough research, a solid understanding of technical analysis, and disciplined risk management are crucial for any trader considering entering the Hamster Kombat market. Remember, the cryptocurrency market is highly speculative, and past performance is not indicative of future results. Always conduct your own due diligence before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trading Hamster Kombat (HMSTR): Navigating Oversold Conditions And Potential Rebounds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

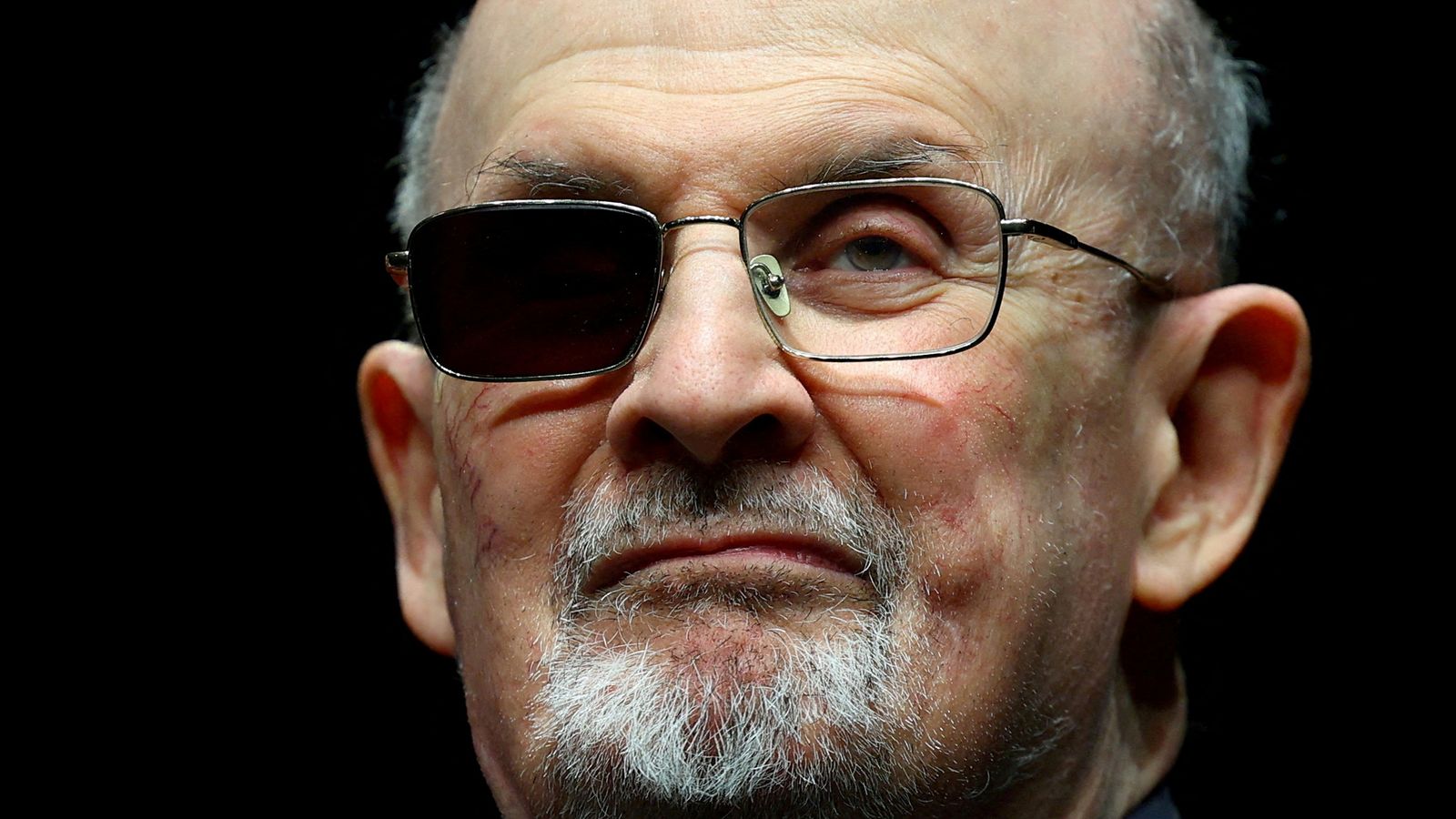

Hadi Matar Jailed For Stabbing Salman Rushdie Authors Injuries And Aftermath

May 17, 2025

Hadi Matar Jailed For Stabbing Salman Rushdie Authors Injuries And Aftermath

May 17, 2025 -

Tesco Outage Technical Issues Leave Shoppers Locked Out Of Online Accounts

May 17, 2025

Tesco Outage Technical Issues Leave Shoppers Locked Out Of Online Accounts

May 17, 2025 -

Queen Latifah Speaks Out Facing Obesity And Its Dangers

May 17, 2025

Queen Latifah Speaks Out Facing Obesity And Its Dangers

May 17, 2025 -

Verstappen Targets Nuerburgring Nordschleife After Impressing In Gt 3 Testing

May 17, 2025

Verstappen Targets Nuerburgring Nordschleife After Impressing In Gt 3 Testing

May 17, 2025 -

Novig Promo Code 2025 Claim Your Bonus Offer Now

May 17, 2025

Novig Promo Code 2025 Claim Your Bonus Offer Now

May 17, 2025