Transatlantic Tensions Rise: EU Challenges US Crypto Initiatives As Threat To Financial Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Transatlantic Tensions Rise: EU Challenges US Crypto Initiatives as Threat to Financial Stability

The transatlantic relationship is facing new strains as the European Union (EU) openly challenges the United States' approach to regulating cryptocurrencies, citing concerns over financial stability and potential regulatory arbitrage. This escalating conflict highlights a growing divergence in regulatory philosophies and could significantly impact the global cryptocurrency landscape.

The EU's concerns stem primarily from the perceived lack of a cohesive and robust regulatory framework in the US for digital assets. While the US has seen a flurry of activity from individual agencies like the SEC and the CFTC, critics argue this fragmented approach creates uncertainty and leaves significant loopholes, potentially undermining the EU's own ambitious regulatory plans like the Markets in Crypto-Assets (MiCA) regulation.

EU's MiCA: A Proactive Approach to Crypto Regulation

The MiCA regulation, set to come into effect in 2024, represents a significant step towards comprehensive crypto regulation within the EU. It aims to establish a clear legal framework for crypto assets, covering everything from licensing requirements for crypto service providers to consumer protection measures. This proactive stance, in contrast to the perceived inaction in the US, has fueled the growing tension.

US Crypto Initiatives: A Patchwork of Regulations?

The US approach to crypto regulation is often described as piecemeal and reactive. While agencies are actively pursuing enforcement actions against alleged fraud and unregistered securities offerings, a comprehensive, unified regulatory framework remains elusive. This lack of clarity, the EU argues, creates a breeding ground for regulatory arbitrage, where firms might choose to operate in less regulated jurisdictions like the US to avoid stricter EU rules.

The Core Concerns:

- Financial Stability: The EU fears that the lack of robust regulation in the US could lead to increased systemic risk, particularly if large-scale crypto failures occur. The interconnected nature of global financial markets means instability in one region can quickly spread.

- Regulatory Arbitrage: The EU worries that companies could exploit differences in regulatory standards between the US and the EU, undermining the integrity of the MiCA framework and creating an uneven playing field for European businesses.

- Data Privacy: Concerns exist over the potential for US crypto firms to collect and utilize sensitive European citizen data without adequate protection under EU privacy regulations like GDPR.

Potential Consequences of the Growing Divide:

This transatlantic rift could have far-reaching consequences:

- Market Fragmentation: Differing regulatory standards could lead to market fragmentation, hindering the development of a truly global cryptocurrency market.

- Reduced Innovation: Uncertainty and conflicting regulatory environments might stifle innovation within the crypto sector.

- Increased Regulatory Scrutiny: The EU’s stance could trigger further scrutiny of US crypto initiatives from other international bodies and potentially lead to international cooperation to establish global regulatory standards.

Looking Ahead:

The growing tension between the EU and US over crypto regulation highlights the urgent need for international cooperation to establish a globally consistent approach. Failure to do so could have significant repercussions for financial stability, market development, and innovation in the rapidly evolving cryptocurrency ecosystem. The coming months will be crucial in observing how these two major economic powers navigate this increasingly complex relationship. The future of global crypto regulation may depend on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Transatlantic Tensions Rise: EU Challenges US Crypto Initiatives As Threat To Financial Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pending Free Agents Status Latest News On Notable Patriot

Mar 13, 2025

Pending Free Agents Status Latest News On Notable Patriot

Mar 13, 2025 -

Really Bad Simeone Dissects Atleticos Loss Against Getafe

Mar 13, 2025

Really Bad Simeone Dissects Atleticos Loss Against Getafe

Mar 13, 2025 -

Irish Premiership Highlights Tuesdays Matches Text Commentary And Video Clips

Mar 13, 2025

Irish Premiership Highlights Tuesdays Matches Text Commentary And Video Clips

Mar 13, 2025 -

Mc Coist Missed Rangers Appointment And The Gerrard Comparison

Mar 13, 2025

Mc Coist Missed Rangers Appointment And The Gerrard Comparison

Mar 13, 2025 -

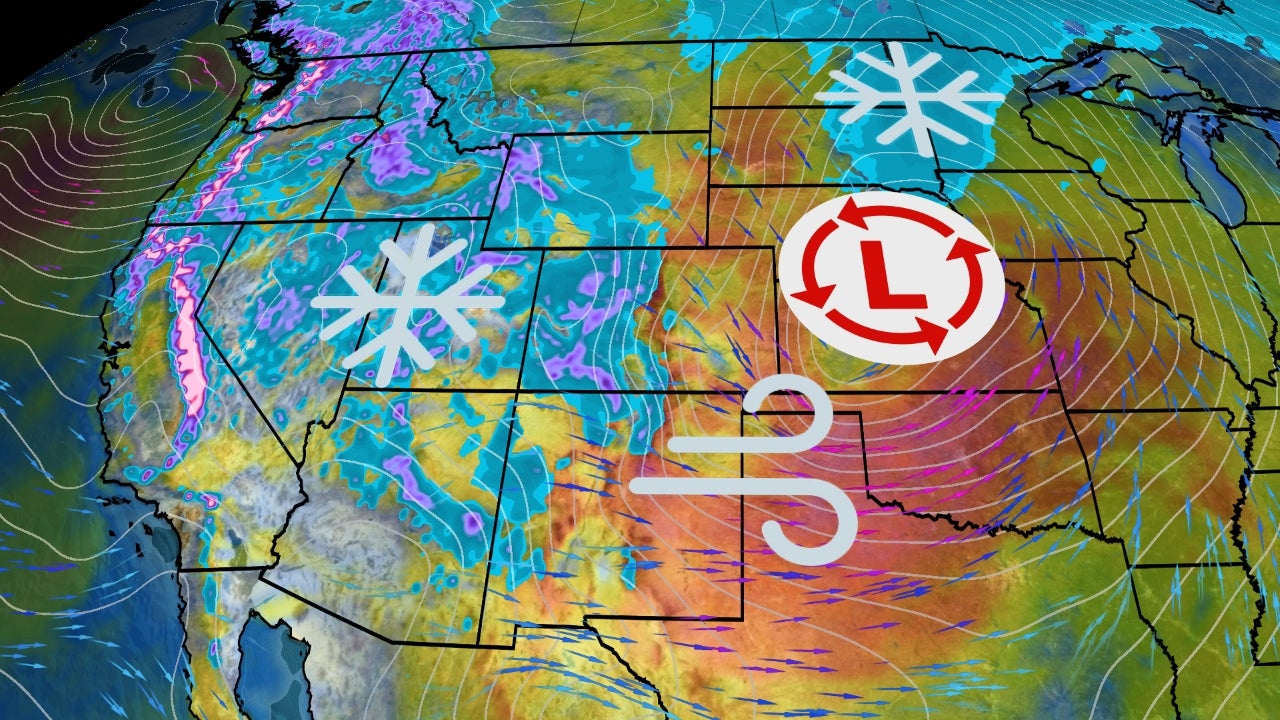

Blizzard Warning Powerful Winter Storm Impacts Plains States

Mar 13, 2025

Blizzard Warning Powerful Winter Storm Impacts Plains States

Mar 13, 2025