Treasurer Fuels Rate Cut Speculation Amidst Dutton's Coalition Warning

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Treasurer Fuels Rate Cut Speculation Amidst Dutton's Coalition Warning

Australia's economic landscape is facing a period of intense uncertainty, with Treasurer Jim Chalmers' recent comments sparking fresh speculation about potential interest rate cuts, even as Deputy Prime Minister Dutton issues a stark warning to the government.

The Australian dollar dipped slightly following Chalmers' carefully worded statements on the current economic climate. While stopping short of explicitly endorsing a rate cut by the Reserve Bank of Australia (RBA), his comments hinted at a softening in the previously hawkish stance on inflation. He highlighted recent positive economic indicators, including a slight easing in inflation and robust employment figures, fueling speculation amongst economists and analysts.

This development comes amidst growing political tension. Deputy Prime Minister Peter Dutton has issued a strong warning to the Labor government, emphasizing the potential risks of prematurely cutting interest rates and the need for fiscal responsibility. Dutton's comments highlight the delicate balancing act the government faces, navigating the pressures of a slowing economy while managing public expectations and maintaining political stability.

Chalmers Walks a Tightrope:

The Treasurer’s approach can be interpreted as a strategic move to manage public perception. By acknowledging positive economic signals while avoiding explicit endorsement of a rate cut, he attempts to alleviate public anxiety without overtly contradicting the RBA's independence. This careful dance highlights the complex relationship between the government and the central bank, a relationship crucial for maintaining economic stability.

- Positive Economic Signals: Chalmers pointed towards a decline in inflation, albeit marginal, coupled with a resilient job market, as reasons for cautious optimism.

- RBA Independence: He stressed the government's commitment to the RBA's autonomy in setting monetary policy, emphasizing that any decisions regarding interest rates remain solely within the RBA's purview.

- Fiscal Responsibility: While hinting at potential economic easing, Chalmers reiterated the government's dedication to responsible fiscal management, acknowledging the need for sustained economic growth.

Dutton's Cautious Approach:

In contrast to Chalmers' measured optimism, Dutton's warnings paint a more cautious picture. He voiced concerns about the potential consequences of premature interest rate cuts, emphasizing the potential for reigniting inflationary pressures and jeopardizing the nation’s economic recovery. His comments serve as a crucial counterpoint, highlighting the divisions within the political landscape on the optimal economic strategy.

Market Reactions and Expert Opinions:

The Australian share market showed a mixed reaction to the news, with some sectors performing better than others. Economists remain divided, with some suggesting that the current economic data warrants a rate cut, while others advocate for a more cautious approach, citing the persistence of underlying inflationary pressures. The uncertainty surrounding the RBA's next move is likely to keep market volatility high in the coming weeks.

Looking Ahead:

The coming weeks will be crucial in determining the direction of Australian monetary policy. The RBA's next meeting will be closely scrutinized, with investors and the public eagerly awaiting their decision. The interplay between political pronouncements and economic indicators will continue to shape the narrative, highlighting the complex interplay between politics, economics, and market sentiment in Australia. The ongoing debate emphasizes the need for informed discussion and clear communication on the path to sustainable economic growth.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Treasurer Fuels Rate Cut Speculation Amidst Dutton's Coalition Warning. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Diabys Post Match Reflection Al Ittihads Draw And The Take A Point Strategy

Apr 07, 2025

Diabys Post Match Reflection Al Ittihads Draw And The Take A Point Strategy

Apr 07, 2025 -

Stadium Rules And Green Initiatives Navigating The Conflict

Apr 07, 2025

Stadium Rules And Green Initiatives Navigating The Conflict

Apr 07, 2025 -

50 Arm Based Compute By 2025 The Shifting Sands Of The Hyperscaler Market

Apr 07, 2025

50 Arm Based Compute By 2025 The Shifting Sands Of The Hyperscaler Market

Apr 07, 2025 -

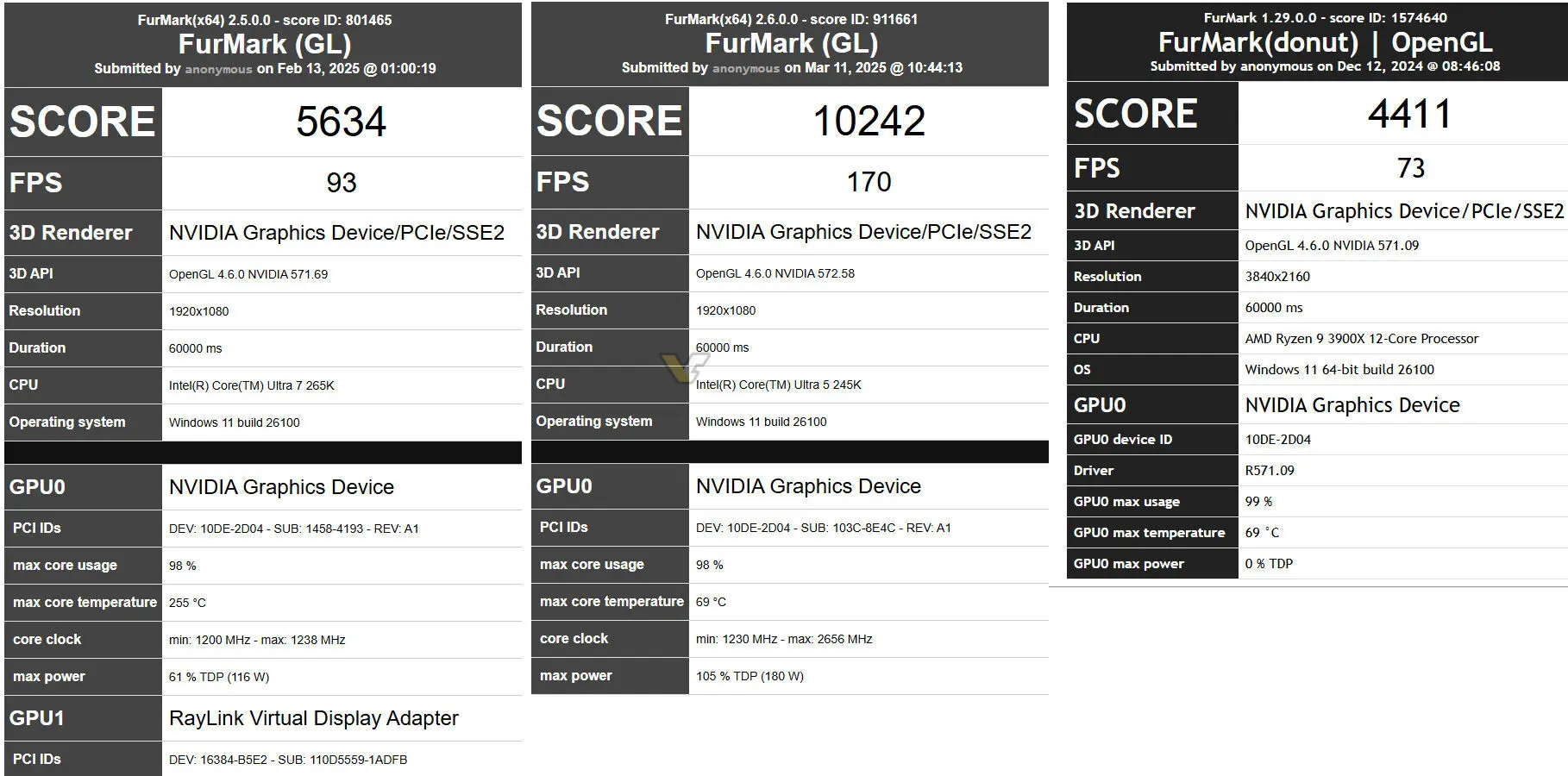

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Performance Data Unveiled

Apr 07, 2025

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Performance Data Unveiled

Apr 07, 2025 -

Ahl Hockey Cayden Primeau Leads Rocket To Overtime Point Against Canucks

Apr 07, 2025

Ahl Hockey Cayden Primeau Leads Rocket To Overtime Point Against Canucks

Apr 07, 2025