Treasury Yield Increase, Stock Market Decline: US Fiscal Uncertainty Bites

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Treasury Yield Increase, Stock Market Decline: US Fiscal Uncertainty Bites

The US stock market experienced a significant downturn this week, mirroring a sharp increase in Treasury yields. This correlated decline points to growing investor anxieties surrounding the nation's fiscal outlook and the potential for higher interest rates. The uncertainty surrounding the debt ceiling debate and ongoing budget negotiations are key drivers behind this market volatility.

The Debt Ceiling Looms Large: The impending deadline to raise the debt ceiling continues to cast a long shadow over financial markets. Failure to reach an agreement could lead to a US default, a catastrophic event with potentially devastating global economic consequences. This looming possibility is fueling risk aversion among investors, prompting them to move funds into safer havens like Treasury bonds, thus increasing their yield.

Higher Yields, Lower Stock Prices: A Classic Correlation

The rise in Treasury yields is directly impacting the stock market. Higher yields make bonds more attractive, diverting investment capital away from equities. This shift in investor sentiment contributes to lower stock valuations and increased market volatility. Furthermore, higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and dampening corporate earnings expectations.

Inflation Concerns Persist: While inflation has cooled somewhat, it remains stubbornly above the Federal Reserve's target rate. This persistent inflation fuels expectations of further interest rate hikes by the Fed, adding another layer of uncertainty for investors. The interplay between inflation, interest rates, and the debt ceiling debate creates a complex and volatile economic landscape.

What Does This Mean for Investors?

The current market conditions present a challenging environment for investors. Here are some key considerations:

- Diversification is Key: A well-diversified portfolio can help mitigate risks associated with market volatility. Spreading investments across different asset classes can help cushion the blow of potential losses in any single sector.

- Risk Assessment is Crucial: Investors should carefully assess their risk tolerance and adjust their investment strategies accordingly. The current environment calls for a cautious approach, with a focus on preserving capital.

- Stay Informed: Keeping abreast of economic developments and policy decisions is crucial for making informed investment choices. Reliable news sources and financial analysis can provide valuable insights into market trends and potential risks.

Looking Ahead: Uncertain Times

The coming weeks will be critical in determining the trajectory of the US economy and financial markets. The resolution (or lack thereof) of the debt ceiling debate will significantly influence investor sentiment and market behavior. While the current situation presents challenges, it also presents opportunities for shrewd investors who can navigate the uncertainty and adapt their strategies accordingly.

Keywords: Treasury yields, stock market decline, US fiscal uncertainty, debt ceiling, interest rates, inflation, Federal Reserve, investment strategies, market volatility, economic outlook, risk assessment, diversification.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Treasury Yield Increase, Stock Market Decline: US Fiscal Uncertainty Bites. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba Playoffs 2024 Breaking Down The Knicks Pacers And Wolves Thunder Showdowns

May 23, 2025

Nba Playoffs 2024 Breaking Down The Knicks Pacers And Wolves Thunder Showdowns

May 23, 2025 -

11 Knicks Legends A Historical Ranking Of New Yorks Basketball Icons

May 23, 2025

11 Knicks Legends A Historical Ranking Of New Yorks Basketball Icons

May 23, 2025 -

Dells Ceo Ai Our New Tools For A More Efficient Species

May 23, 2025

Dells Ceo Ai Our New Tools For A More Efficient Species

May 23, 2025 -

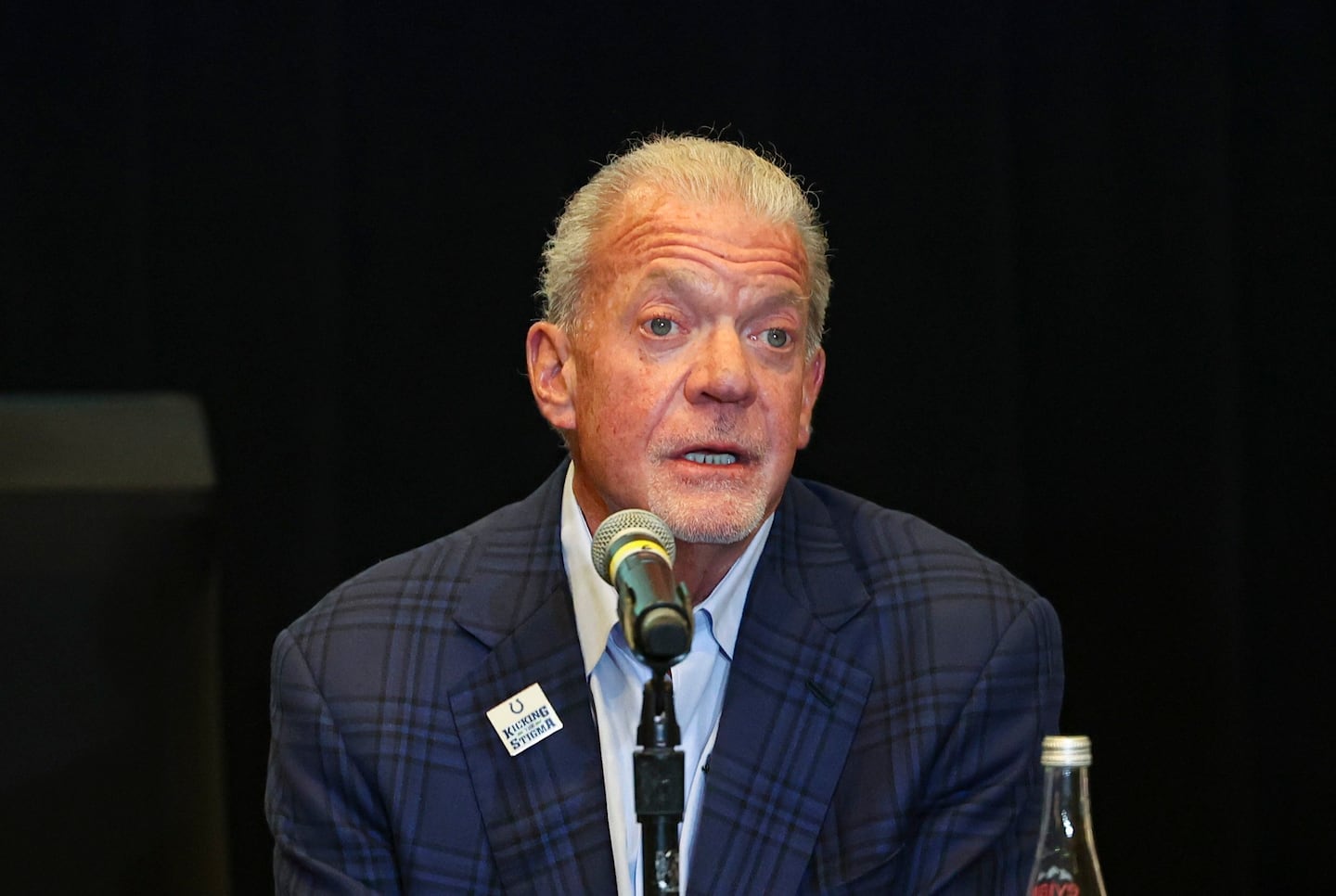

Jim Irsay 1957 2023 A Remembrance Of The Indianapolis Colts Owner

May 23, 2025

Jim Irsay 1957 2023 A Remembrance Of The Indianapolis Colts Owner

May 23, 2025 -

Trumps Qatari Jet Security And Ethical Concerns Raised Over Luxurious Gift

May 23, 2025

Trumps Qatari Jet Security And Ethical Concerns Raised Over Luxurious Gift

May 23, 2025

Latest Posts

-

El Salvadors Bitcoin Law A Case Study In Cryptocurrency Adoption And Its Limitations For The Us

May 23, 2025

El Salvadors Bitcoin Law A Case Study In Cryptocurrency Adoption And Its Limitations For The Us

May 23, 2025 -

Game Of Thrones Kingsroad Challenge Difficulty Levels And Player Experiences

May 23, 2025

Game Of Thrones Kingsroad Challenge Difficulty Levels And Player Experiences

May 23, 2025 -

Octopus Energys Ceo On China Building Key Partnerships For Future Success

May 23, 2025

Octopus Energys Ceo On China Building Key Partnerships For Future Success

May 23, 2025 -

Idris Elba And Jeremy Renners Zombie Thriller Coming To Hulu

May 23, 2025

Idris Elba And Jeremy Renners Zombie Thriller Coming To Hulu

May 23, 2025 -

Long Standing Martin Place Food Charity Displaced By Vivid Sydney

May 23, 2025

Long Standing Martin Place Food Charity Displaced By Vivid Sydney

May 23, 2025