Treasury Yield Surge Triggers Stock Market Rout: Dow, S&P 500, Nasdaq Fall Sharply

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Treasury Yield Surge Triggers Stock Market Rout: Dow, S&P 500, Nasdaq Fall Sharply

The stock market experienced a significant downturn on Tuesday, with the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all falling sharply. This dramatic market correction was primarily triggered by a surge in Treasury yields, signaling growing concerns about inflation and the Federal Reserve's monetary policy.

The 10-year Treasury yield, a key benchmark for interest rates, climbed to its highest level in several months, exceeding [Insert actual yield percentage here]. This increase reflects investor anxieties about persistent inflation and the potential for further interest rate hikes by the Federal Reserve. Higher yields make borrowing more expensive for companies, impacting profitability and potentially slowing economic growth. This, in turn, puts downward pressure on stock valuations.

Understanding the Connection: Treasury Yields and Stock Prices

The inverse relationship between Treasury yields and stock prices is a crucial element in understanding Tuesday's market turmoil. When Treasury yields rise, investors often shift their investments from riskier assets like stocks to safer, higher-yielding bonds. This capital outflow from the stock market leads to decreased demand and subsequently lower stock prices.

Several factors contributed to this recent surge in Treasury yields:

- Persistent Inflation: Stubbornly high inflation figures continue to fuel concerns about the Fed's ability to control price increases. The market is pricing in the likelihood of further interest rate increases to combat inflation.

- Stronger-than-Expected Economic Data: Recent economic data, including [cite specific economic data reports], has exceeded expectations, reinforcing the narrative of a resilient economy that may necessitate more aggressive monetary tightening by the Fed.

- Geopolitical Uncertainty: Ongoing geopolitical tensions, such as the war in Ukraine and rising tensions in [mention relevant geopolitical hotspots], also contribute to investor uncertainty, driving demand for safer assets like government bonds.

Market Impact: A Day of Significant Losses

The impact on major indices was substantial:

- Dow Jones Industrial Average: Experienced a decline of [Insert percentage and points here].

- S&P 500: Suffered a drop of [Insert percentage and points here].

- Nasdaq Composite: Fell by [Insert percentage and points here].

This widespread sell-off impacted various sectors, with technology stocks, typically sensitive to interest rate changes, experiencing some of the most significant losses.

What's Next for the Market?

The market's reaction to the Treasury yield surge highlights the ongoing uncertainty surrounding inflation and the Fed's policy trajectory. Analysts are divided on the market's future direction. Some predict further declines as investors grapple with the implications of higher interest rates, while others anticipate a potential rebound based on [mention supporting arguments, e.g., strong corporate earnings].

Investors are closely monitoring upcoming economic data releases and Federal Reserve announcements for clues about the future direction of interest rates and the overall economic outlook. The volatility in the market underscores the importance of a well-diversified investment strategy and careful risk management.

Keywords: Treasury Yields, Stock Market, Stock Market Crash, Dow Jones, S&P 500, Nasdaq, Interest Rates, Federal Reserve, Inflation, Economic Data, Market Volatility, Investment Strategy, Risk Management.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Treasury Yield Surge Triggers Stock Market Rout: Dow, S&P 500, Nasdaq Fall Sharply. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

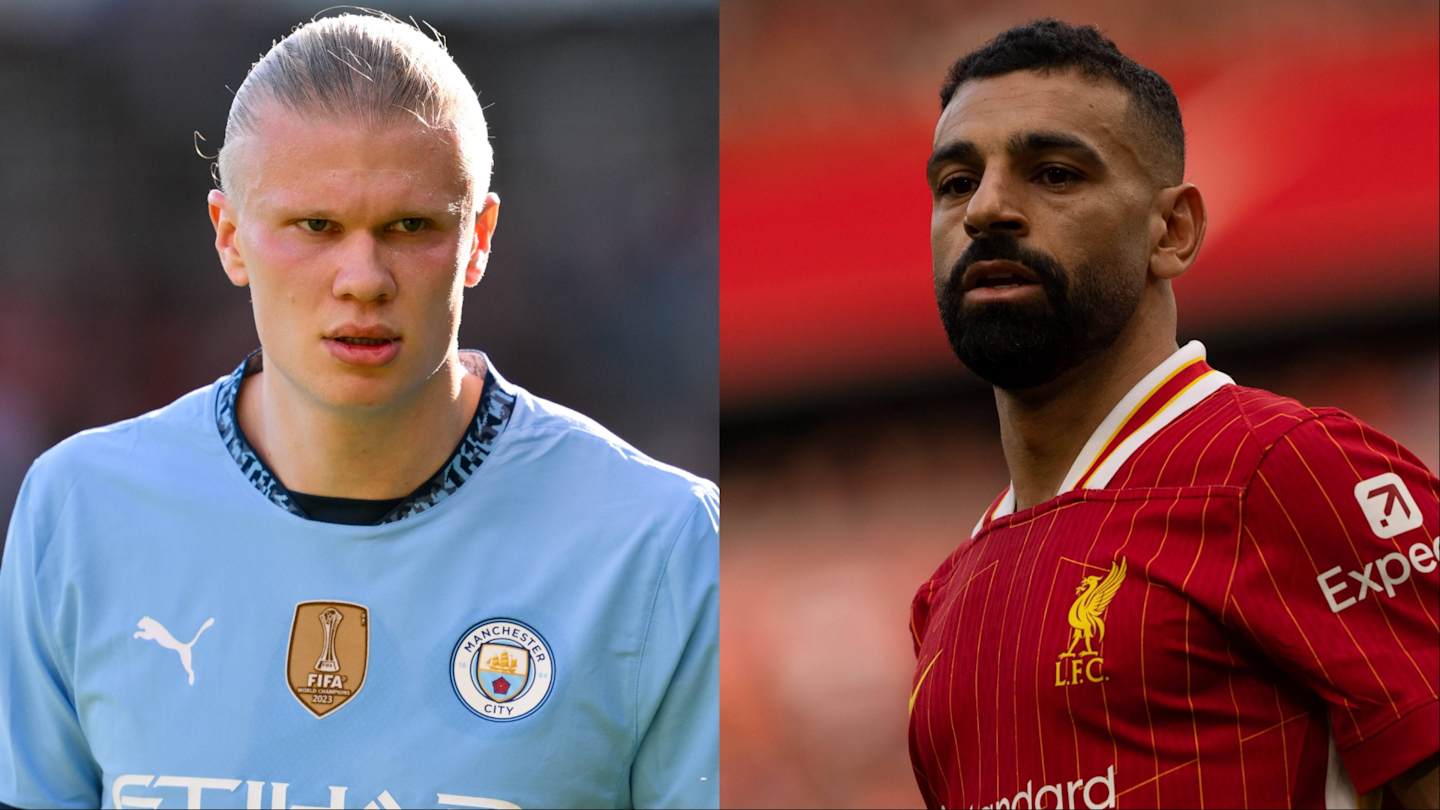

Premier League Top Scorers 2023 24 Golden Boot Battle Heats Up

May 22, 2025

Premier League Top Scorers 2023 24 Golden Boot Battle Heats Up

May 22, 2025 -

Bch Price Stabilizes Following 16 Jump Analysis And Outlook

May 22, 2025

Bch Price Stabilizes Following 16 Jump Analysis And Outlook

May 22, 2025 -

Xrp Dominance And A 40 T Crypto Market Whats The Potential Price

May 22, 2025

Xrp Dominance And A 40 T Crypto Market Whats The Potential Price

May 22, 2025 -

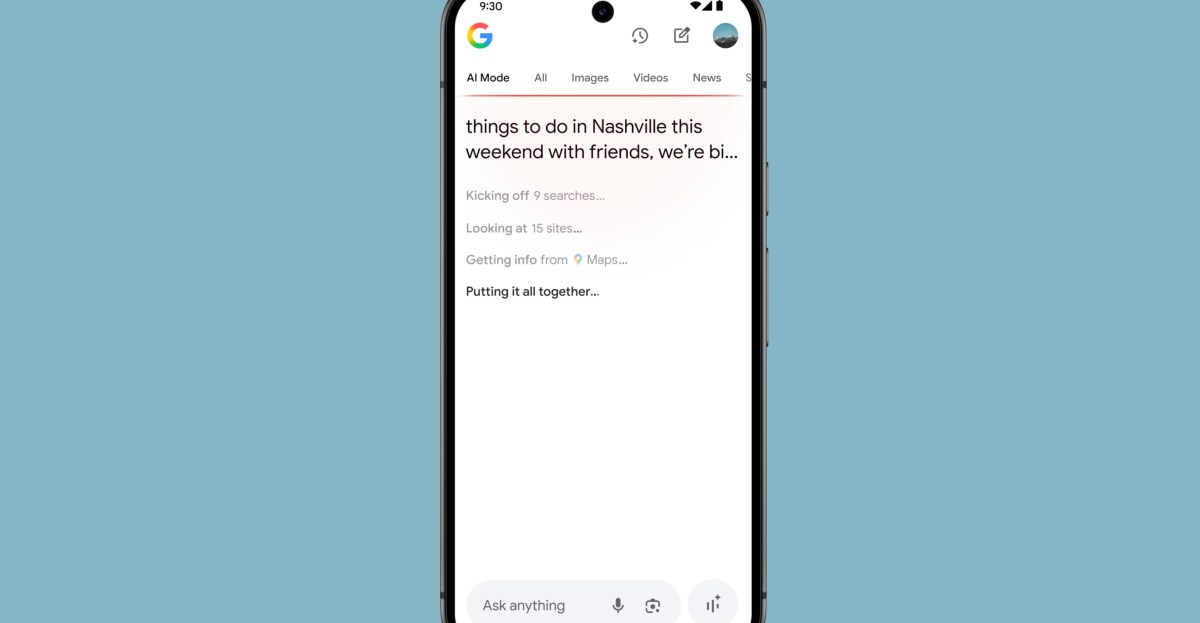

Is Ai Mode The Future Of Google Search Exploring The Implications

May 22, 2025

Is Ai Mode The Future Of Google Search Exploring The Implications

May 22, 2025 -

Haliburton Pacers Shock Knicks In Game 1 Thriller Eastern Conference Finals Upset

May 22, 2025

Haliburton Pacers Shock Knicks In Game 1 Thriller Eastern Conference Finals Upset

May 22, 2025