Trump Family's USD1 Stablecoin: Central To Abu Dhabi's Binance Investment?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Family's USD1 Stablecoin: A Central Piece in Abu Dhabi's Binance Investment?

The whispers are growing louder: A potential connection between a rumored Trump family-backed USD1 stablecoin and Abu Dhabi's significant investment in Binance is sparking intense speculation within the cryptocurrency and political spheres. While neither the Trump organization nor Binance has publicly confirmed any direct involvement, the circumstantial evidence is fueling a firestorm of debate. This article delves into the swirling rumors, examining the potential implications of such a partnership and the regulatory hurdles it might face.

The USD1 Stablecoin: Fact or Fiction?

Rumors of a Trump-affiliated stablecoin, tentatively called "USD1," have circulated for months. The purported stablecoin aims to offer a dollar-pegged digital asset, potentially leveraging the Trump family's brand recognition and influence. However, concrete details remain scarce. No official announcements or whitepapers have been released, leaving many to question the project's legitimacy and its true backers. The lack of transparency fuels skepticism, with critics questioning the potential for market manipulation and regulatory compliance issues.

Abu Dhabi's Strategic Binance Investment:

Abu Dhabi's recent substantial investment in Binance, the world's largest cryptocurrency exchange by trading volume, represents a significant step towards legitimizing the cryptocurrency sector within the region. This investment signals a growing acceptance of digital assets and blockchain technology among major global players. However, the exact terms of the investment remain confidential, adding to the intrigue surrounding the potential link to the rumored Trump stablecoin.

Connecting the Dots: Speculation and Implications

The connection between the rumored Trump stablecoin and Abu Dhabi's Binance investment is purely speculative at this point. However, the timing and potential financial benefits create a compelling narrative. Several theories propose that:

- A Strategic Partnership: Abu Dhabi's investment might be strategically linked to the Trump stablecoin project, potentially providing crucial capital and market access. This would allow USD1 to leverage Binance's established infrastructure and global reach, significantly accelerating its adoption.

- Political Influence: The Trump family's name carries significant political weight, potentially influencing regulatory decisions and market sentiment. A successful stablecoin could further enhance the Trump brand's value in the burgeoning digital asset market.

- Diversification and Risk Mitigation: For Abu Dhabi, investing in a stablecoin alongside Binance diversifies its cryptocurrency portfolio, reducing reliance on volatile assets like Bitcoin and Ethereum. A stablecoin provides a more predictable investment with lower risk.

Regulatory Challenges and Concerns:

Any potential partnership between a Trump-affiliated stablecoin and a major exchange like Binance faces considerable regulatory scrutiny. Stablecoin regulation is still in its nascent stages globally, with authorities grappling with issues such as:

- Reserve Transparency: Ensuring sufficient backing for the stablecoin's peg to the US dollar is paramount. Lack of transparency in reserve management could lead to significant risks for investors.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance: Strict adherence to AML/KYC regulations is essential to prevent illicit activities.

- Market Manipulation: The potential for manipulation of the stablecoin's price is a significant concern, requiring stringent oversight and regulatory frameworks.

Conclusion: A Waiting Game

The rumored connection between the Trump family's USD1 stablecoin and Abu Dhabi's Binance investment remains a subject of intense speculation. The lack of official confirmation leaves room for various interpretations. However, the potential implications are significant, impacting the cryptocurrency market, international geopolitics, and regulatory frameworks. Only time will tell if these rumors hold any truth and what the long-term consequences may be. Further investigation and official statements are crucial to clarify the situation and address the numerous uncertainties surrounding this developing story. We will continue to monitor this situation closely and provide updates as they become available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Family's USD1 Stablecoin: Central To Abu Dhabi's Binance Investment?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ukraine War Update United States Announces New Sanctions Package Against Russia

May 03, 2025

Ukraine War Update United States Announces New Sanctions Package Against Russia

May 03, 2025 -

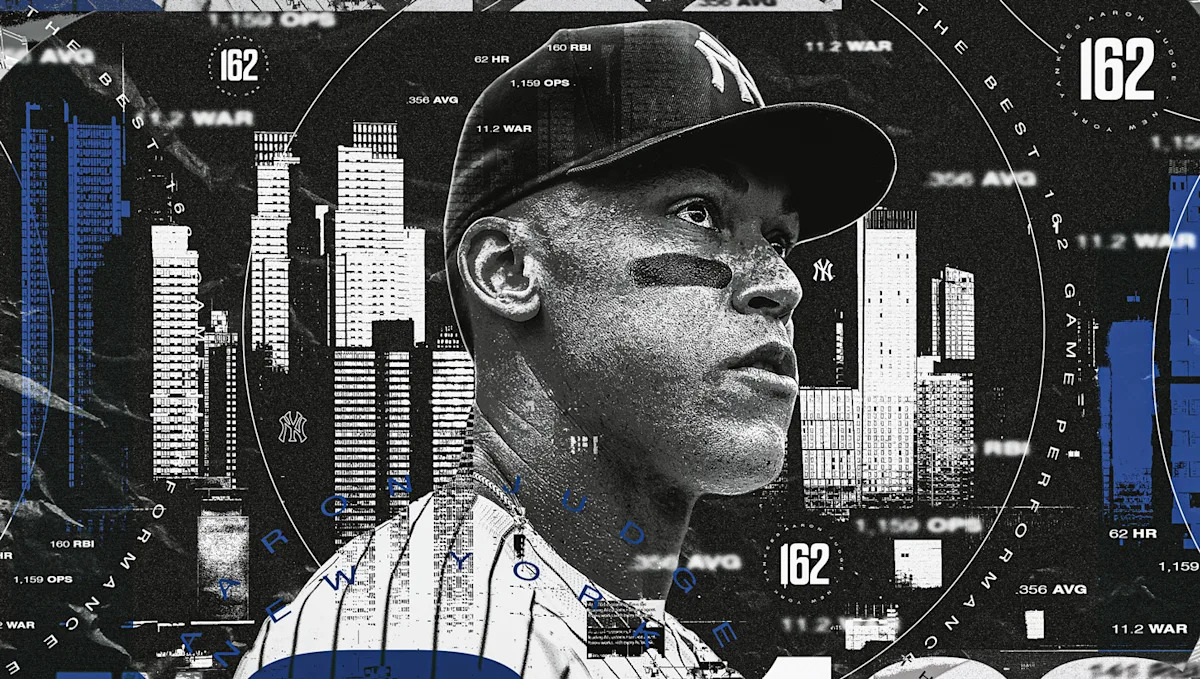

Beyond The Numbers Understanding Aaron Judges 2023 Mlb Year

May 03, 2025

Beyond The Numbers Understanding Aaron Judges 2023 Mlb Year

May 03, 2025 -

Impacto Da Economia Chinesa No Brasil Analise Da Semana Copom Ipca E Setor Industrial

May 03, 2025

Impacto Da Economia Chinesa No Brasil Analise Da Semana Copom Ipca E Setor Industrial

May 03, 2025 -

Understanding Obesity Rates In Minoritized Ethnic Groups A Comprehensive Overview

May 03, 2025

Understanding Obesity Rates In Minoritized Ethnic Groups A Comprehensive Overview

May 03, 2025 -

Balancing Act Australias Response To Shifting Global Power Dynamics China And Us

May 03, 2025

Balancing Act Australias Response To Shifting Global Power Dynamics China And Us

May 03, 2025

Latest Posts

-

Westbrooks Historic Performance Clippers Nuggets Game Highlights

May 04, 2025

Westbrooks Historic Performance Clippers Nuggets Game Highlights

May 04, 2025 -

Can The Dallas Stars Overcome The Avalanche Without Their Star Defenseman

May 04, 2025

Can The Dallas Stars Overcome The Avalanche Without Their Star Defenseman

May 04, 2025 -

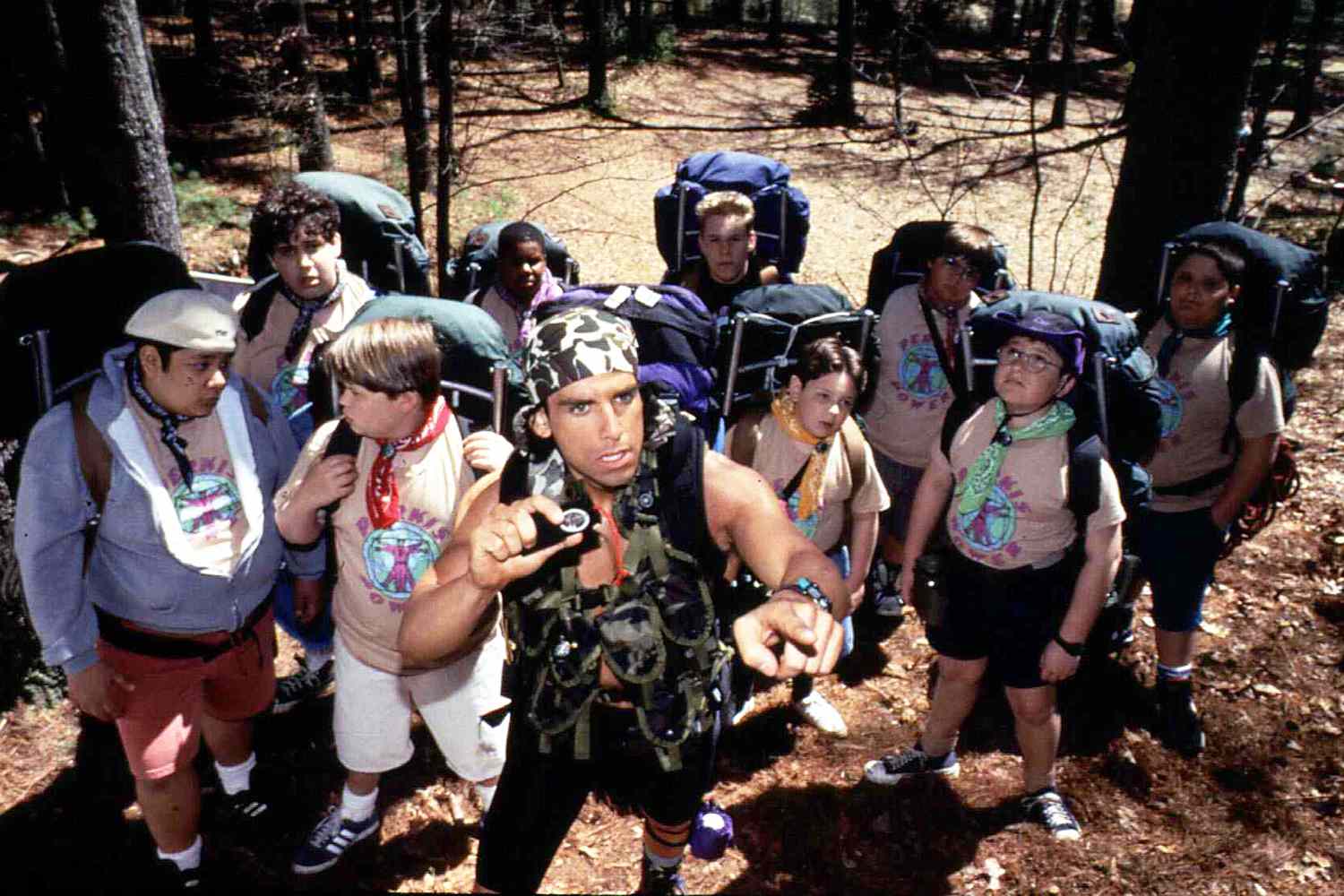

Very Scary Shaun Weiss Recalls Ben Stillers Directing Style On Heavyweights

May 04, 2025

Very Scary Shaun Weiss Recalls Ben Stillers Directing Style On Heavyweights

May 04, 2025 -

Seven Months Later Marc Andre Ter Stegens Long Awaited Barcelona Comeback

May 04, 2025

Seven Months Later Marc Andre Ter Stegens Long Awaited Barcelona Comeback

May 04, 2025 -

Yana Santos Targets Miesha Tate Ufc Des Moines Showdown To Seal Her Place

May 04, 2025

Yana Santos Targets Miesha Tate Ufc Des Moines Showdown To Seal Her Place

May 04, 2025