Trump Stock Faces Resistance: Crucial May 22 Dinner Could Trigger Market Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Stock Faces Resistance: Crucial May 22 Dinner Could Trigger Market Decline

A looming dinner meeting and persistent legal challenges are casting a shadow over the performance of stocks associated with Donald Trump. Investors are watching closely as the former president faces mounting pressure on multiple fronts, potentially impacting the market value of companies linked to his brand and ventures.

The upcoming dinner on May 22nd has become a focal point for market analysts. While details remain scarce, the potential for negative headlines stemming from this event is fueling concerns among investors already wary of the Trump-related investment landscape. The perceived risk is substantial enough to prompt many to consider hedging their positions or even divesting entirely.

Why is the May 22nd Dinner So Important?

The significance of the May 22nd dinner lies in its potential to generate further negative publicity for Trump and his businesses. Any association with controversial figures or policies could trigger a sell-off in Trump-related stocks. This risk is amplified by the current political climate and the ongoing legal battles facing the former president.

- Increased Legal Scrutiny: The escalating legal challenges against Trump are a major factor influencing investor sentiment. Ongoing investigations and potential indictments create uncertainty, making investments in Trump-branded companies appear increasingly risky. This uncertainty is a key driver of market volatility.

- Brand Reputation: The Trump brand itself remains a subject of intense debate and polarization. Any negative news, regardless of its veracity, can negatively impact consumer perception and ultimately affect the profitability of related businesses. Maintaining a positive brand image is crucial for long-term success, and recent events are challenging this.

- Economic Headwinds: The broader economic climate also plays a role. Inflationary pressures and rising interest rates create a challenging environment for all investments, making riskier ventures, such as those linked to Trump, even less attractive.

What Stocks Are Affected?

While pinpointing specific stocks solely tied to Trump can be complex, several publicly traded companies have demonstrable links to his businesses or brand that are likely experiencing volatility. Investors should carefully scrutinize holdings associated with real estate, hospitality, and media ventures that have previously benefited from, or are perceived to benefit from, Trump's influence. Conducting thorough due diligence before making any investment decisions is paramount.

What Should Investors Do?

Given the current uncertainties, investors should exercise caution. A conservative approach is recommended.

- Diversification: Diversifying your portfolio is crucial to mitigate risk. Don't concentrate your investments in assets heavily reliant on a single individual or brand.

- Risk Assessment: Thoroughly assess the risk profile of any Trump-related investment before committing capital. Consider the potential for both upside and downside scenarios.

- Stay Informed: Keep abreast of developments through reliable news sources and financial analysis. Informed decision-making is critical in volatile markets.

The Future of "Trump Stocks"

The future performance of stocks connected to Donald Trump remains uncertain. The May 22nd dinner could be a pivotal event, potentially exacerbating existing market anxieties. Investors should approach these assets with a keen awareness of the considerable risks involved and prepare for potential volatility in the coming weeks and months. The current situation underscores the importance of diligent research and a well-diversified investment strategy in today's dynamic market landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Stock Faces Resistance: Crucial May 22 Dinner Could Trigger Market Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tesla Unveils Progress On Robotaxi Optimus Humanoid Robot And Dojo 2 Ai Training

May 21, 2025

Tesla Unveils Progress On Robotaxi Optimus Humanoid Robot And Dojo 2 Ai Training

May 21, 2025 -

Tigers And Galvin In Discussions Immediate Release On The Cards

May 21, 2025

Tigers And Galvin In Discussions Immediate Release On The Cards

May 21, 2025 -

New Allegation Actress Claims Harvey Weinstein Used Medication Before Assault

May 21, 2025

New Allegation Actress Claims Harvey Weinstein Used Medication Before Assault

May 21, 2025 -

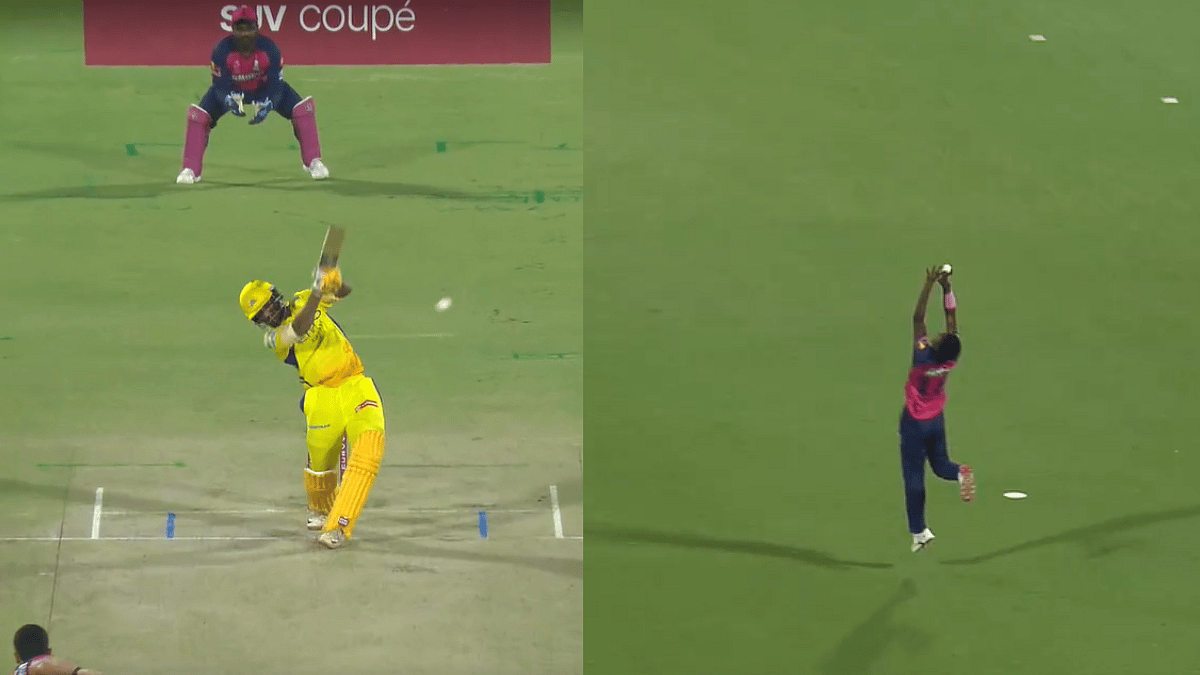

Spectactular Catch Maphaka Dismisses Patel In Thrilling Csk Vs Rr Ipl 2025 Encounter

May 21, 2025

Spectactular Catch Maphaka Dismisses Patel In Thrilling Csk Vs Rr Ipl 2025 Encounter

May 21, 2025 -

Caitlin Clarks Indiana Fever Vs Atlanta Dream Free Game Streaming Guide

May 21, 2025

Caitlin Clarks Indiana Fever Vs Atlanta Dream Free Game Streaming Guide

May 21, 2025