Trump Tariffs And The Australian Economy: Is The RBA's May Wait A Gamble?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tariffs and the Australian Economy: Is the RBA's May Wait a Gamble?

The Reserve Bank of Australia (RBA) held interest rates steady in May 2023, a decision that has sparked debate amidst lingering uncertainty surrounding the impact of past Trump-era tariffs on the Australian economy. While inflation remains a concern, the RBA's cautious approach suggests a calculated gamble, balancing the need for economic stability against potential future shocks. This article delves into the complex interplay between Trump's trade policies, Australia's economic vulnerabilities, and the RBA's strategic decision.

The Lingering Shadow of Trump's Tariffs:

Donald Trump's presidency saw a significant escalation of trade tensions, particularly with China. Australia, heavily reliant on trade with both the US and China, found itself navigating a turbulent global landscape. While some of the tariffs imposed during this period have since been altered or removed, their lingering effects on Australian export sectors, such as agriculture and resources, continue to impact the economy. The uncertainty created by these trade disputes contributed to a period of economic volatility, impacting investment decisions and consumer confidence. This volatility remains a factor considered by the RBA.

Analyzing the RBA's May Decision:

The RBA's decision to hold interest rates in May was met with mixed reactions. Some economists argued that the inflation rate warranted a further increase, citing concerns about rising cost of living. Others praised the cautious approach, emphasizing the need to assess the full impact of past economic shocks and global uncertainties before enacting further monetary policy changes. The RBA's statement highlighted a need for a measured approach, recognizing the potential for future economic challenges.

Key Factors Influencing the RBA's Strategy:

Several key factors influenced the RBA’s decision to wait:

- Global Economic Uncertainty: The ongoing war in Ukraine, persistent global supply chain issues, and the still-unfolding consequences of the pandemic all contribute to a complex and unpredictable global economic environment.

- Inflationary Pressures: While inflation remains a significant concern, the RBA acknowledged signs of easing price pressures, suggesting that aggressive rate hikes might not be necessary at this juncture.

- Impact on the Housing Market: Further interest rate increases could further dampen the already cooling Australian housing market, potentially leading to a sharper economic slowdown.

- Trade Relations with China: The ongoing complexities in the relationship between Australia and China, while not directly linked to Trump's tariffs, remain a significant factor impacting the Australian economy and the RBA's decision-making process.

The Gamble Ahead:

The RBA’s decision represents a calculated gamble. Maintaining stable interest rates in the face of inflationary pressures risks further inflation. However, a premature increase could trigger a sharper economic downturn. The RBA is clearly prioritizing a balanced approach, carefully monitoring incoming data to assess the optimal path forward. The success of this strategy hinges on several factors, including the evolution of global trade relations, the trajectory of inflation, and the resilience of the Australian economy.

Looking Forward:

The coming months will be crucial in determining whether the RBA’s gamble pays off. Close monitoring of inflation, consumer spending, and the broader global economic climate will be essential in guiding future monetary policy decisions. The lingering effects of Trump's trade policies, coupled with other global uncertainties, mean the Australian economy continues to navigate a complex and challenging landscape. The RBA's ability to effectively manage this uncertainty will be key to Australia's future economic stability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tariffs And The Australian Economy: Is The RBA's May Wait A Gamble?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

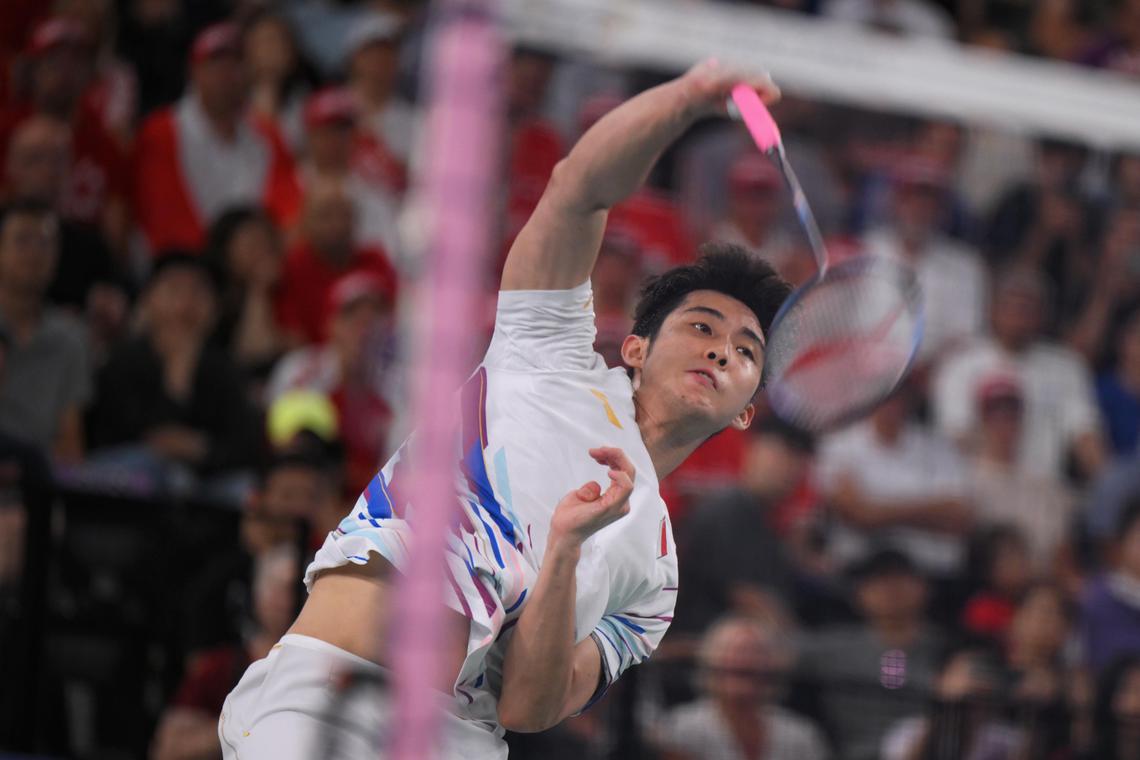

Singapores Loh Kean Yew Reaches Asia Championships Quarterfinals

Apr 11, 2025

Singapores Loh Kean Yew Reaches Asia Championships Quarterfinals

Apr 11, 2025 -

Gunung Gede Pangrango Tutup Sampai 13 April 2025 Informasi Lengkap

Apr 11, 2025

Gunung Gede Pangrango Tutup Sampai 13 April 2025 Informasi Lengkap

Apr 11, 2025 -

Hatton Targets Augusta National For Breakthrough Major Triumph

Apr 11, 2025

Hatton Targets Augusta National For Breakthrough Major Triumph

Apr 11, 2025 -

Legia Warsaws Goncalo Feio Facing Chelsea A Giant In His Path

Apr 11, 2025

Legia Warsaws Goncalo Feio Facing Chelsea A Giant In His Path

Apr 11, 2025 -

Official Chelsea Starting Xi Vs Legia Warsaw

Apr 11, 2025

Official Chelsea Starting Xi Vs Legia Warsaw

Apr 11, 2025