Trump Tariffs: Dow Futures Dive 1300 Points, Bear Market Looms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tariffs: Dow Futures Plunge 1300 Points, Bear Market Looms Large

The possibility of renewed trade tensions under a potential Trump presidency sent shockwaves through global markets, with Dow futures plummeting a staggering 1300 points overnight. This dramatic drop fuels growing concerns about a looming bear market and underscores the significant impact of protectionist trade policies on investor sentiment. The market's reaction highlights the fragility of the current economic climate and the lingering uncertainty surrounding future trade relations.

<h3>A Perfect Storm of Uncertainty</h3>

The steep decline in Dow futures isn't solely attributable to Trump's potential return to the White House. Several factors converged to create this perfect storm of market anxiety:

- Trump's protectionist rhetoric: Trump's past pronouncements regarding tariffs and trade wars have instilled fear among investors. His recent statements reiterating a commitment to protectionist policies reignited these anxieties. The uncertainty surrounding his potential trade actions is a major driver of this market volatility.

- Inflationary pressures: Persistently high inflation remains a major concern for investors. The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes have increased the risk of a recession. The potential for renewed trade wars could exacerbate these inflationary pressures.

- Global economic slowdown: The global economy is facing numerous headwinds, including the ongoing war in Ukraine, energy price volatility, and supply chain disruptions. These factors contribute to a generally pessimistic outlook, making investors more susceptible to negative news.

<h3>Bear Market Fears Intensify</h3>

The sharp drop in Dow futures has fueled concerns that the market is entering a bear market. A bear market is typically defined as a 20% or greater decline from a recent peak. While not officially a bear market yet, the current trajectory is alarming, especially for long-term investors.

Many analysts are closely watching key economic indicators for further signs of a broader economic slowdown. The fear is that renewed trade protectionism could act as a catalyst, pushing the economy into a full-blown recession.

<h3>What Happens Next?</h3>

The immediate future remains uncertain. Market reactions will heavily depend on several factors:

- Trump's future policy announcements: Any further clarification on Trump's trade policy intentions could significantly impact market sentiment. A more conciliatory tone could help alleviate some concerns, while further protectionist rhetoric would likely trigger further declines.

- Federal Reserve actions: The Federal Reserve's next moves regarding interest rates will play a crucial role. A more aggressive approach to combat inflation could further dampen economic growth, potentially exacerbating the market downturn.

- Global economic data: Key economic indicators from around the world will offer clues about the overall health of the global economy. Negative data could fuel further market anxieties.

The current situation emphasizes the critical relationship between trade policy and market stability. The 1300-point drop in Dow futures serves as a stark reminder of the potential consequences of protectionist policies and the significant impact they can have on investor confidence and the broader global economy. Investors are urged to monitor the situation closely and adjust their portfolios accordingly. The coming weeks will be crucial in determining whether this market downturn is a temporary correction or the precursor to a full-blown bear market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tariffs: Dow Futures Dive 1300 Points, Bear Market Looms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hud Ice Data Sharing Implications For Nyc Immigrants And Affordable Housing

Apr 07, 2025

Hud Ice Data Sharing Implications For Nyc Immigrants And Affordable Housing

Apr 07, 2025 -

Urgent Tax News Irs Updates And Changes Impacting 2024 Filings

Apr 07, 2025

Urgent Tax News Irs Updates And Changes Impacting 2024 Filings

Apr 07, 2025 -

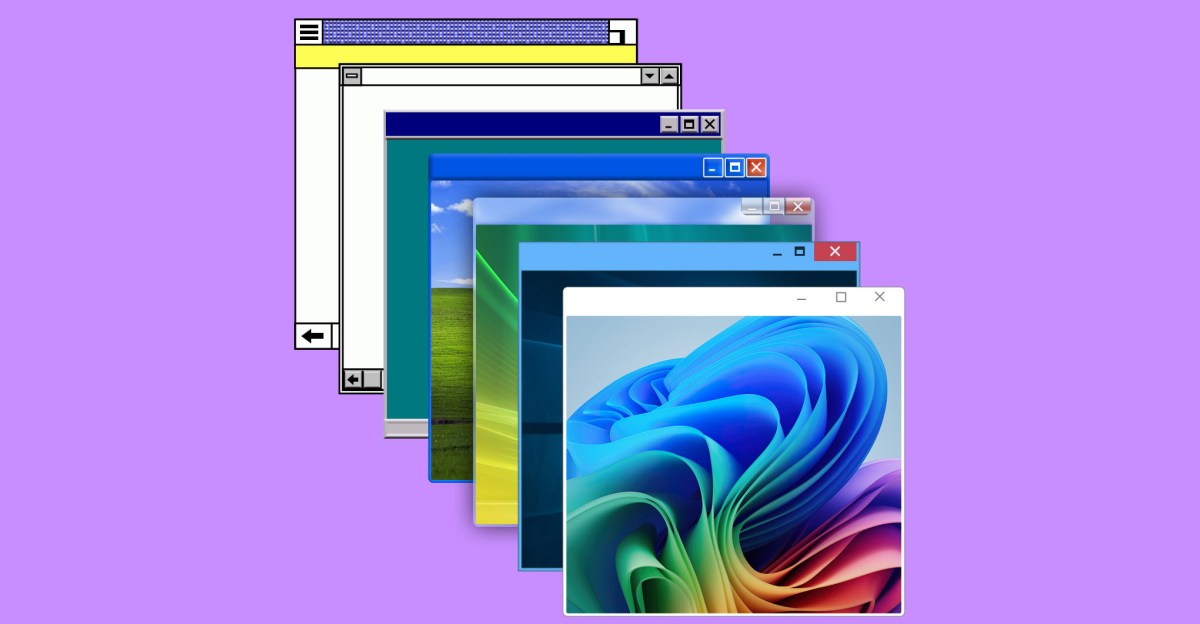

From Dos To Cloud Microsofts 50 Year Evolution In The Tech Industry

Apr 07, 2025

From Dos To Cloud Microsofts 50 Year Evolution In The Tech Industry

Apr 07, 2025 -

Kenan Thompsons Snl Legacy A Look At His Potential Long Term Role

Apr 07, 2025

Kenan Thompsons Snl Legacy A Look At His Potential Long Term Role

Apr 07, 2025 -

Top 3 Bargain Tech Stocks Ready To Soar

Apr 07, 2025

Top 3 Bargain Tech Stocks Ready To Soar

Apr 07, 2025