Trump Tariffs Send Shockwaves: Dow Futures Down 1300 Points, Bear Market Looms

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tariffs Send Shockwaves: Dow Futures Plunge 1300 Points, Bear Market Looms

The potential re-imposition of Trump-era tariffs on Chinese goods has sent shockwaves through global markets, triggering a dramatic plunge in Dow futures. Early Monday morning, futures contracts tumbled a staggering 1300 points, fueling fears of a looming bear market and widespread economic uncertainty. The news underscores the fragility of the current economic climate and the significant impact even the threat of protectionist policies can have on investor confidence.

A Sudden Market Reversal:

The market’s reaction reflects a dramatic shift from the relative optimism seen in recent weeks. The initial positive sentiment surrounding recent economic data quickly evaporated as the possibility of renewed trade tensions came to the forefront. The steep drop in Dow futures points to a significant level of anxiety among investors, who are now bracing for potential repercussions across various sectors.

Understanding the Tariff Impact:

The proposed tariffs, echoing the trade policies of the Trump administration, target a wide range of Chinese goods. This could lead to:

- Increased Consumer Prices: Higher import costs translate directly to increased prices for consumers, potentially dampening consumer spending and slowing economic growth.

- Supply Chain Disruptions: The re-imposition of tariffs could further complicate already strained global supply chains, leading to shortages and delays in various industries.

- Reduced Corporate Profits: Companies reliant on imports from China face the prospect of reduced profitability, potentially impacting investment and job creation.

Bear Market Fears Intensify:

The sharp decline in futures is fueling concerns that the market may be entering a bear market – a sustained period of 20% or more decline from a recent peak. While a single day's decline doesn't automatically signal a bear market, the magnitude of the drop coupled with underlying economic anxieties is certainly a cause for alarm. Analysts are closely monitoring the situation, analyzing the potential ripple effects across different sectors and assessing the overall strength of the economy.

Political Implications and Uncertainty:

The potential reintroduction of these tariffs carries significant political implications. The move is seen by some as a protectionist measure aimed at bolstering domestic industries, while others criticize it for potentially exacerbating global economic instability. The uncertainty surrounding the ultimate outcome adds to the market volatility and investor anxiety. The situation highlights the interconnectedness of global trade and the significant consequences of protectionist policies on market stability.

What to Watch For:

Investors and economists alike are closely monitoring several key factors in the coming days and weeks:

- Official announcements regarding the tariffs: Any clarification on the scope and timing of the potential tariffs will significantly impact market sentiment.

- Reaction from China: The Chinese government's response will play a crucial role in determining the severity of the trade conflict.

- Federal Reserve's response: The Federal Reserve's monetary policy decisions will heavily influence the market’s trajectory.

The current situation underscores the importance of diversified investment strategies and careful risk management in the face of geopolitical and economic uncertainty. The coming days will be crucial in determining whether this is a temporary market correction or the prelude to a more significant downturn. The impact of the potential Trump tariffs extends far beyond the immediate market fluctuations, potentially shaping the economic landscape for months to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tariffs Send Shockwaves: Dow Futures Down 1300 Points, Bear Market Looms. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

3 Hidden Gems Tech Stocks Primed For A Rally

Apr 08, 2025

3 Hidden Gems Tech Stocks Primed For A Rally

Apr 08, 2025 -

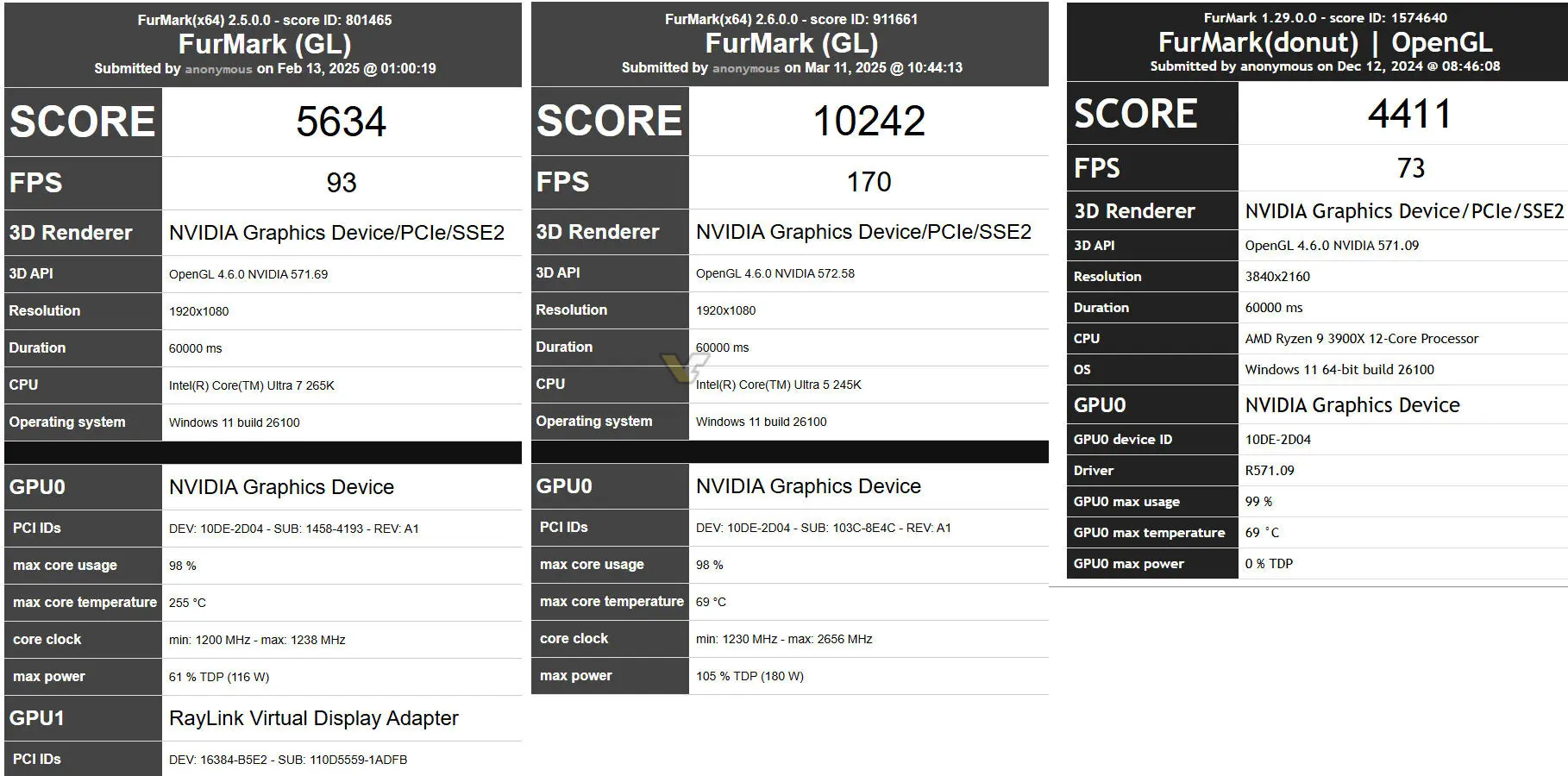

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Benchmark Results Unveiled

Apr 08, 2025

180 W Tdp Nvidia Rtx 5060 Ti Fur Mark Benchmark Results Unveiled

Apr 08, 2025 -

Fast Token Price Forecast 2025 Analyzing Ftns Potential For Growth

Apr 08, 2025

Fast Token Price Forecast 2025 Analyzing Ftns Potential For Growth

Apr 08, 2025 -

Analysis Boeing Starliners Near Catastrophic Space Station Docking

Apr 08, 2025

Analysis Boeing Starliners Near Catastrophic Space Station Docking

Apr 08, 2025 -

Six Car Pileup Shuts Down Section Of Southbound Don Valley Parkway

Apr 08, 2025

Six Car Pileup Shuts Down Section Of Southbound Don Valley Parkway

Apr 08, 2025