Trump's Assault On Powell Triggers Downturn In US Stocks And Dollar

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Assault on Powell Triggers Downturn in US Stocks and Dollar

Donald Trump's renewed attacks on Federal Reserve Chairman Jerome Powell sent shockwaves through the US financial markets, triggering a downturn in both stocks and the dollar. The president's criticism, delivered via a series of tweets and public statements, reignited concerns about political interference in the central bank's independence, a cornerstone of economic stability. This escalation of the ongoing tension between the White House and the Fed has left investors anxious and uncertain about the future economic trajectory.

Market Reactions: A Deep Dive

The immediate impact was palpable. The Dow Jones Industrial Average experienced a significant drop, shedding over [Insert Percentage]% on [Date]. Similarly, the broader S&P 500 and Nasdaq Composite indices also experienced declines, reflecting a widespread sell-off fueled by investor uncertainty. The US dollar, often seen as a safe haven currency, weakened against major global currencies like the euro and the yen. This indicates a flight to safety as investors sought refuge from the perceived risk associated with the political turmoil.

Trump's Criticism: A Recurring Theme

This isn't the first time Trump has publicly criticized Powell. The president has previously expressed frustration over the Fed's interest rate hikes, arguing that they were hindering economic growth. This latest assault, however, is seen as particularly concerning given its intensity and timing. [Insert specific details about Trump's recent statements and their context]. Analysts suggest that the president's actions undermine confidence in the Fed's ability to manage monetary policy effectively, independent of political pressure.

Impact on Investor Sentiment and Economic Outlook

The market's reaction underscores the deep concern among investors about the potential for political interference to disrupt the stability of the US economy. The independence of the Federal Reserve is crucial for maintaining price stability and managing inflation. Any perceived threat to this independence can trigger market volatility and negatively impact investor confidence. This uncertainty adds another layer of complexity to an already challenging economic climate, characterized by [mention relevant economic factors like trade wars, global slowdown etc.].

Experts Weigh In: Analyzing the Fallout

Financial analysts and economists are expressing serious reservations about the long-term consequences of Trump's actions. [Quote a relevant expert, citing their credentials and affiliation]. Many are warning of the potential for further market instability if the president continues his attacks on the Fed. The unpredictability introduced by this political interference is a major concern, making it difficult for businesses to plan for the future and for investors to make informed decisions.

What's Next? Uncertainty Prevails

The future remains uncertain. The market's response will largely depend on how the situation evolves. If Trump continues his attacks, further market volatility is likely. Conversely, a de-escalation of tensions could help restore some investor confidence. However, the damage done to the perception of the Fed's independence may take time to repair. The ongoing situation highlights the critical importance of maintaining the separation of powers between the political and monetary authorities in a healthy economy. Close monitoring of both the political landscape and market indicators is crucial in the coming days and weeks.

Keywords: Trump, Powell, Federal Reserve, US Stocks, Dollar, Dow Jones, Market Downturn, Economic Instability, Political Interference, Investor Sentiment, Monetary Policy, Economic Outlook, US Economy, Market Volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Assault On Powell Triggers Downturn In US Stocks And Dollar. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Technical Difficulties Huaweis Advanced Driving Tech Fails In Shenyang

Apr 22, 2025

Technical Difficulties Huaweis Advanced Driving Tech Fails In Shenyang

Apr 22, 2025 -

New York Knicks Vs Detroit Pistons Game Highlights And Analysis April 21 2025

Apr 22, 2025

New York Knicks Vs Detroit Pistons Game Highlights And Analysis April 21 2025

Apr 22, 2025 -

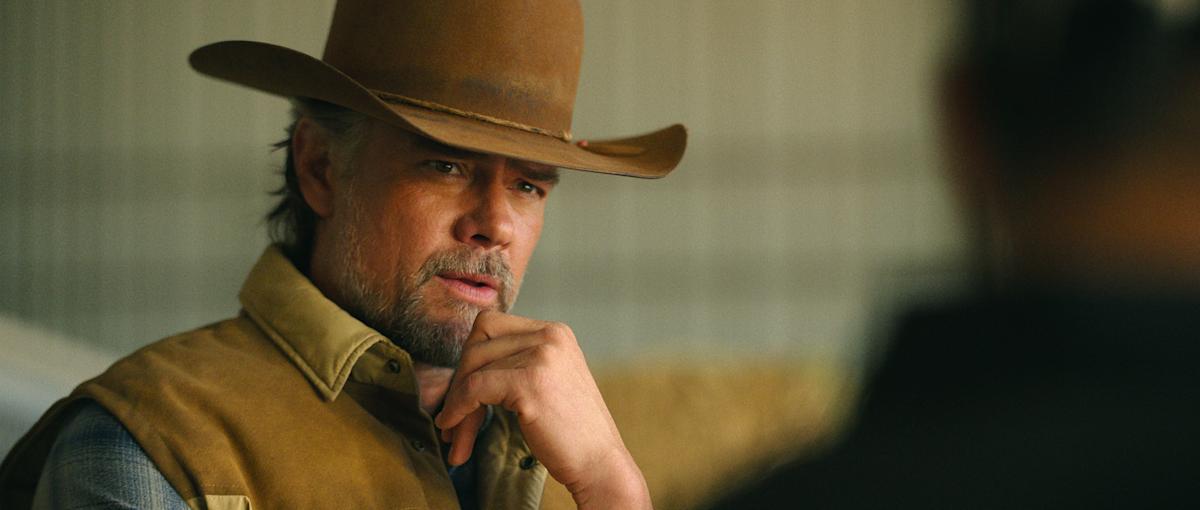

Exploring Grief Josh Duhamel Discusses His Role In Netflixs Ransom Canyon

Apr 22, 2025

Exploring Grief Josh Duhamel Discusses His Role In Netflixs Ransom Canyon

Apr 22, 2025 -

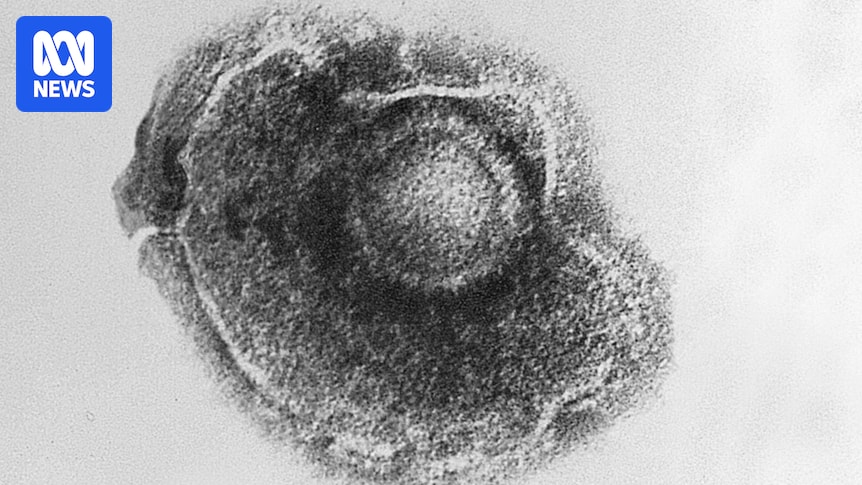

Understanding The Link Between Viruses And Neurodegenerative Diseases Like Dementia

Apr 22, 2025

Understanding The Link Between Viruses And Neurodegenerative Diseases Like Dementia

Apr 22, 2025 -

Where Home Prices Soar Fastest Growing Markets In Texas

Apr 22, 2025

Where Home Prices Soar Fastest Growing Markets In Texas

Apr 22, 2025