Trump's Fed Attack: US Stocks And Dollar Plunge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Fed Attack: US Stocks and Dollar Plunge – Market Volatility Intensifies

Former President Donald Trump's renewed attack on Federal Reserve Chair Jerome Powell sent shockwaves through global financial markets, triggering a sharp decline in US stocks and a plunge in the value of the dollar. The comments, made during a televised interview, reignited concerns about political interference in the central bank's independence and fueled uncertainty about the future trajectory of interest rates.

A Fresh Assault on Fed Independence:

Trump's criticism, echoing previous pronouncements, accused Powell of deliberately sabotaging the US economy through aggressive interest rate hikes aimed at combating inflation. He called for a significant interest rate cut, directly contradicting the Fed's current strategy of maintaining a restrictive monetary policy to cool down persistently high inflation. This direct challenge to the Fed's autonomy represents a significant escalation in the ongoing political tension surrounding monetary policy.

Market Reactions: A Steep Dive:

The immediate market reaction was swift and severe. The Dow Jones Industrial Average plummeted over 300 points, while the S&P 500 and Nasdaq Composite also experienced substantial losses. The US dollar, already weakened by recent economic data, fell sharply against major currencies like the euro and the yen. The volatility underscores the market's sensitivity to any perceived threat to the Fed's independence and its ability to manage inflation effectively.

Impact Beyond Wall Street:

The implications of Trump's attack extend far beyond Wall Street. The uncertainty injected into the markets could hamper economic growth, potentially affecting investment decisions and consumer confidence. International investors, already wary of geopolitical risks, may become even more hesitant to invest in US assets, further weakening the dollar and potentially increasing inflation.

Experts Weigh In: Concerns over Credibility:

Economists and market analysts expressed deep concern over Trump's comments, highlighting the importance of central bank independence for maintaining price stability and long-term economic health. The repeated attacks undermine the credibility of the Fed and could make it more difficult for the central bank to effectively manage the economy, regardless of who holds the presidency. Many fear that such actions could set a dangerous precedent, inviting future political interference in monetary policy decisions.

The Future Outlook: Uncertainty Reigns:

The immediate future remains uncertain. The market's reaction demonstrates the significant influence of political rhetoric on investor sentiment. While the Fed is unlikely to be swayed by political pressure, the ongoing uncertainty surrounding the future direction of monetary policy, combined with the heightened geopolitical risks, could keep market volatility elevated in the coming weeks. The situation demands close monitoring, and investors should brace for further potential fluctuations.

Keywords: Trump, Fed, Powell, interest rates, US stocks, dollar, inflation, market volatility, economic uncertainty, monetary policy, central bank independence, political interference.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Fed Attack: US Stocks And Dollar Plunge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Giants Fall To Crows In Tense Battle Underdogs Stunning Win

Apr 22, 2025

Giants Fall To Crows In Tense Battle Underdogs Stunning Win

Apr 22, 2025 -

Red Dead Redemption 2 Hidden Area Challenges Rockstars Development Claims

Apr 22, 2025

Red Dead Redemption 2 Hidden Area Challenges Rockstars Development Claims

Apr 22, 2025 -

Passengers Stranded Bc Ferries Breakdown Near Horseshoe Bay

Apr 22, 2025

Passengers Stranded Bc Ferries Breakdown Near Horseshoe Bay

Apr 22, 2025 -

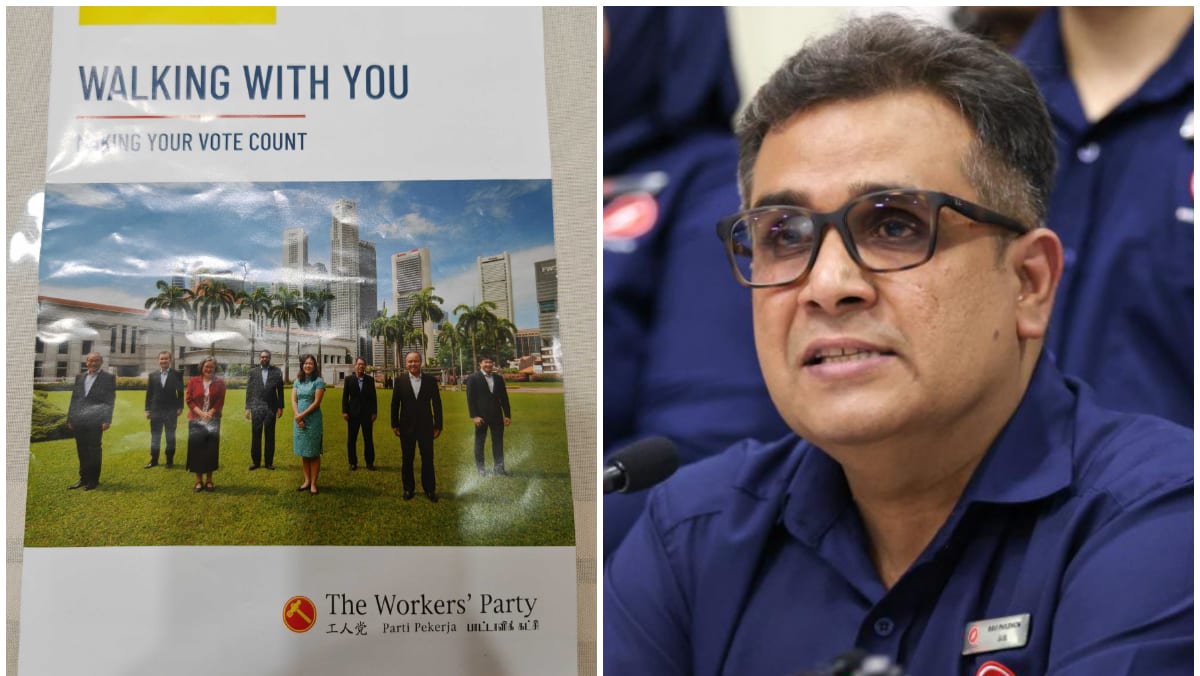

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Concession

Apr 22, 2025

Workers Party To Contest Jalan Kayu Smc In Ge 2025 After Red Dot Uniteds Concession

Apr 22, 2025 -

More Than A Vacation Understanding The Significance Of Black Family Travel

Apr 22, 2025

More Than A Vacation Understanding The Significance Of Black Family Travel

Apr 22, 2025