Trump's Proposed Bitcoin Reserve: Implications For Cryptocurrency Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Proposed Bitcoin Reserve: A Tsunami for Cryptocurrency Markets?

Donald Trump's recent suggestion of a US Bitcoin reserve has sent shockwaves through the cryptocurrency market. The implications of such a bold move are far-reaching and deeply debated, promising to reshape the landscape of digital assets and global finance. This isn't just another political soundbite; it's a potential game-changer with profound consequences for investors, regulators, and the future of money itself.

The Proposal: A Radical Shift in US Monetary Policy

Trump's proposition, floated during various interviews and social media posts, suggests a significant portion of US reserves be converted to Bitcoin. While details remain scarce, the sheer audacity of the idea has ignited fervent discussion amongst economists and cryptocurrency enthusiasts. The core argument hinges on Bitcoin's perceived stability and potential to hedge against inflation, a growing concern in the current economic climate. This would represent a monumental shift from traditional fiat currencies and a dramatic endorsement of Bitcoin’s legitimacy on a global stage.

Potential Impacts on Cryptocurrency Markets:

-

Price Volatility: A US adoption of Bitcoin as a reserve asset would likely trigger an unprecedented surge in Bitcoin's price. The sheer demand from the world's largest economy could overwhelm existing market liquidity, leading to dramatic price swings and potential short-term instability. Experienced traders will likely see opportunities, but less-seasoned investors could be caught off guard.

-

Regulatory Scrutiny: Such a move would almost certainly accelerate regulatory oversight of the cryptocurrency market. Expect increased pressure on exchanges to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, potentially impacting trading speed and accessibility for some users.

-

Increased Mainstream Adoption: A US Bitcoin reserve would serve as a powerful endorsement, potentially legitimizing Bitcoin in the eyes of many who have previously been skeptical. This could accelerate widespread adoption, both from institutional investors and individual users.

-

Geopolitical Implications: The US embracing Bitcoin as a reserve currency could challenge the dollar's dominance in global finance, potentially triggering a reassessment of international monetary policies and trade relationships. This could lead to both opportunities and challenges for various nations and their economies.

Hurdles and Challenges:

While the potential upside is significant, several significant hurdles stand in the way of Trump's proposal:

-

Scalability Issues: Bitcoin's current transaction processing capacity might struggle to handle the volume of transactions associated with a US reserve. This could lead to congestion and increased fees.

-

Security Concerns: Securing such a massive Bitcoin reserve would require robust security measures to protect against hacking and theft. The potential financial implications of a successful attack are staggering.

-

Regulatory Uncertainty: Current regulatory frameworks for cryptocurrencies are still evolving. The legal complexities associated with incorporating Bitcoin into US reserves are considerable and would require substantial legislative action.

Conclusion: A Future Uncertain, but Potentially Revolutionary

Trump's proposed Bitcoin reserve remains a highly speculative idea, but its very existence is forcing a crucial conversation about the future of finance and the role of cryptocurrencies. Whether or not it becomes reality, this proposal has ignited a debate that will undeniably shape the trajectory of the cryptocurrency market and global economics for years to come. The next few months will be critical in observing how the market reacts to further developments and pronouncements regarding this potentially revolutionary shift. Stay informed, stay vigilant, and prepare for a future where the lines between traditional and digital finance are increasingly blurred.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Proposed Bitcoin Reserve: Implications For Cryptocurrency Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Federal Crackdown On Immigration Two Judges Arrested

Apr 26, 2025

Federal Crackdown On Immigration Two Judges Arrested

Apr 26, 2025 -

Eni Aluko Rejects Ian Wright Attack Claims Highlights Clickbait Problem

Apr 26, 2025

Eni Aluko Rejects Ian Wright Attack Claims Highlights Clickbait Problem

Apr 26, 2025 -

Behind The Scenes With Alison Hammond For The Love Of Dogs

Apr 26, 2025

Behind The Scenes With Alison Hammond For The Love Of Dogs

Apr 26, 2025 -

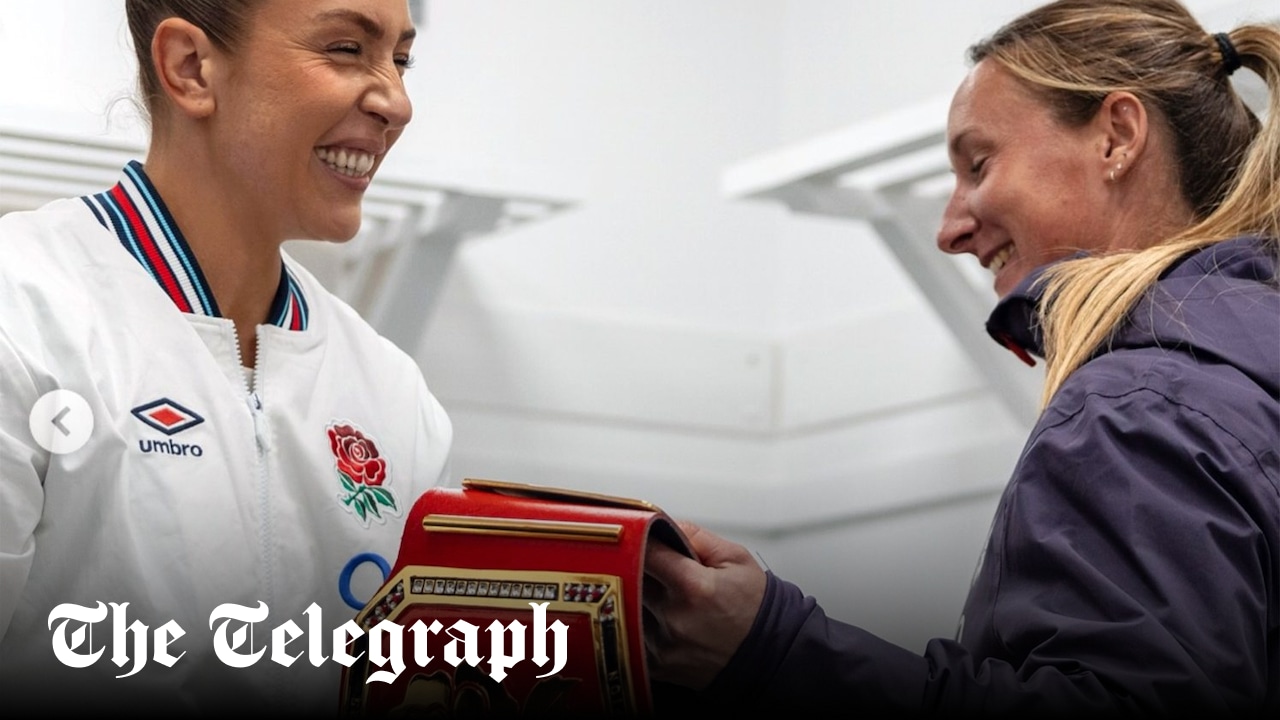

Red Roses Aim High France Match Presents A New Trophy Target

Apr 26, 2025

Red Roses Aim High France Match Presents A New Trophy Target

Apr 26, 2025 -

Netflixs Love Death And Robots Season 4 Trailer A Closer Look At The Fincher Directed Segment

Apr 26, 2025

Netflixs Love Death And Robots Season 4 Trailer A Closer Look At The Fincher Directed Segment

Apr 26, 2025