Trump's Regulatory Agenda: Could It Pave The Way For A Tether US Stablecoin?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Regulatory Agenda: Could it Pave the Way for a Tether US Stablecoin?

The lingering shadow of Donald Trump's regulatory approach continues to cast a long shadow over the cryptocurrency landscape, sparking debate about its potential impact on the future of stablecoins, particularly Tether (USDT). While a direct causal link remains speculative, the potential for a US-backed stablecoin under a future Trump administration is a topic worthy of serious consideration.

Trump's "America First" agenda, characterized by a push for deregulation and a more protectionist stance, could significantly alter the regulatory environment surrounding digital assets. His administration's approach, though often criticized for its inconsistency, prioritized easing burdens on businesses, a philosophy that could find resonance within the cryptocurrency industry's call for clearer and less restrictive rules.

Deregulation and Crypto: A Double-Edged Sword?

The cryptocurrency industry has long argued that excessive regulation stifles innovation and prevents the US from becoming a global leader in this rapidly evolving sector. Trump's preference for deregulation could theoretically create a more welcoming environment for projects like Tether, which operates under significant scrutiny regarding its reserves and regulatory compliance. A less stringent regulatory framework could potentially streamline Tether's operations and reduce compliance costs.

However, this deregulation also presents a significant risk. Without adequate oversight, the potential for market manipulation and fraud increases exponentially. The lack of robust consumer protection mechanisms could lead to significant financial losses for individuals investing in stablecoins like Tether. This risk underscores the critical need for a balanced approach, even under a less regulatory-heavy administration.

Tether and the Need for Transparency

Tether's history has been fraught with controversies surrounding its claimed backing by US dollar reserves. The lack of complete transparency has fueled skepticism and raised concerns about its stability. While a less interventionist regulatory stance might initially seem beneficial, it could also exacerbate these issues if adequate safeguards aren't put in place to ensure transparency and accountability. A future Trump administration would need to address these concerns to build confidence in the US stablecoin market.

A Potential US-Backed Stablecoin?

The possibility of a US government-backed stablecoin has been discussed for some time. A future Trump administration, with its emphasis on American dominance in the global economy, might see such a project as a strategic imperative. A US-backed stablecoin could challenge the dominance of privately issued stablecoins like Tether and potentially offer a more regulated and secure alternative. This could bolster the US's position in the burgeoning global digital asset market.

However, the creation of a government-backed stablecoin raises significant questions about financial sovereignty, monetary policy, and the potential for abuse of power. A careful and deliberate approach would be crucial to prevent unintended consequences.

Conclusion: Navigating the Uncertain Future

The interplay between Trump's regulatory philosophy and the future of Tether and other stablecoins remains complex and uncertain. While a less stringent regulatory environment could initially benefit Tether, it necessitates a robust framework to mitigate the risks associated with deregulation. The potential for a US-backed stablecoin introduces a new layer of complexity, demanding careful consideration of its potential economic and political implications. The cryptocurrency landscape, especially regarding stablecoins, will likely continue to be a fiercely debated topic, especially in light of potential shifts in the regulatory environment. The future of Tether, and indeed the broader stablecoin market, will depend significantly on the delicate balance between fostering innovation and ensuring market integrity and consumer protection.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Regulatory Agenda: Could It Pave The Way For A Tether US Stablecoin?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Previsoes Economicas Copom Ipca Industria Brasileira E O Cenario Global

Apr 08, 2025

Previsoes Economicas Copom Ipca Industria Brasileira E O Cenario Global

Apr 08, 2025 -

Dampak Tarif Dagang Trump Pada Ekonomi China Studi Kasus And Analisis

Apr 08, 2025

Dampak Tarif Dagang Trump Pada Ekonomi China Studi Kasus And Analisis

Apr 08, 2025 -

Crows Midfielders Gather Round Participation In Jeopardy

Apr 08, 2025

Crows Midfielders Gather Round Participation In Jeopardy

Apr 08, 2025 -

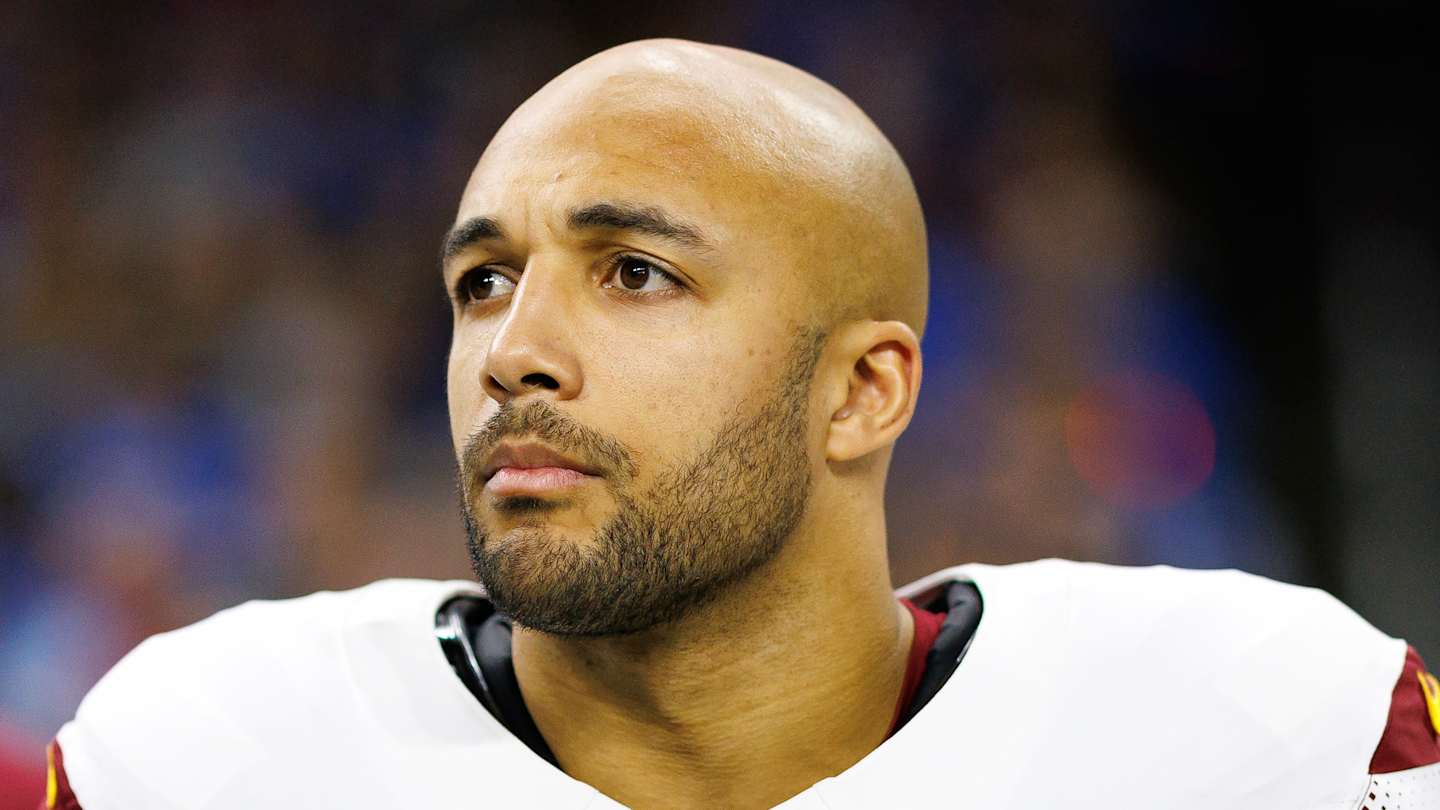

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025

Seven Washington Commanders Likely To Retire After This Season

Apr 08, 2025 -

Singapore Airlines Sg 60 Anniversary Celebrate With Special In Flight Amenities

Apr 08, 2025

Singapore Airlines Sg 60 Anniversary Celebrate With Special In Flight Amenities

Apr 08, 2025