Trump's Tariffs And Australia's Economic Peril: The RBA's May Decision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tariffs and Australia's Economic Peril: The RBA's May Decision & the Looming Recession

The Reserve Bank of Australia (RBA) held its interest rates steady in May 2023, a decision fraught with complexity given the looming threat of a global recession fueled by lingering effects of Trump-era tariffs and a volatile international landscape. While inflation remains a concern, the RBA’s cautious approach reflects a delicate balancing act between controlling price rises and supporting an already fragile Australian economy. This article delves into the interconnectedness of these factors and analyses the implications of the RBA’s decision.

The Lingering Shadow of Trump's Tariffs:

Donald Trump's trade protectionist policies, particularly his imposition of tariffs on various goods, continue to ripple through the global economy. These tariffs, while ostensibly aimed at protecting American industries, disrupted international trade flows and contributed to increased uncertainty and inflation worldwide. Australia, as a significant trading partner with both the US and China, felt the pinch acutely. The resulting supply chain disruptions and elevated input costs placed pressure on Australian businesses, dampening economic growth and contributing to inflationary pressures.

Australia's Economic Vulnerability:

Australia’s economy, heavily reliant on commodity exports, is particularly sensitive to global economic fluctuations. The slowdown in China, a major trading partner, exacerbated by ongoing geopolitical tensions, further compounded the challenges faced by Australia. The RBA’s May decision underscores this vulnerability. Maintaining interest rates at their current level aims to prevent a sharper economic contraction, acknowledging the risk of a potential recession.

The RBA's Balancing Act:

The RBA faces a difficult dilemma. Inflation remains stubbornly high, driven by both global and domestic factors. However, raising interest rates too aggressively could trigger a significant economic downturn, leading to job losses and increased financial distress. The RBA's decision to hold rates reflects a pragmatic assessment of this delicate balance, prioritizing economic stability over immediate inflation control.

Key Factors Influencing the RBA's Decision:

- Global Economic Slowdown: Concerns about a potential global recession, fueled by high inflation and rising interest rates in many developed economies, played a crucial role in the RBA’s decision.

- High Inflation: While easing slightly, inflation remains above the RBA's target range, necessitating careful monitoring and potential future action.

- Housing Market Cooling: The Australian housing market is showing signs of cooling, reducing the risk of overheating but also raising concerns about potential job losses in related sectors.

- Wage Growth: Moderate wage growth provides some relief, suggesting that inflationary pressures may not be as entrenched as initially feared.

Looking Ahead: Navigating Uncertain Waters:

The RBA's May decision is not a sign of complacency, but rather a reflection of the considerable uncertainties facing the Australian economy. The ongoing impact of Trump's tariffs, geopolitical instability, and the global economic slowdown all contribute to a complex and challenging environment. Future RBA decisions will hinge on the evolution of these factors and the resilience of the Australian economy in navigating these turbulent waters. The possibility of a recession remains a very real threat, and the RBA’s actions will be closely scrutinized in the coming months. The next few months will be crucial in determining whether Australia can successfully weather the storm.

Keywords: RBA, Reserve Bank of Australia, interest rates, inflation, recession, Australia, economy, Trump tariffs, trade war, global economy, economic slowdown, monetary policy, housing market, wage growth, China, geopolitical risk.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Tariffs And Australia's Economic Peril: The RBA's May Decision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Black Mirror Season 7 The Most Human Yet A Critical Review

Apr 11, 2025

Is Black Mirror Season 7 The Most Human Yet A Critical Review

Apr 11, 2025 -

Daredevil Born Again Punishers Shocking Reappearance Confirmed For Episode 9

Apr 11, 2025

Daredevil Born Again Punishers Shocking Reappearance Confirmed For Episode 9

Apr 11, 2025 -

Third Maiden Over This Year In Ipl Mukesh Kumars Rcb Bowling Masterclass

Apr 11, 2025

Third Maiden Over This Year In Ipl Mukesh Kumars Rcb Bowling Masterclass

Apr 11, 2025 -

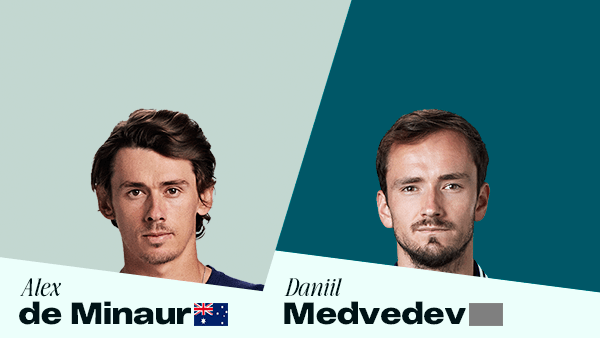

Medvedev Vs De Minaur Monte Carlo Masters Preview And Live Streaming Guide

Apr 11, 2025

Medvedev Vs De Minaur Monte Carlo Masters Preview And Live Streaming Guide

Apr 11, 2025 -

River Valley Fire Exposes Safety Issues Scdf Investigation And Uras Building Approval Scrutinized

Apr 11, 2025

River Valley Fire Exposes Safety Issues Scdf Investigation And Uras Building Approval Scrutinized

Apr 11, 2025