Trump's Tariffs: Sharp Decline In UK And EU Stock Markets

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tariffs Trigger Sharp Decline in UK and EU Stock Markets: A Global Economic Shockwave?

The ripple effect of escalating trade tensions between the US and its key trading partners is undeniable. The latest announcement of new tariffs by the Trump administration sent shockwaves through global markets, resulting in a significant downturn for UK and EU stock markets. Investors reacted swiftly, selling off shares across various sectors, raising concerns about the potential for a wider economic slowdown.

This isn't just another market fluctuation; the impact of these tariffs is far-reaching and could significantly reshape the global economic landscape. The immediate aftermath saw the FTSE 100 in London and major European indices like the DAX and CAC 40 experience their sharpest single-day drops in several months. This volatility underscores the deep interconnectedness of global finance and the potent influence of US trade policy.

Understanding the Impact: More Than Just Market Fluctuations

The decline isn't solely attributable to the tariffs themselves. The uncertainty surrounding future trade relations and the potential for retaliatory measures from the EU and UK are equally significant contributors to investor anxiety. This uncertainty creates a climate of fear, discouraging investment and hindering economic growth.

- Increased Costs for Consumers: Tariffs inevitably lead to higher prices for imported goods, impacting consumers across the UK and the EU. This decreased purchasing power can stifle consumer spending, further hindering economic growth.

- Supply Chain Disruptions: Businesses reliant on US imports now face higher costs and potential delays, impacting their profitability and competitiveness. This disruption could ripple through various sectors, impacting employment and investment.

- Weakening of the Pound and Euro: The market turmoil has led to a weakening of the British pound and the Euro against the US dollar, exacerbating the impact of the tariffs on import costs.

H2: Political Fallout and Potential for Escalation

The political implications are equally significant. The tariffs represent a clear challenge to the established global trading order and have sparked renewed calls for greater trade independence within the EU and UK. The situation could easily escalate if the EU and UK implement retaliatory tariffs, creating a damaging trade war with potentially devastating consequences for global economies.

- Negotiations and Retaliation: The EU and UK are exploring various options, from retaliatory tariffs to seeking alternative trade agreements to mitigate the negative consequences of Trump's trade policies. These actions will significantly shape the trajectory of the global economy in the coming months.

- Shifting Global Alliances: The ongoing trade dispute could lead to a realignment of global alliances and partnerships, potentially reshaping the global economic order in the long term.

H2: What Lies Ahead? Navigating Uncertainty in the Global Market

The short-term outlook remains uncertain. The severity of the market decline hinges on several factors, including:

- The duration of the tariffs: A prolonged trade dispute will exacerbate the negative consequences for the UK and EU economies.

- The scale of retaliatory measures: The response of the EU and UK will determine the extent of the global economic fallout.

- The overall global economic climate: Existing economic vulnerabilities could be amplified by the trade war, potentially leading to a broader recession.

Investors and businesses alike are closely monitoring the situation, bracing for further volatility and seeking strategies to navigate this period of heightened uncertainty. The Trump administration's trade policies serve as a stark reminder of the interconnected nature of the global economy and the profound impact of unilateral protectionist measures. Only time will tell the full extent of the long-term consequences.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Tariffs: Sharp Decline In UK And EU Stock Markets. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Anti Aging Hair Reality Tv Stars Dramatic Transformation

Apr 10, 2025

Anti Aging Hair Reality Tv Stars Dramatic Transformation

Apr 10, 2025 -

Phil Mickelson And Keegan Bradley A Display Of Sportsmanship On The Course

Apr 10, 2025

Phil Mickelson And Keegan Bradley A Display Of Sportsmanship On The Course

Apr 10, 2025 -

Jumbo Animasi Indonesia Lampaui Ekspektasi Media Asing Berikan Pujian

Apr 10, 2025

Jumbo Animasi Indonesia Lampaui Ekspektasi Media Asing Berikan Pujian

Apr 10, 2025 -

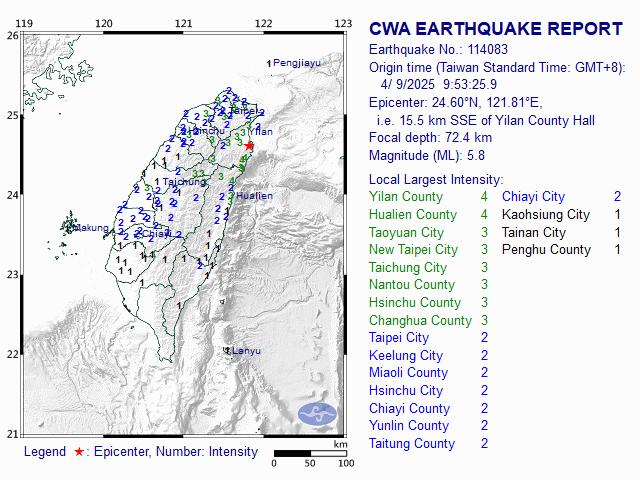

Taiwan Earthquake Northern Region Experiences Seismic Activity No Casualties

Apr 10, 2025

Taiwan Earthquake Northern Region Experiences Seismic Activity No Casualties

Apr 10, 2025 -

Le Festif 16e Edition Un Bilan Des Artistes Locaux Et Internationaux

Apr 10, 2025

Le Festif 16e Edition Un Bilan Des Artistes Locaux Et Internationaux

Apr 10, 2025