Tuesday's Market: Deconstructing Super Micro Computer's (SMCI) Dramatic Price Rise

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Tuesday's Market: Deconstructing Super Micro Computer's (SMCI) Dramatic Price Rise

Super Micro Computer (SMCI) experienced a dramatic price surge on Tuesday, leaving investors scrambling to understand the driving forces behind this unexpected jump. The stock saw a significant increase, defying broader market trends and sparking considerable interest and speculation. This article delves into the potential factors contributing to SMCI's remarkable performance, examining both the short-term catalysts and the longer-term implications for investors.

Understanding the SMCI Surge: A Closer Look at the Numbers

Tuesday's market saw SMCI shares climb [Insert Percentage]% to close at [Insert Closing Price]. This represents a considerable increase compared to [Insert Previous Day's Closing Price] and a significant departure from recent market performance. The sheer magnitude of the rise has naturally prompted questions regarding the underlying causes.

Potential Catalysts Behind the SMCI Rally:

Several factors could have contributed to this unexpected surge in SMCI's stock price. While pinpointing the exact cause remains challenging, a confluence of factors likely played a role:

- Positive Earnings Expectations: Upcoming earnings reports often influence stock prices. Anticipation of strong Q[Insert Quarter] results, potentially exceeding analyst expectations, could have fueled buying pressure. Positive revenue projections, particularly in high-growth sectors like AI, could be a key driver.

- Increased Investor Confidence in the Tech Sector: A broader upswing in investor sentiment towards the technology sector might have indirectly boosted SMCI. If investors are becoming more bullish on the overall tech market, companies like SMCI, with a strong position in server technology, could benefit disproportionately.

- Supply Chain Improvements: The global chip shortage has been a significant headwind for many tech companies. If SMCI has managed to effectively navigate these supply chain challenges, improved production and delivery could be reflected in its stock price.

- Strategic Partnerships and New Product Launches: The announcement of a significant partnership or the launch of a groundbreaking new product could also trigger a sudden increase in stock valuation. While no such announcements were made publicly on Tuesday, speculation regarding future partnerships or innovations might be influencing investor behavior.

- Short Squeeze: A rapid increase in the price of a stock can be driven by a short squeeze, where investors who bet against the stock (short sellers) are forced to buy shares to cover their positions, leading to further price increases.

Analyzing the Long-Term Implications for SMCI Investors:

While Tuesday's dramatic price increase is certainly noteworthy, investors should approach this development with a degree of caution. The sustained success of SMCI will depend on several factors:

- Continued Innovation: The technology sector is highly competitive. SMCI's ability to consistently innovate and develop cutting-edge products will be crucial for maintaining its market position and driving future growth.

- Effective Management of Supply Chains: Successfully navigating future supply chain disruptions will be critical for ensuring consistent production and meeting market demand.

- Financial Performance: Sustained strong financial performance, including consistent revenue growth and profitability, will be essential for justifying the current valuation.

Conclusion: A Day of Volatility and Speculation

Tuesday's dramatic price rise for Super Micro Computer (SMCI) presents a compelling case study in market volatility. While several factors could have contributed to the surge, the exact causes remain a subject of speculation and analysis. Investors are advised to conduct thorough due diligence and consider the long-term prospects of the company before making any investment decisions. This situation underscores the importance of remaining informed and understanding the multifaceted nature of market fluctuations. Keep an eye on upcoming earnings reports and any significant company announcements for further insights into SMCI’s future trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Tuesday's Market: Deconstructing Super Micro Computer's (SMCI) Dramatic Price Rise. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Australia And New Zealand Wrexhams Destination For 2024 Pre Season

May 14, 2025

Australia And New Zealand Wrexhams Destination For 2024 Pre Season

May 14, 2025 -

Acesso A Casas Na Praia E No Campo Solucoes De Uso Compartilhado

May 14, 2025

Acesso A Casas Na Praia E No Campo Solucoes De Uso Compartilhado

May 14, 2025 -

Djis Mavic 4 Pro Camera Drone Us Shipping Delays And Concerns

May 14, 2025

Djis Mavic 4 Pro Camera Drone Us Shipping Delays And Concerns

May 14, 2025 -

Measles Outbreak Predicted This Summer Travel Health Warning

May 14, 2025

Measles Outbreak Predicted This Summer Travel Health Warning

May 14, 2025 -

Le Ministre Des Habous Et Des Affaires Islamiques Rencontre Son Homologue Saoudien A Riyad

May 14, 2025

Le Ministre Des Habous Et Des Affaires Islamiques Rencontre Son Homologue Saoudien A Riyad

May 14, 2025

Latest Posts

-

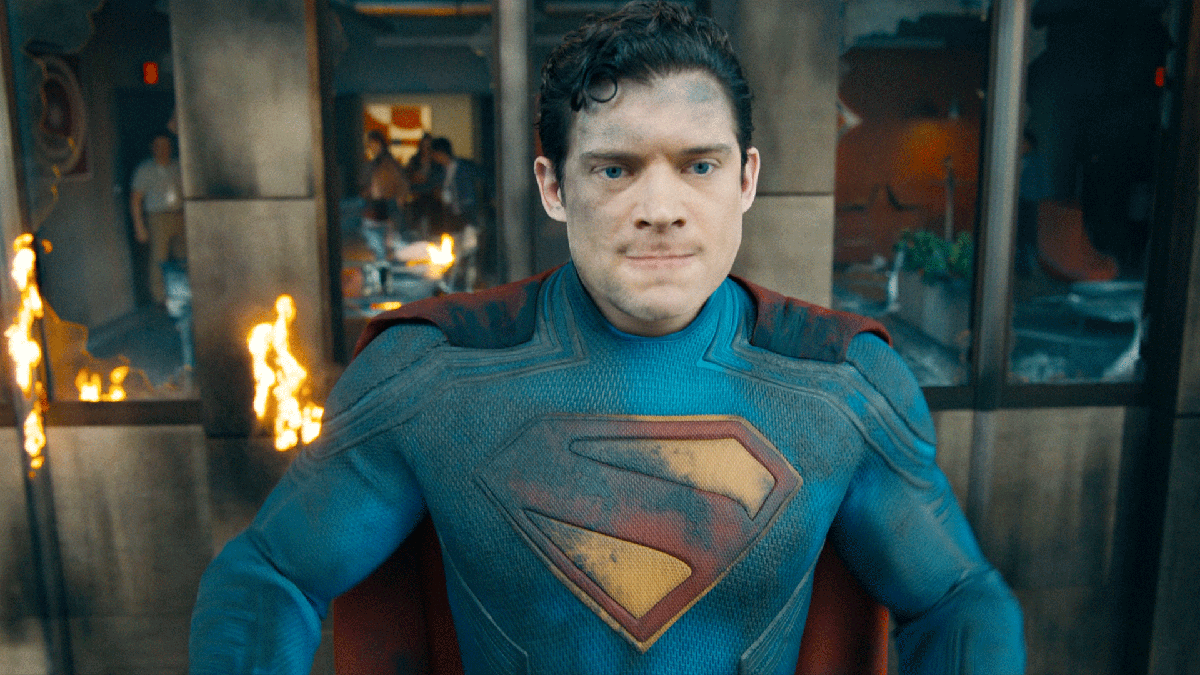

Superman Teaser Trailer 2 Everything You Need To Know

May 15, 2025

Superman Teaser Trailer 2 Everything You Need To Know

May 15, 2025 -

Mavic 4 Pro Djis New Drone And Us Market Restrictions

May 15, 2025

Mavic 4 Pro Djis New Drone And Us Market Restrictions

May 15, 2025 -

J 10 Makers Stock Crash Avic Chengdu Aircraft Shares Down 9 5 Following Modi Address

May 15, 2025

J 10 Makers Stock Crash Avic Chengdu Aircraft Shares Down 9 5 Following Modi Address

May 15, 2025 -

Riyadh And Doha Trumps Diplomatic Balancing Act In The Middle East

May 15, 2025

Riyadh And Doha Trumps Diplomatic Balancing Act In The Middle East

May 15, 2025 -

Karen Read Defense Strategy Unintentionally Opens Door For New Evidence In Court

May 15, 2025

Karen Read Defense Strategy Unintentionally Opens Door For New Evidence In Court

May 15, 2025