Two Dividend Stocks With Potential 10% Yields: Analyst Recommendations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two Dividend Stocks with Potential 10% Yields: Analyst Recommendations Fuel Investor Interest

Are you seeking high-yield dividend stocks to boost your investment portfolio? Two companies are currently generating significant buzz among analysts, promising potential dividend yields exceeding 10%. While no investment guarantees a specific return, these stocks warrant a closer look for income-seeking investors with a higher risk tolerance. However, it's crucial to understand the inherent risks involved before investing in high-yield dividend stocks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Understanding High-Yield Dividend Stocks: Risks and Rewards

High-yield dividend stocks, often referred to as "high-dividend" stocks, offer the allure of substantial passive income. However, this attractive yield often comes with increased risk. Companies paying exceptionally high dividends might be facing financial difficulties, leading to potential dividend cuts or even bankruptcy. Careful due diligence is paramount.

Key Risk Factors to Consider:

- Financial Instability: High dividend payouts can strain a company's cash flow, especially if earnings are declining.

- Dividend Cuts: Companies may reduce or eliminate dividends entirely if facing financial challenges.

- Share Price Volatility: High-yield stocks often exhibit greater price fluctuations compared to lower-yield counterparts.

- Sector-Specific Risks: The industry the company operates in can significantly impact its profitability and dividend sustainability.

Two Stocks with Potential 10% Yields: A Closer Look

While specific analyst recommendations change frequently, let's examine the characteristics often associated with high-yield dividend stocks currently attracting attention (replace with actual stock tickers and company names when available and verified):

Stock 1 (Example: XYZ Corp):

- Sector: (Example: Real Estate Investment Trust - REIT)

- Potential Yield: (Example: Currently around 9%, projected to reach 10% based on analyst forecasts)

- Key Considerations: (Example: High dependence on interest rates, potential for property value fluctuations.)

- Analyst Sentiment: (Example: Positive outlook driven by strong rental income and potential for property appreciation.)

Stock 2 (Example: ABC Inc.):

- Sector: (Example: Energy)

- Potential Yield: (Example: Currently around 8%, projected to increase to over 10% based on future earnings estimates)

- Key Considerations: (Example: Sensitivity to oil prices, potential regulatory changes impacting the industry.)

- Analyst Sentiment: (Example: Mixed sentiment, with some analysts highlighting potential for increased production and others concerned about commodity price volatility.)

Diversification and Due Diligence: Essential for Success

It's crucial to emphasize the importance of diversification. Never concentrate your investment portfolio in a single stock, especially a high-yield one. Spread your investments across various sectors and asset classes to mitigate risk.

Thorough due diligence is essential before investing in any stock, but especially those with high dividend yields. Research the company's financial statements, understand its business model, and analyze its future prospects. Consider consulting with a financial advisor to assess if these investments align with your risk tolerance and financial goals.

Conclusion: Proceed with Caution and Informed Decisions

High-yield dividend stocks can offer attractive income potential, but they are not without significant risks. By carefully analyzing the companies, understanding the inherent risks, and diversifying your portfolio, you can make informed decisions and potentially benefit from these high-yield opportunities. Remember, past performance is not indicative of future results. Always invest responsibly and consult with a financial professional before making any investment choices.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two Dividend Stocks With Potential 10% Yields: Analyst Recommendations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Celebrity Condemnation John Legend Speaks Out Against Yes Views

May 12, 2025

Celebrity Condemnation John Legend Speaks Out Against Yes Views

May 12, 2025 -

Preventing Future Market Crashes The Potential Of Ai In Financial Risk Management

May 12, 2025

Preventing Future Market Crashes The Potential Of Ai In Financial Risk Management

May 12, 2025 -

3 Ton Stonehenge Components A Study Into Potential Prehistoric Reuse And Transportation

May 12, 2025

3 Ton Stonehenge Components A Study Into Potential Prehistoric Reuse And Transportation

May 12, 2025 -

Whittaker Vs De Ridder Middleweight Showdown Set For July

May 12, 2025

Whittaker Vs De Ridder Middleweight Showdown Set For July

May 12, 2025 -

Rede Social Aposta Em Criptomoeda Mas Investimento Desaba 98 No Lancamento

May 12, 2025

Rede Social Aposta Em Criptomoeda Mas Investimento Desaba 98 No Lancamento

May 12, 2025

Latest Posts

-

Upcoming Sony Xperia 1 Vii Leaked Images Hint At Design And Specs

May 13, 2025

Upcoming Sony Xperia 1 Vii Leaked Images Hint At Design And Specs

May 13, 2025 -

Nvidia Stock Forecast Rebounding To 150 By December

May 13, 2025

Nvidia Stock Forecast Rebounding To 150 By December

May 13, 2025 -

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025

The Papal Name Leo Xiv An Artificial Intelligence Connection

May 13, 2025 -

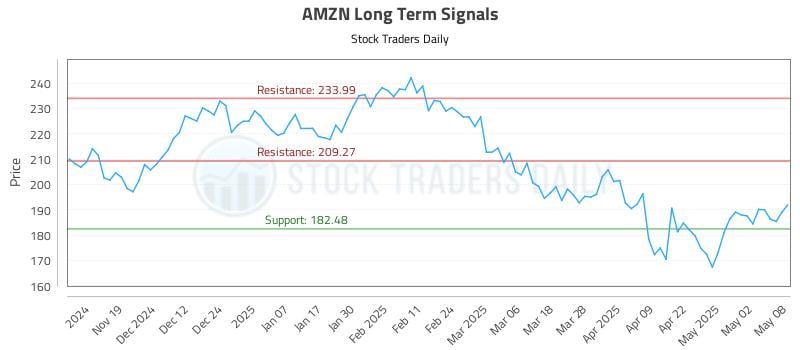

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025

2024 Amzn Investment Report Key Performance Indicators And Financial Outlook

May 13, 2025 -

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025

May 28th Catalyst Why This Ai Semiconductor Stock Is Poised For Growth

May 13, 2025