Two-Year, $1 Billion Compliance Investment Announced By TD

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

TD Bank Invests $1 Billion Over Two Years in Enhanced Compliance Measures

Toronto, ON – October 26, 2023 – TD Bank Group (TD) today announced a significant investment of $1 billion over the next two years to bolster its compliance infrastructure and strengthen its commitment to regulatory adherence. This substantial financial commitment underscores the bank's dedication to maintaining the highest ethical standards and proactively mitigating risks across its operations.

The announcement follows increased regulatory scrutiny across the financial services sector and reflects TD's proactive approach to ensuring ongoing compliance with evolving global regulations. This investment will be focused on several key areas, strengthening the bank’s ability to detect and prevent financial crime and protect customer data.

Key Areas of Investment:

-

Enhanced Technology: A significant portion of the investment will focus on upgrading and expanding its technology infrastructure. This includes implementing advanced analytics, artificial intelligence (AI), and machine learning (ML) capabilities to improve the detection of suspicious activities and enhance fraud prevention. These technological advancements will allow for more efficient monitoring of transactions and identification of potential compliance breaches.

-

Expanded Workforce: TD plans to significantly expand its compliance team, recruiting specialized professionals with expertise in areas such as anti-money laundering (AML), know your customer (KYC), and sanctions compliance. This expansion will ensure the bank has the necessary human capital to effectively manage and monitor its compliance programs.

-

Improved Training and Development: The investment will also fund enhanced training and development programs for employees across all levels of the organization. This comprehensive training will focus on improving compliance awareness and ensuring employees understand their responsibilities in maintaining the integrity of TD's operations. This includes regular updates on evolving regulatory landscapes and best practices in compliance management.

-

Strengthened Governance: TD will strengthen its governance frameworks and oversight mechanisms to ensure accountability and transparency within its compliance programs. This includes enhanced reporting structures and improved communication channels to facilitate proactive risk management.

A Proactive Approach to Risk Management:

"This significant investment reflects our unwavering commitment to maintaining the highest standards of ethical conduct and regulatory compliance," said [Insert Name and Title of relevant TD executive]. "We believe this proactive approach is essential for protecting our customers, upholding the integrity of our operations, and building trust with our stakeholders. We are committed to investing in the resources and expertise needed to navigate the increasingly complex regulatory landscape."

The $1 billion investment represents a substantial commitment to strengthening TD's compliance program. This proactive approach underscores the bank's understanding of its responsibilities in the financial ecosystem and its commitment to building a sustainable and responsible future. The bank anticipates the implementation of these initiatives will significantly reduce risk, enhance efficiency, and ultimately improve the overall customer experience.

Keywords: TD Bank, TD, compliance, investment, billion dollar investment, regulatory compliance, anti-money laundering (AML), know your customer (KYC), sanctions compliance, financial crime, AI, artificial intelligence, machine learning, ML, risk management, financial services, banking, Canada, Toronto

This article is for informational purposes only and does not constitute financial advice. Always consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two-Year, $1 Billion Compliance Investment Announced By TD. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Official Trump Price Surge A 12 Rally Explained

May 23, 2025

Official Trump Price Surge A 12 Rally Explained

May 23, 2025 -

South Sydney Rabbitohs Aggressive Rebuild Strategy Continues With Garlick

May 23, 2025

South Sydney Rabbitohs Aggressive Rebuild Strategy Continues With Garlick

May 23, 2025 -

All Time High For Bitcoin Btc Expert Opinions And Price Forecasts

May 23, 2025

All Time High For Bitcoin Btc Expert Opinions And Price Forecasts

May 23, 2025 -

New Zombie Movie Featuring Jeremy Renner And Idris Elba Premieres On Hulu

May 23, 2025

New Zombie Movie Featuring Jeremy Renner And Idris Elba Premieres On Hulu

May 23, 2025 -

Jon Stewart Slams Cnns Biden Book News They Should Have Told You

May 23, 2025

Jon Stewart Slams Cnns Biden Book News They Should Have Told You

May 23, 2025

Latest Posts

-

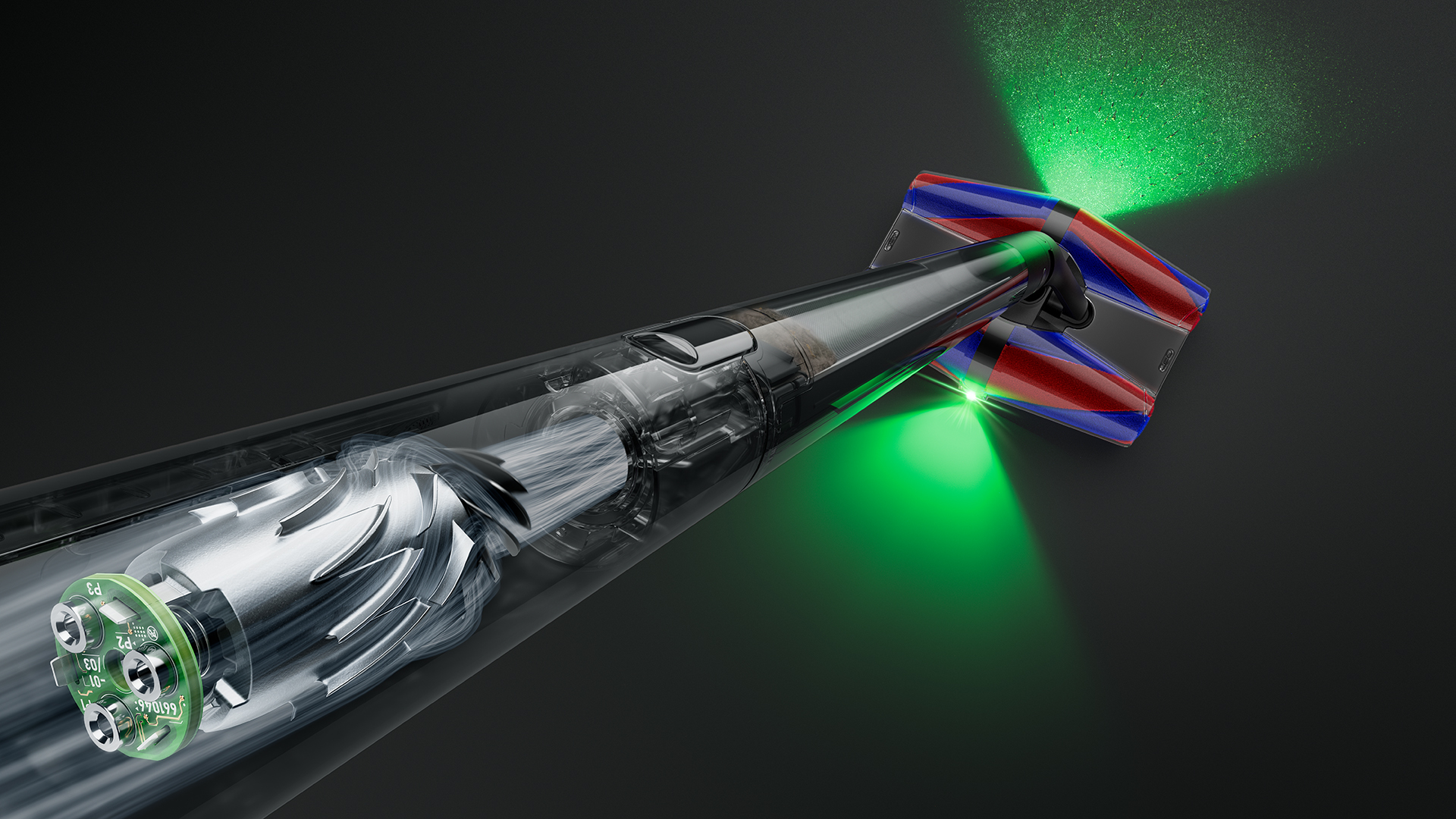

Lightweight And Powerful Dysons Latest Vacuum Redefines Cleaning

May 23, 2025

Lightweight And Powerful Dysons Latest Vacuum Redefines Cleaning

May 23, 2025 -

Understanding The Mission Impossible Timeline From Dead Reckoning To The Beginning

May 23, 2025

Understanding The Mission Impossible Timeline From Dead Reckoning To The Beginning

May 23, 2025 -

Que Peliculas Ver Aventura Y Ciencia Ficcion Con Localizaciones En Bangkok Y Egipto

May 23, 2025

Que Peliculas Ver Aventura Y Ciencia Ficcion Con Localizaciones En Bangkok Y Egipto

May 23, 2025 -

Channel Sevens Sunrise Welcomes Newest Member A Healthy Baby Girl

May 23, 2025

Channel Sevens Sunrise Welcomes Newest Member A Healthy Baby Girl

May 23, 2025 -

Concerns Rise As Martin Place Homeless Kitchen Closes For Vivid

May 23, 2025

Concerns Rise As Martin Place Homeless Kitchen Closes For Vivid

May 23, 2025